Quick and efficient insurance claim management has become indispensable because of the fast, customer-driven market we currently face. Insurance providers expand their operations through robust claims management software to meet growing customer demands for streamlined services.

Digital solutions automate complex workflows, yet simultaneously lower errors, boost communication, and accelerate claims settlement times. Numerous available platforms make choosing the optimal insurance claims management software an extremely challenging task.

A comprehensive list of the leading candidates has been assembled for 2025 because each system includes state-of-the-art functionality, an easy-to-use interface, and AI-powered analytic features.

Understand Insurance Software

Digital solutions that assist insurance companies with operational efficiency enhancement constitute insurance software. Insurance software handles process automation across underwriting, policy management, claims processing, and customer service functions.

Insurance software enhances operations by streamlining workflows and reducing errors while delivering accurate data and regulatory compliance. Insurance software helps companies improve operational efficiency through its AI analytics and real-time reporting.

Business system integration capabilities to deliver enhanced customer service while speeding up decisions. Smaller agencies, along with larger insurers, require this software to maintain their competitiveness and meet constant industry demands.

Factors to Consider When Choosing Insurance Claims Management Software

Your organisation requires a careful selection of insurance claims management software to achieve maximal efficiency together with customer satisfaction and regulatory compliance. Before your choice, you should evaluate these essential factors among the different market options:

1. Functionality and Features

Insurance claims management software should allow complete functionality by providing tracking features combined with automated workflows and document management functions, fraud detection and reporting tools, and system integration capabilities. You should select tools that can manage claims from FNOL through the entire settlement phase.

2. User-Friendly Interface

The interface design keeps your team members from needing lengthy training because it shows information clearly to them. Simple-to-use user interfaces prevent mistakes and improve operational performance, particularly during crucial claim assessment periods.

3. Customisation and Scalability

The nature of your business operations will change through time. Search for adaptable software tools that enable customisation needed to handle upcoming organisational modifications. Companies that expect rising claim quantities or new service products must prioritise software applications that demonstrate scalability.

4. Integration Capabilities

The application needs to work perfectly with CRM, accounting and underwriting and policy management systems. Better data sharing occurs through integrated systems, which enable both seamless workflows and enhanced accuracy.

5. Security and Compliance

Since insurance data requires strict protection, the software solution needs to implement encryption and access control protocols, which also require regular backup maintenance. Any insurance solution must follow required regulatory standards, including GDPR, HIPAA, and applicable industry laws.

6. Automation and AI Features

Claims software systems today use artificial intelligence together with machine learning to perform automated processes, find fraudulent claims, and generate predictive analytics. The system incorporates features that help users make faster decisions and save processing time.

7. Vendor Support and Training

A system implementation requires both dependable customer support services in addition to complete setup training for an efficient transition. Verify if the vendor maintains dedicated support channels for training their customers and updates them and provides continuous technical help every hour.

8. Cost and ROI

Consider the full value impact of the software programme over its monetary expense. The added cost will be worthwhile if the platform delivers major efficiency improvements combined with enhanced customer satisfaction.

List of Best Insurance Claims Management Software

1. BriteCore

Website: https://www.britecore.com

BriteCore provides customers with sophisticated claims management software solutions that merge usability features with operational speed. Real-time claim tracking and automated workflows, together with extensive reporting tools, constitute the main features of this platform. Cloud-based technology enables the software to open insurance provider data instantly from any geographic location for consistent cross-department work.

The system maintains robust security functionalities that protect confidential data. The platform uses an easy-to-use interface, which helps new users acclimate quickly. The platform from BriteCore can serve agencies of different sizes and their respective organisational requirements.

