Wondering what are the big, trusted banks in India which are government-run? Perhaps you are a student, someone seeking to open your first bank account or you are just trying to learn more about the Indian banking system. Whatever the reason, you are in the right place!

This article is your friendly guide to all that you need to know about the list of govt banks in India. We will explain it in simple and easy to comprehend language. No jargon, we assure you! We shall discuss what these banks are, why they are so important, and give a full list of all the government banks now in operation in India. Take a cup of chai, relax and read on!

The Heartbeat of the Nation: Why Government Banks Matter

Before we answer the question of why we should care about government banks, we must first answer the question of why we should care about the list of govt banks in India. Well, these banks, also called Public Sector Banks (PSBs), are not merely banks where people can keep money. They are the economic engine of our nation and contribute immensely to our day to day lives and the economy of the country.

The Role in Economic Growth

Think of the list of govt banks in India wishing to construct a new highway, a metro line or a huge factory. Where does the cash to fund such mega projects come in? Much of it is funded by these government banks. They give the required loans to fuel the India infrastructure and industrial development.

They also ensure that the economy is well oiled by lending to large and small businesses so that they can create employment opportunities. They do not only aim at making profits, but they are also guided by the objective of national development.

Financial Inclusion Champions

Banking was an urban privilege many decades ago. The poor and villagers did not get access to safe banking services. Government banks became totally different. They have always had the mission of touching every corner of the country.

You may recall the Pradhan Mantri Jan Dhan Yojana (PMJDY)? It was a humongous government program whereby every Indian family is provided with a bank account. What were the banks that did the heavy lifting to make this a success? The PSBs, of the PSBs! They opened millions of zero-balance accounts, and got a large portion of the population into the formal financial system, for the first time. This is known as financial inclusion and PSBs are the biggest proponents of the same.

Serving Both Villages and Cities

Whereas the private banks tend to concentrate on lucrative urban sectors, government banks are required to be inclusive to all and everywhere. A branch of a government bank is present in a remote village in the Himalayas as well as in a metro city like Mumbai. They provide services that are specific to farmers like the Kisan Credit Card, as well as advanced corporate banking services to large companies in the cities. This moderation will not leave behind anyone.

What Exactly is a Government Bank?

All right, we need to define what it is. A Government Bank or Public Sector Bank (PSB) is a bank in which the Government of India controls the majority share (more than 51%).

Put it this way: when a company is a large cake, the government owns more than half of the cake. This implies that the government exercises the controlling power and makes the key decisions of the bank. The government ownership makes these banks special with the high level of trust. The citizens usually believe that their money is most secure in a governmental bank.

Government Banks vs. Private Banks: What’s the Difference?

The easiest way to see the difference is to consider their ownership and the main purpose.

| Feature | Government Banks (PSBs) | Private Banks |

| Ownership | Majority-owned by the Government of India. | Owned by private individuals, shareholders, or companies. |

| Main Goal | Social welfare and national development, along with earning a profit. | Primarily focused on maximizing profit for shareholders. |

| Reach | Extensive network in both rural and urban areas. | Tend to have a stronger presence in urban and semi-urban areas. |

| Customer Base | Caters to a very diverse customer base, from farmers to large corporations. | Often targets middle-class, affluent customers, and corporations. |

| Schemes | Are the primary channels for implementing government welfare schemes. | Focus more on commercial products like credit cards and personal loans. |

| Job Security | Generally offer higher job security to employees. | More performance-driven and competitive work culture. |

How Many Govt Banks Are There in India (2025)?

It is a fantastic question as the number has changed recently!

As of 2025, India has 12 Public Sector Banks.

Your parents or grandparents may also mention a lot of other government banks that are no longer there like Syndicate Bank, Corporation Bank, or Dena Bank. They are not mistaken! A few years back, there were more than 25 government banks in India.

What occurred? The Government of India decided to combine some banks in order to make them larger, more effective, and powerful. This was referred to as consolidation and the idea was to form a few large banks that could compete with the rest of the world and serve the needs of an increasing economy. This mega-merger was established in 2020 reducing the number to 12.

