Forex trading in India has been experiencing significant growth. The Indian foreign exchange market was valued at $30.7 billion in 2024, and it is projected to reach $65.8 billion by 2033, exhibiting a CAGR of 8.8% from 2025 to 2033. citeturn0search0 This surge is driven by factors such as rising remittances from Non-Resident Indians (NRIs), strengthening foreign exchange reserves, and increasing foreign portfolio investment inflows.

However, it’s important to note that the Reserve Bank of India (RBI) reported that the average daily turnover in the Indian forex market was about $33 billion as of 2018. citeturn0search19 This indicates that while the market is growing, it is still a fraction of the global forex market, which had a daily turnover of $7.5 trillion in April 2022. citeturn0search6

Given this landscape, selecting the right forex trading platform is crucial for accessing global currency markets, utilizing advanced trading tools, and ensuring compliance with regulations. The Securities and Exchange Board of India (SEBI) regulates forex trading in the country, mandating that traders use SEBI-authorized brokers for legal and secure transactions.In this guide, we will explore the top forex trading platforms in India for 2025, highlighting their key features and how to choose the one that best fits your trading needs. Let’s dive in!

What is Forex Trading?

Forex exchanging, moreover known as remote trade or money exchanging, is the prepare of buying and offering monetary standards in the worldwide monetary showcase. It is one of the biggest and most fluid markets in the world, with a day by day exchanging volume surpassing $7 trillion. Forex exchanging includes trading one cash for another to benefit from changes in trade rates.

Regulations for Forex Trading in India

Forex exchanging in India is entirely controlled by the Save Bank of India (RBI) and the Securities and Trade Board of India (SEBI) to guarantee a secure and lawful exchanging environment. Dealers must comply with these directions to dodge legitimate consequences.

Key Regulatory Aspects:

Permitted Currency Pairs

- Forex trading in India is only allowed in currency pairs that are listed on the Indian exchanges (NSE, BSE, MCX-SX).

- The permitted pairs include USD/INR, EUR/INR, GBP/INR, and JPY/INR.

- Trading in foreign currency pairs (like EUR/USD or GBP/USD) is restricted for retail traders under Indian law.

Authorized Forex Brokers

- Forex trading must be done through SEBI-registered brokers or banks regulated by RBI.

- Popular regulated brokers include Zerodha, ICICI Direct, HDFC Securities, and Kotak Securities.

- International brokers offering forex trading in non-INR pairs are considered illegal under Indian law unless authorized.

Leverage Restrictions

- SEBI imposes limits on leverage to prevent excessive risk-taking.

- Typically, leverage is capped at 1:50 or lower, depending on the broker and trading instrument.

FEMA Guidelines & Restrictions

- The Foreign Exchange Management Act (FEMA), 1999 governs forex trading in India.

- Violating FEMA by trading on unauthorized platforms can lead to penalties and legal action.

- Indian residents cannot transfer funds to foreign forex brokers without RBI approval.

Taxation on Forex Trading

- Forex trading profits are taxable under Income Tax Act based on the trader’s tax slab.

- Short-term profits may be subject to capital gains tax or classified as business income.

List of Top Forex Trading Platforms in India

1. IG

IG is broadly respected as the best in general forex broker in India due to its broad showcase get to, progressed exchanging instruments, and solid administrative system. With a nearness in over 17,000 markets, IG offers competitive spreads, profound liquidity, and a user-friendly exchanging interface.

The stage gives capable charting apparatuses, real-time information investigation, and hazard administration highlights, making it perfect for both fledglings and experienced dealers. IG is directed by top-tier budgetary specialists, guaranteeing security and straightforwardness. Also, dealers advantage from instructive assets, responsive client back, and different account sorts custom fitted to diverse exchanging needs.

Features

- Progressed Exchanging Stages

- Competitive Spreads & Moo Expenses

- Profound Liquidity & Quick Execution

- Solid Administrative System

2. FOREX.com

FOREX.com is one of the most trusted and broadly utilized forex exchanging stages, known for its capable exchanging apparatuses, profound liquidity, and solid administrative compliance. It offers competitive spreads, quick exchange execution, and get to to a wide run of cash sets.

The stage gives progressed charting highlights, computerized exchanging choices, and consistent integration with MetaTrader 4 (MT4) and MetaTrader 5 (MT5). With a user-friendly interface, instructive assets, and 24/7 client bolster, FOREX.com is perfect for both apprentices and experienced dealers in India.

Features

- User-Friendly Interface

- Security and Direction

- Low Exchanging Expenses & Spreads

- Wide Run of Money Sets

- Fast Execution Speed

3. Zerodha Forex

Zerodha Forex is a profoundly solid and broadly utilized Forex Trading Platform in India, known for its low brokerage expenses and user-friendly interface. As one of the driving brokerage firms in the nation, Zerodha gives a consistent trading experience with advanced tools for market analysis.

The stage is especially well known among retail dealers due to its straightforward estimating, zero covered up charges, and amazing client back. With an natural exchanging dashboard, real-time showcase information, and effective charting instruments, Zerodha Forex makes forex exchanging available to both tenderfoots and experienced dealers. Also, it offers smooth integration with stages like Kite and TradingView, permitting dealers to execute exchanges effectively whereas keeping track of showcase movements.