Features

- Real-time claim tracking

- Automated workflows for efficiency

- Document management system

- Customizable claims process

- Secure cloud-based platform

- Integration with existing systems

- User-friendly interface

- Scalable for businesses of all sizes

- Robust data analytics and reporting

- Compliance with industry regulations

Pricing: Connect with the team

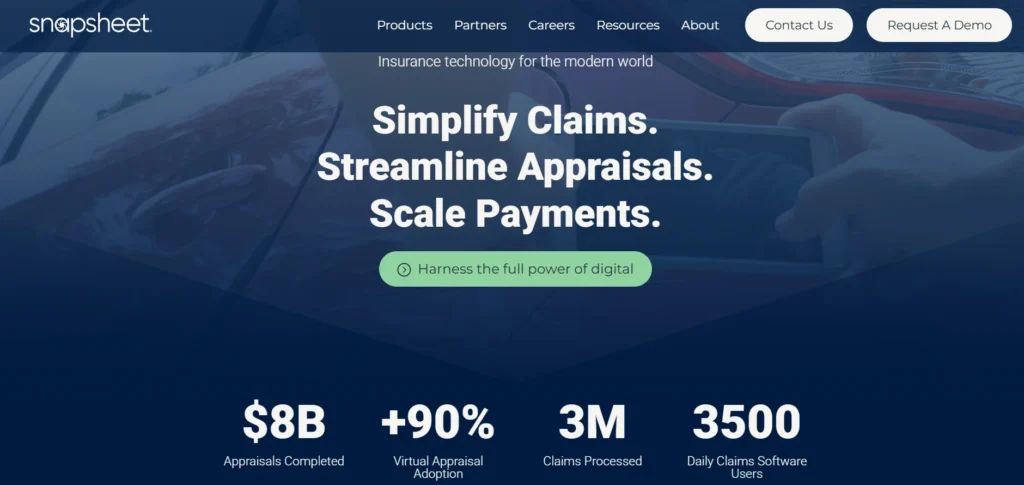

2. Snapsheet

Website: https://www.snapsheetclaims.com

Claims management software Snapsheet makes use of artificial intelligence to achieve streamlined processing of vehicle insurance claims. The platform enhances claims processing speed by automating vital functions that go from damage estimation to claims approval. Remote assessments represent one of the leading digital claims solutions offered by Snapsheet because they eliminate physical examination requirements.

Through AI-powered virtual appraisals, the software achieves accurate claims estimations at high speed. The software works seamlessly with external tools to boost data connectivity and team collaboration efficiency. Insurance companies need this technology to transform their operations while delivering enhanced digital experiences to customers.

Features

- AI-powered damage estimates

- Virtual appraisals and claims assessments

- Automated claims approval process

- Remote claim handling capabilities

- Integration with third-party tools

- Real-time claim tracking and updates

- Customizable workflows for claims management

- Digital claims submission and tracking

- Secure cloud-based platform

Pricing: Connect with the team

3. Applied Systems, Inc.

Website: https://www1.appliedsystems.com/en-us

Applied Systems Inc. provides a full insurance platform that includes specialised claims management software tools for operational enhancement. The solution helps insurers operate claims processing through complete lifecycle management support.

It also includes automated routing capabilities and real-time reports, as well as document management tools. The software from Applied delivers smooth connections to multiple systems that provide continuous data movement through the entire enterprise.

The software system provides sophisticated analytical tools that enable insurers to detect patterns across data while making more informed decisions. The flexible software solution operates across different business sizes and provides customisable features for unique industry requirements.