Table: List of Govt Banks in India at a Glance

Before we dive deep into each bank, here’s a quick table to give you an overview of the list of govt banks in India.

| Name of the Bank | Founded In | Approx. Number of Branches |

| State Bank of India (SBI) | 1955 | 22,500+ |

| Punjab National Bank (PNB) | 1894 | 10,000+ |

| Bank of Baroda (BoB) | 1908 | 8,200+ |

| Canara Bank | 1906 | 9,700+ |

| Union Bank of India | 1919 | 8,700+ |

| Bank of India (BoI) | 1906 | 5,100+ |

| Indian Bank | 1907 | 5,800+ |

| Central Bank of India | 1911 | 4,500+ |

| Indian Overseas Bank (IOB) | 1937 | 3,200+ |

| UCO Bank | 1943 | 3,000+ |

| Bank of Maharashtra | 1935 | 2,400+ |

| Punjab & Sind Bank | 1908 | 1,500+ |

Complete List of Govt Banks in India (2025)

Here is the list of completed list of Govt Banks in India:

1. State Bank of India (SBI)

- CEO: Dinesh Kumar Khara

- Headquarters: Mumbai, Maharashtra

- Established: 1955 (Originally Bank of Calcutta in 1806)

- Branches: Over 22,500

- Specialty: The biggest bank in all aspects network, deposits, loans and services.

The State Bank of India is not just any bank but an institution. It is the unrivaled giant of the Indian banking system and many companies. SBI is older than the Indian Railways with a history that can be traced back to the early 19th century. It is the bank of choice of millions of Indians, the farmer in a small village to the top CEO in a big city. For anyone exploring the List of Govt Banks in India, SBI is always at the very top.

The sheer size of its network of branches and ATMs also means that you are not far away from an SBI touchpoint. With strong digital platforms such as YONO, SBI has a large number of services to its credit, such as personal banking, corporate loans, NRI services, etc. Its scale, coverage and the trust that it enjoys makes it a real indicator of financial power of India.

2. Punjab National Bank (PNB)

- CEO: Atul Kumar Goel

- Headquarters: New Delhi

- Established: 1894

- Branches: Over 10,000

- Specialty: Good presence in North India and good services to small and medium enterprises (SMEs).

Punjab National Bank is the first Indian bank that was initiated with Indian funds. Its founders were the leaders of the freedom movement, such as Lala Lajpat Rai. PNB has a heritage of serving the country for more than 125 years. It is now the second-largest PSB in India in terms of the business and branch network since its merger with the Oriental Bank of Commerce and United Bank of India in 2020.

NB is particularly well established in personal banking, agricultural lending, and small-scale business lending. It is a bank that is closely entwined in the Indian economic history and remains a trusted name to millions of customers.

3. Bank of Baroda (BoB)

- CEO: Debadatta Chand

- Headquarters: Vadodara, Gujarat

- Established: 1908

- Branches: Over 8,200

- Specialty: International presence, which makes it the International Bank of India.

Bank of Baroda is a global banking powerhouse that was founded by the Maharaja Sayajirao Gaekwad III in Vadodara. It is one of the banks with the largest international networks among all Indian banks, having branches and offices in more than 20 countries. This makes it a bank of choice to the NRIs and international trade businesses, and it consistently features in the List of Govt Banks in India.

Following the merger of Vijaya Bank and Dena Bank with it in 2019, BoB is the third-largest public sector bank. It is characterized by a high level of technological orientation and has been a trendsetter in the area of digital banking innovations. BoB has a global outlook with a wide range of services in retail banking, corporate finance, and so on.

4. Canara Bank

- CEO: K. Satyanarayana Raju

- Headquarters: Bengaluru, Karnataka

- Established: 1906

- Branches: Over 9,700

- Specialty: Retail customer-centric, rural development and financial inclusion.

