With inflation reaching multi-decade highs in recent years, investors are on the lookout for ways to protect their purchasing power. Traditional hedges like gold and real estate have shown mixed results, which has led to more investors considering the “digital gold” bitcoin as an inflation hedge.

Read on to learn whether bitcoin inflation hedge truly works as an effective safeguard against inflation.

The Case for Bitcoin as a Potential Hedge Against Inflation

Bitcoin’s design contains features that clearly distinguish it from fiat currencies and arguably position it as a superior form of money.

Fixed Supply

Unlike fiat currencies, which central banks can print at will, bitcoin has a hard-capped supply of 21 million coins. This inherent scarcity is often compared to precious metals like gold, whose value is underpinned by their limited availability. This fixed supply makes bitcoin immune to the kind of monetary expansion that can lead to excessive inflation.

Decentralization

Bitcoin operates outside government and central bank control. This independence makes it especially attractive in countries experiencing currency devaluation or hyperinflation, where citizens seek alternatives to failing fiat systems. Its borderless, digital nature allows it to serve as a global store of value, accessible to anyone with an internet connection.

Halving Events

Roughly every four years, the reward for mining bitcoin is reduced in an event known as a ‘halving.’ The most recent halving, on April 19, 2024, reduced block rewards from 6.25 to 3.125 bitcoin. This reduction slows the rate of new bitcoin issuance, contributing to its scarcity. Bitcoin’s annual inflation rate has now fallen to approximately 0.83%, lower than gold’s typical annual supply increase of 1% to 1.5%.

The Case Against Bitcoin as an Inflation Hedge

Despite its structural attributes, bitcoin faces several challenges that may limit its effectiveness as an inflation hedge.

High Volatility

Bitcoin’s price is very volatile in the short term, with frequent and sometimes dramatic swings in value. This volatility means that, while it may appreciate over the long term, it can lose significant purchasing power in the short term, making it a risky inflation hedge compared to traditional assets like gold.

Speculative Nature

Critics argue that bitcoin’s value is driven more by speculation than by fundamentals. Its track record as an inflation hedge is mixed: during the inflation surge from late 2020 to mid-2022,

Bitcoin’s price rose, but with considerable volatility and no clear, sustained correlation to inflation rates.

Correlation with Risk Assets

Bitcoin has sometimes moved in tandem with risk-on assets like technology stocks, especially during market downturns. This correlation can reduce its appeal as a safe haven, particularly when investors seek stability.

Bitcoin’s Performance During Inflationary Periods

Bitcoin’s historical behavior during inflationary periods has been mixed.

Some studies suggest that bitcoin delivers strong returns after inflation shocks, especially during its early years before widespread institutional adoption. Other research finds inconsistent or even negative correlations with the Consumer Price Index (CPI) at certain times.

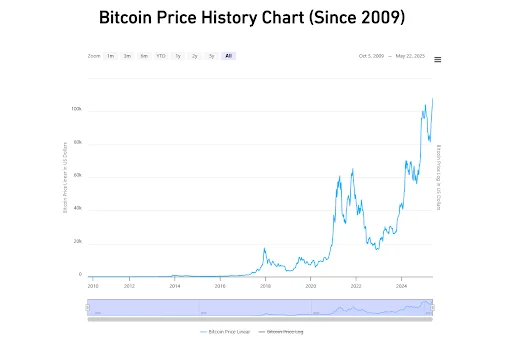

During the initial COVID-19 stimulus period (2020–2021), bitcoin rose from about $10,000 to nearly $69,000, supporting its inflation hedge narrative.

However, in 2022, when inflation was fully realized, bitcoin declined by over 75% amid Federal Reserve interest rate hikes. This performance aligned more with risk assets than with traditional hedges.

While some data indicate that bitcoin can perform well during economic uncertainty, its volatility complicates its role as a short-term safe haven.

Longer-term returns are more compelling. Since 2013, bitcoin has averaged annual returns exceeding 100%, far outpacing inflation. Yet these gains have come with significant price swings, often more than 80% annually.

Correlation data remain inconsistent. At times, bitcoin has moved inversely to the U.S. dollar and inflation expectations. At other times, it has behaved like a risk asset, tracking equity markets.

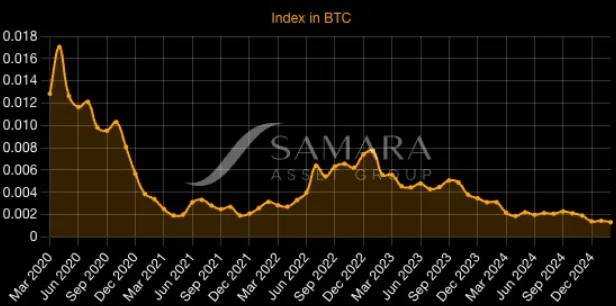

Interestingly, the Bitcoin CPI published by Samara Asset Group shows that on longer time horizon’s, bitcoin has acted as an excellent inflation hedge but in the short term, its volatility has large prevented it from acting as a safe haven against rising inflation.

The ‘Digital Gold’ Narrative: Bitcoin vs. Gold

While gold has historically been the quintessential inflation hedge, the world’s first cryptocurrency has emerged as a contender for the title of ‘digital gold.’ Bitcoin’s proponents argue it shares key characteristics with gold but has superior properties in some areas.

Here’s a detailed comparison:

| Feature | Gold | Bitcoin |

| Nature | Physical commodity | Digital currency |

| Scarcity | Limited supply, mined from the earth | Hard-capped supply (21 million coins) |

| Inflation Hedge | Historically proven due to scarcity and intrinsic value | Potential due to fixed supply and deflationary halving events |

| Portability | Requires physical transport; can be cumbersome | Highly portable; easily transferable digitally |

| Divisibility | Can be divided, but less practical for small units | Highly divisible (e.g., Satoshis) |

| Transaction Ease | Requires physical exchange or secure transfers | Near-instantaneous digital transactions |

| Decentralization | Inherently decentralized (physical asset) | Fully decentralized (no central authority) |

| Volatility | Relatively stable, less volatile than bitcoin | Highly volatile, significant price swings |

| Tangibility | Tangible asset that can be held physically | Intangible digital asset that exists on a blockchain |

| Market Maturity | Centuries-old established market | Relatively young and evolving market (since 2009) |

| Correlation with Inflation | Generally positive, historical evidence | Mixed; some studies show positive correlation, others are inconclusive, and context-specific |

| Statistical Correlation (with each other) | Generally weak and fluctuates; they don’t always move in lockstep | Generally weak and fluctuates; they don’t always move in lockstep |

Gold’s long-standing role as a store of value is rooted in its tangibility and stability. Bitcoin, by contrast, offers advantages in portability, divisibility, and ease of digital transfer.

While both respond to macroeconomic forces, their statistical relationship is weak and inconsistent.

So, Is Bitcoin a Worthy Hedge?

Bitcoin offers long-term potential as an inflation hedge, supported by its capped supply and growing adoption. The concept of a bitcoin inflation hedge has gained traction as its inflation rate, now lower than gold’s, adds to its appeal for investors seeking protection against currency debasement.

Still, bitcoin’s high volatility and relatively young market status mean it isn’t a guaranteed safe haven for all investors. Historical data support its inflation-hedge potential in the long term, but its behavior often resembles that of high-risk assets in the short term.

A balanced view of bitcoin should include both its structural strengths and its practical limitations. Investors considering it as a hedge against inflation should do so with a clear understanding of its risks and time horizon.