Features

- Full claims lifecycle management

- Automated claim routing

- Real-time reporting and dashboards

- Document management and storage

- Integration with CRM, policy, and accounting systems

- Advanced analytics and reporting

- User-friendly interface

- Customizable workflows

- Mobile access for adjusters and agents

- Cloud-based deployment

Pricing: Connect with the team

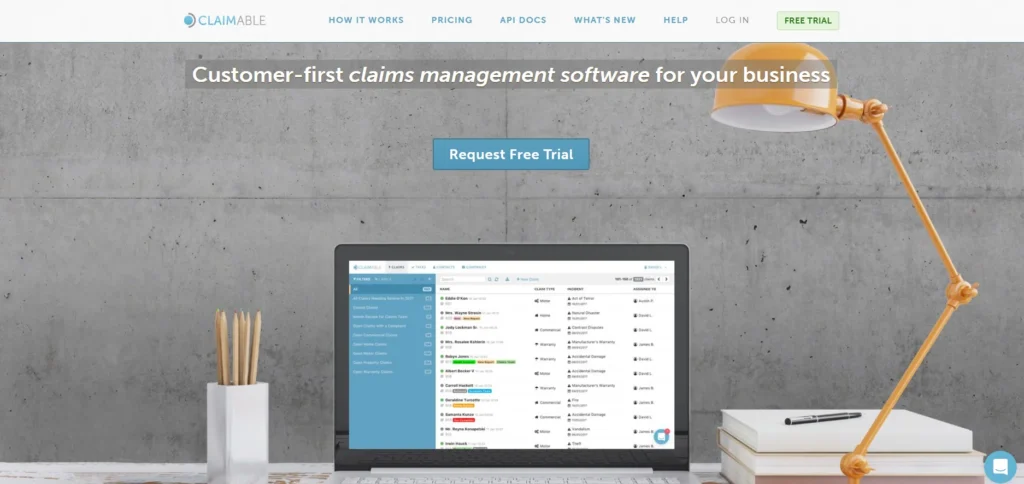

4. Claimable Ltd.

Website: https://www.claimable.com

Claimable Ltd. delivers a user-friendly software solution for insurance claims management that supports providers’ effective and budget-conscious claim processing. Users can utilise automated claim filing alongside progress tracking and reporting tools through the platform to optimise their claims handling process. The system provides collaborative features that enable adjusters and agents to communicate with clients through its functionality.

Insurers can customise the solution from Claimable to design workflows that match their individual requirements. The user-centric design, together with real-time system updates provided by Claimable Ltd., enables a rapid and transparent resolution process for claims.

Features

- Automated claim filing and processing

- Real-time claim progress tracking

- Integrated document management system

- Collaboration tools for team communication

- Customizable workflows and claim forms

- User-friendly interface for quick adoption

- Secure cloud storage for sensitive data

- Reporting tools for performance tracking

- Scalable to meet business needs

- Fast claims resolution for improved customer satisfaction

Pricing:

- Startup: £59 per user/month

- Growth (Most Popular): £99 per user/month

- Established: £179 per user/month

Suggested Read:

Educational Loans for Students in India

5. Insurity

Website: https://insurity.com

Insurity works as a top cloud-based insurance software provider that delivers sophisticated claims management solutions to the market. Their platform supports efficient claims management through automated workflows and real-time tracking along with integration capabilities for enterprise systems.

Insurity employs its software technology to enhance decision-making while predicting outcomes and finding fraudulent claims through data analytics coupled with AI functionality—the software solution scales from small to large insurance providers while maintaining its operational abilities.

User data safety is guaranteed because the platform achieves industry compliance by implementing strong security measures. Through the use of Insurity software, insurers achieve both a reduction in costs and operational improvements and enhanced claims experiences for their policyholders.

Features

- Cloud-based claims management

- Automated claims processing

- Real-time tracking and updates

- Integration with policy management and other systems

- AI-powered analytics for decision-making

- Fraud detection and prevention tools

- Compliance management features

- Customizable workflows

- Scalable for growing businesses

- Secure data handling and encryption

Pricing: Connect with the team

6. LexisNexis

Website: https://risk.lexisnexis.com/global/en/insurance

LexisNexis provides powerful insurance claims management software that optimises processing operations through analytic and data-driven systems. The software system merges up-to-date information to boost managerial decisions, cut down on fraudulent activities, and boost claims process quality. Through LexisNexis, insurance organisations can detect potential fraudulent claims before the initial stages of processing.

The platform enables insurance providers to process claims efficiently through automated workflows, connects to third-party systems, and generates performance data analytics that ensure smooth operations. The platform is suitable for insurance providers working in regulated environments because it shows a strong commitment to compliance with rules.

Features

- Real-time claims tracking

- AI-powered fraud detection tools

- Integrated reporting and analytics

- Customizable workflows for claims handling

- Secure data storage and encryption

- Third-party tool integration

- Compliance with industry regulations

Pricing: Connect with the team

7. Mobexo Claims Management

Website: www.mobexo.de/

Mobexo Claims Management provides digital solutions that streamline the entire insurance claims management process. The system promotes operational effectiveness by giving users a convenient interface alongside cloud-based functionality.

The software system implements automated claims processing together with real-time status updates and secure document management features as its main functions. The analytics feature of Mobexo’s system tracks claims operations to spot performance weaknesses while providing detailed insights.

Mobexo optimises workflows to allow insurers to shorten their processing times and deliver better customer satisfaction results. Businesses of every size can use the platform, and its full customisation capabilities permit insurers to customise it for their particular needs.