Canara Bank started in Mangalore by the great visionary and philanthropist, Shri Ammembal Subba Rao Pai. His guiding philosophy was to eliminate superstition and ignorance and to disseminate education among everyone. This social mission remains a part of the DNA of the bank. As one of the prominent names in the List of Govt Banks in India, Canara Bank has continued to uphold this vision.

Following its merger with Syndicate Bank, which also has a long history in South India, Canara Bank became the fourth-largest PSB. It has a high reputation in relation to customer-centric services and it has always been keen on assisting students, farmers and small entrepreneurs. It has a broad product base, which includes education loans and agricultural credit, indicating its social banking.

5. Union Bank of India

- CEO: A. Manimekhalai

- Headquarters: Mumbai, Maharashtra

- Established: 1919

- Branches: Over 8,700

- Specialty: High quality corporate and retail banking assets and pan-India presence.

Union Bank of India boasts of an illustrious past; it is in the building of its head office in Mumbai that Mahatma Gandhi inaugurated it in 1921! This tradition of national service is still present to date. The bank expanded greatly in size following the merger of Andhra Bank and Corporation Bank with it in 2020.

As one of the leading names in the List of Govt Banks in India, it is currently one of the biggest government-owned banks in the country. Union Bank is considered to have a broad range of products to serve individuals, businesses and agricultural sectors. It is well equipped with a digital infrastructure with ease of mobile and internet banking services to its wide customer base in the country.

6. Bank of India (BoI)

- CEO: Rajneesh Karnatak

- Headquarters: Mumbai, Maharashtra

- Established: 1906

- Branches: Over 5,100

- Specialty: Experienced in corporate banking and international operations.

Bank of India was established by a set of leading business name in Mumbai. It was among the earliest banks to be nationalized in 1969, which was a significant change in the Indian banking scenario. BoI also has a large international presence with offices in major financial centers in the world.

As a major name in the List of Govt Banks in India, it is also well known domestically due to its close ties with large corporate customers and funding of major industrial projects. Although it leads in corporate banking, it is also providing a full range of retail services to its millions of customers. The star logo of the bank represents its guiding principles of trust, security and service.

7. Indian Bank

- CEO: Shanti Lal Jain

- Headquarters: Chennai, Tamil Nadu

- Established: 1907

- Branches: Over 5,800

- Specialty: A high level of presence in South India and attention to the common person.

Indian Bank was started as a part of the Swadeshi movement, which urged Indians to consume goods and services produced in the country. This sense of self-help and national service has been a key to its identity. It has strong roots and a powerful presence in the southern states of India and is headquartered in Chennai.

Following the merger of Allahabad Bank (one of the oldest joint-stock banks in India) with Indian Bank in 2020, it has gained a considerably broader national presence. Featured prominently in the List of Govt Banks in India, the bank has a reputation of having good fundamentals and easy-to-understand banking products for retail customers, farmers, and small businesses.

8. Central Bank of India

- CEO: M. V. Rao

- Headquarters: Mumbai, Maharashtra

- Established: 1911

- Specialty: The first Swadeshi bank, which had an all-round banking service orientation.

The Central Bank of India is a unique bank in the history of India because it was the first ever Indian commercial bank to be owned and managed by Indians. Its founder Sir Sorabji Pochkhanawala declared it as the property of the nation and the asset of the country. He named it the “Central Bank” with a hope that it would transform to become the central banking institution of the country.

Although that role was assigned to the RBI, the Central Bank of India has played an important role in the commercial banking arena. Featured in the List of Govt Banks in India, it has an expansive branch network in the country and provides a full line of banking products to all classes of the population.

9. Indian Overseas Bank (IOB)

- CEO: Ajay Kumar Srivastava

- Headquarters: Chennai, Tamil Nadu

- Established: 1937

- Branches: Over 3,200

- Specialty: Experience in foreign exchange and international trade.

Indian Overseas Bank was established with the sole aim of specializing in foreign exchange business and overseas banking. This vision has seen it play a central role in the facilitation of foreign trade of India. With its head office in Chennai, IOB has a wide network of branches in India and also in key locations across the world, particularly Southeast Asia.

Although it is specialized in trade finance, the bank offers a variety of retail and corporate banking services. Featured in the List of government banks in India, it is a bank which has a global perspective but a strong sense of commitment to its domestic customers, making it a very unique bank in the Indian banking sector.

10. UCO Bank

- CEO: Ashwani Kumar

- Headquarters: Kolkata, West Bengal

- Established: 1943

- Branches: Over 3,000

- Specialty: Well established in Eastern India and a reliable business partner of the government.

UCO Bank, formerly known as United Commercial Bank, was established in Kolkata by the great industrialist Ghanshyam Das Birla. It was founded with the notion of developing a business bank that would address the needs of the Indian people and businesses. The bank was nationalized in 1969 and has since then been a very significant part of the economic development of the country especially in the eastern and northeastern parts.

It is most of the time trusted with the big government businesses and transactions. UCO Bank has a reputation of being a stable bank and one that specializes in offering stable banking services to its various customers.

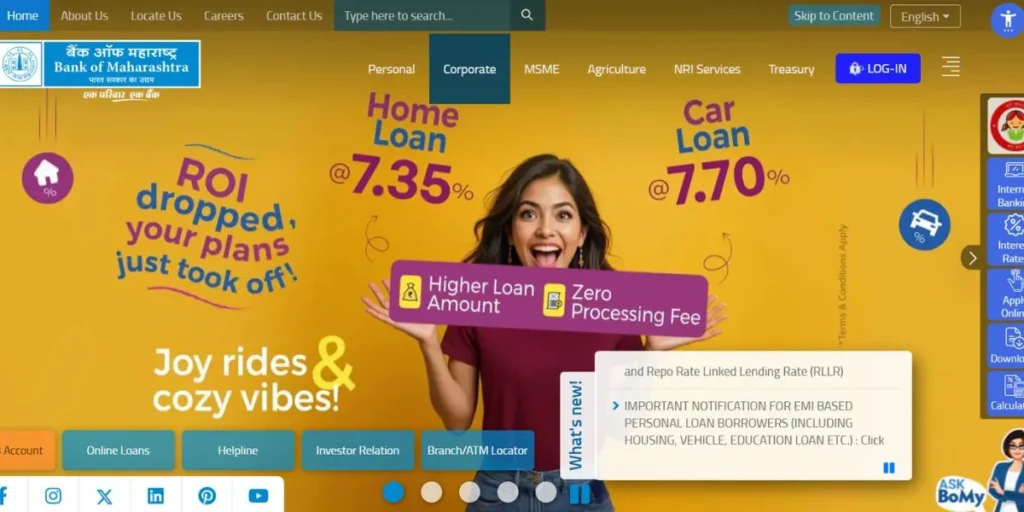

11. Bank of Maharashtra

- CEO: Nidhu Saxena

- Headquarters: Pune, Maharashtra

- Established: 1935

- Branches: Over 2,400

- Specialty: Strong presence in Maharashtra and a leader in lending to priority sectors.

The Bank of Maharashtra is a PSB with its headquarters in Pune, and the largest network of branches in the state of Maharashtra. It was established by a team of visionaries who had a desire to cater to the banking requirements of the common man. This has remained its strength. Featured in the List of Govt Banks in India, the bank has been a consistent leader in low-cost deposits (CASA) mobilisation and has been very efficient in its operations.

It is a key player in the economy of Maharashtra, sustaining small-scale industries, agriculture and retail customers. It is a perfect case of a bank that has a rich regional background and a contemporary forward-looking attitude.

12. Punjab & Sind Bank

- CEO: Swarup Kumar Saha

- Headquarters: New Delhi

- Established: 1908

- Branches: Over 1,500

- Specialty: Its strong commitment to the agricultural sector and small-business sector especially in North India.

Punjab & Sind Bank was established on the basis of social responsibility to assist the weaker classes of the society. The founders of it were convinced in the idea of uplifting the community financially. The bank has its headquarters in New Delhi and a major presence in the state of Punjab and other states in the north of India.