Features:

- Automated claims processing

- Real-time claim status updates

- Secure document management

- Cloud-based platform for easy access

- Customizable workflows and features

- Reporting tools for performance analysis

- Mobile access for adjusters and agents

- Scalable solution for various business sizes

- User-friendly interface

- Fraud detection and risk analysis

Pricing:

- Basic: 6.90 € per month per vehicle (bookable from 10 vehicles)

- Comfort: 9.90 € per month per vehicle (bookable for 30 vehicles)

- Enterprise: Individually tailored to you

8. OneShield Software

Website: https://oneshield.com/

Oneshield Software offers an advanced claims management platform featuring flexible design and analytics capabilities to benefit insurance organisations during their operations. The platform enhances claims management efficiency through workflow automation while offering real-time tracking capabilities and integration with existing business systems.

OneShield’s software lets insurers access sophisticated reporting tools that deliver insights throughout their claims database for better decision-making processes. Insurance adjusters can access claim information anywhere through the platform because it supports mobile functions.

The software from OneShield delivers operational enhancements that lower administrative costs while speeding up settlement processes to give both insurance customers and policyholders a streamlined journey.

Features:

- Full claims lifecycle management

- Automated workflows for increased efficiency

- Real-time claims tracking and updates

- Integration with third-party systems

- Mobile access for on-the-go claims management

- Advanced analytics and reporting

- Customizable claims processing

- Cloud-based and secure platform

- Collaboration tools for teams

- Scalability to grow with your business

Pricing: Connect with the team

9. Riskonnect, Inc.

Website: https://riskonnect.com/

Riskonnect Inc. delivers an extensive risk management system that provides complete insurance claims processing functionality. Insurance companies can monitor claims progress while assessing risks through a unified dashboard under the software system.

Riskonnect uses analytics together with real-time reports to help insurance companies base their decisions on data while spotting upcoming risks. Users have access to compliance tools integrated within the platform to verify insurance companies maintain regulatory compliance.

The Riskonnect cloud platform gives insurers remote data access for expedited claims settlements and enhanced operational performance.

Features

- Centralized dashboard for claims management

- Automated workflows for efficient claims handling

- Real-time claims tracking and updates

- Advanced data analytics and reporting

- Integration with risk management and policy systems

- Compliance management tools

- Cloud-based platform with mobile access

- Customizable claims handling workflows

- Predictive analytics for risk identification

Pricing: Connect with the team

10. Sapiens International Corporation

Website: https://sapiens.com/

Sapiens International Corporation delivers complete claims management software to automate insurance company operations and optimise their claims processing efficiency. The system provides strong features for processing insurance claims along with automated workflows and immediate tracking abilities for claims.

Artificial intelligence and machine learning capabilities in Sapiens’ software identify fraudulent claims while predicting outcomes and maximizing decision effectiveness. The software integrates smoothly with current operations to maintain a fluid data exchange process that strengthens departmental collaboration.

Features:

- End-to-end claims management solution

- AI and machine learning for fraud detection

- Automated claims processing and workflows

- Real-time claims tracking and reporting

- Customizable workflows for different insurance needs

- Integration with other business systems

- Advanced analytics and decision-making tools

- Cloud-based deployment for remote access

- Scalable solution for growing businesses

- Mobile capabilities for adjusters and agents

Pricing: Connect with the team

Conclusion

The insurance industry requires organisations to prioritise their selection of proper claims management software because it represents a critical business investment. Advanced tools increase transparency while ensuring accurate data and give your team the power to achieve faster resolutions that satisfy customers fully.

The advanced solutions of 2025 were developed to satisfy different organisational requirements. Before making your selection, check for scalability features along with integration potential and available support services.

The right platform enables you to achieve more than claim management as it improves the entire operational environment. Settle for the smart choice right now to achieve efficiency advancement, along with accuracy improvements and greater customer trust.

FAQs

How secure is insurance claims management software?

The security features of the insurance claims management software platform consist of encryption and secure data storage with access control measures. The system secures confidential customer data by protecting it and adhering to applicable regulations.

Does the platform support connections with existing operating systems?

Existing systems, including CRM, policy management, and accounting software, have interoperability with diverse claims management platforms. The integrated system provides consistent data clarity and eliminates duplicate data input across multiple platforms.

Can claims management software work effectively for organizations of all sizes?

The majority of claims management software systems are designed to scale their operations, hence accommodating businesses of all sizes. Your business growth will allow you to modify both the capabilities and functionalities of the software.

How does claims management software create improved levels of customer satisfaction?

Claims management software accelerates the claims processing while giving customers live updates through self-service interfaces. The system delivered improved customer satisfaction by speeding up procedures while providing transparent and accessible information.