It is especially concerned with financing agriculture and small and medium-sized enterprises (SMEs). As much as it is smaller than the other giants on this list, it has a dedicated customer base and it is highly regarded because of its ethical banking practices and its unswerving commitment to community development.

Which Govt Bank is Best in India?

This is equivalent to asking, “What is the best car?” It is really up to what you require! There is no ideal bank that fits all. Nevertheless, we can emphasize the advantages of some of the best players in order to make the choice.

- To cover maximum areas and provide all-round services: State Bank of India (SBI) In the case of the bank that covers maximum areas and offers all-round services, there is no doubt that SBI is the leader. Its huge network of ATMs and well-known brand name makes it a secure choice to most individuals.

- Bank of Baroda (BoB): The strong international presence of Bank of Baroda gives it an edge over other banks; especially when it comes to NRI, students studying abroad, or businesses with international clientele.

- For Strong Retail and Corporate Services: PNB, Canara Bank, Union Bank These banks are enormous institutions that provide an excellent balance of services. They possess a huge branch network, state-of-the-art digital channels, and offer a wide product and service portfolio that includes loans and deposits to individuals and businesses. Any of these is likely to give you competitive rates and good service.

Ultimately, the optimal bank for you might be the one that has a branch in your neighborhood, has good customer service, is easy to use in terms of its mobile app, or has a particular type of loan that you require.

Comparison Table: Strengths at a Glance

| Name of the Bank | Founded In | HQ Location | Key Strengths |

| State Bank of India | 1955 | Mumbai | Largest network, high public trust, digital innovation (YONO). |

| Punjab National Bank | 1894 | New Delhi | Second largest PSB, strong in North India, focuses on SMEs. |

| Bank of Baroda | 1908 | Vadodara | Strongest international presence, tech-savvy. |

| Canara Bank | 1906 | Bengaluru | Strong in South India, customer-centric, rural focus. |

| Union Bank of India | 1919 | Mumbai | Pan-India presence, strong corporate & retail mix. |

Recent Mergers: Creating Bigger and Stronger Banks

As we said, the landscape of the list of government banks in India was changed due to a major consolidation exercise in 2020. The reasoning was quite basic: there should be fewer, big and well-capitalized banks, as opposed to numerous smaller ones.

In a nutshell, here is a list of who merged with whom:

- Oriental Bank of Commerce and United Bank of India were absorbed by Punjab National Bank.

- Canara Bank swallowed Syndicate Bank

- Corporation Bank and Andhra Bank were taken over by Union Bank of India.

- Allahabad Bank was merged with Indian Bank

This has strengthened the banking sector and has the capacity to finance big projects which is necessary to achieve the goal of India becoming a 5 trillion economy.

Conclusion

List of govt banks in India are the pillars of the financial system of India. They are the local banks of the common man, the mighty financiers of the industries of our country and the reliable partners of the government in its social upliftment mission. The 12 PSBs all have their own unique stories and their own important role to play, whether it is the mighty SBI or the community-centric Punjab and Sind Bank.

They are ever changing, embracing new technology and trying to offer superior services. The next time you see a government bank, then, you will be seeing more than a building–you will be seeing an institution that is part of the history of a modern, expanding India.

We hope that this comprehensive guide helped you to know a little more about the world of government banks!

FAQs

1. How many government banks will there be in India in 2025?

There are 12 government owned public sector banks in India as of 2025.

2. Which is the biggest government bank in India?

The State Bank of India (SBI) is the biggest government bank in India in all aspects including assets, deposits as well as the number of branches.

3. Is my money secure in a government bank?

Absolutely. The Government banks are guaranteed by the Government of India and thus have an implicit sovereign guarantee. They are regarded as one of the safest places to save your money.

4. How does a government bank differ from a private bank?

The primary distinction is ownership. Government banks are owned by the government in majority and the aim of the bank is both social welfare and profit.