Features

- Wide Market Access

- Advanced Trading Platforms

- Competitive Spreads & Low Fees

- Deep Liquidity & Fast Execution

- Strong Regulatory Framework

4. Angel Broking Forex

Angel Broking Forex is a SEBI-regulated forex trading platform known for its high security, AI-driven trading insights, and competitive spreads. It provides traders with access to multiple currency pairs, advanced research tools, and a seamless trading experience.

The platform is designed for both beginners and experienced traders, offering automated trading strategies and expert recommendations to enhance profitability. With a strong reputation in India’s financial markets, Angel Broking ensures safe and efficient forex trading.

Features

- SEBI-Regulated & High Security

- AI-Powered Trading Insights

- Multiple Currency Pair Support

- Advanced Trading Tools

- Seamless Mobile & Web Trading

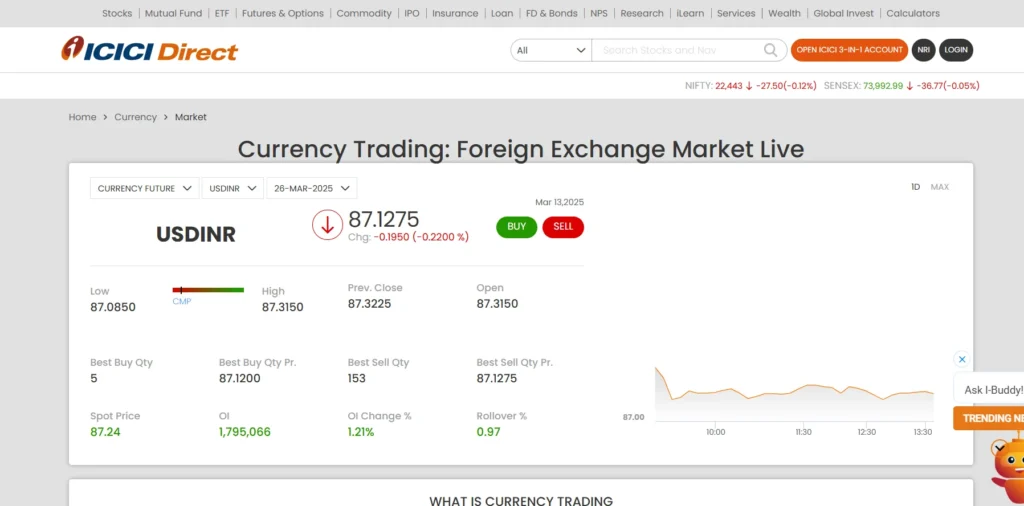

5. ICICI Direct Forex

ICICI Direct Forex is a trusted forex trading platform backed by ICICI Securities, one of India’s leading financial institutions. It offers a secure and seamless trading experience with advanced risk management tools, leverage trading options, and easy integration with ICICI Bank accounts.

The platform is ideal for both beginner and professional traders, providing access to global forex markets with real-time data and expert research insights. ICICI Direct Forex ensures compliance with Indian regulations, making it a preferred choice for forex traders looking for a safe and efficient trading environment.

Features

- Leverage Trading

- Risk Management Tools

- Seamless Bank Integration

- Expert Research & Market Insights

- Regulatory Compliance & Security

6. HDFC Securities Forex

HDFC Securities Forex is a reliable Forex Trading Platform in India backed by HDFC Bank, one of India’s leading financial institutions. It offers a secure and well-regulated environment for forex traders, providing in-depth research reports, expert market insights, and seamless integration with HDFC banking services.

With its advanced trading tools, competitive pricing, and excellent customer support, HDFC Securities Forex is a great option for both beginners and experienced traders looking for a stable and feature-rich trading experience.

Features

- Well-Regulated & Secure

- Comprehensive Research Reports

- Seamless Banking Integration

- Advanced Trading Tools

- Dedicated Customer Support

7. Upstox Forex

Upstox Forex is a leading forex trading platform in India, known for its ultra-fast trade execution and cost-effective trading solutions. It offers a user-friendly interface, making it an excellent choice for both beginners and professional traders.

With advanced charting tools and seamless integration with TradingView, Upstox Forex enables in-depth technical analysis to enhance trading strategies. The platform is backed by strong customer support and provides valuable educational resources to help traders make informed decisions.

Features

- Ultra-Fast Execution

- Low-Cost Trading

- Advanced Charting Tools

- Seamless Platform Integration

- Strong Customer Support & Education

8. Saxo Bank Forex

Saxo Bank is a well-established forex trading platform with a strong global presence, including India. It is known for offering a highly secure trading environment, advanced tools, and access to a wide range of currency pairs.

With its professional-grade trading platforms and deep liquidity, Saxo Bank is a preferred choice for serious traders and institutional investors. The platform ensures strict compliance with financial regulations, making it one of the safest options for forex trading in India.

Features

- Wide Market Access

- Advanced Trading Platforms

- High Security & Compliance

- Competitive Spreads & Low Fees

- Comprehensive Research & Analysis

9. PrimeXBT

PrimeXBT is a cryptocurrency trading platform that offers leveraged trading on various assets, including cryptocurrencies, forex, commodities, and indices. Founded in 2018, it provides users with advanced trading tools, low fees, and high-speed order execution.

The platform supports margin trading with up to 100x leverage on crypto assets and even higher for forex and commodities. It also features copy trading, allowing users to follow and replicate the strategies of experienced traders. PrimeXBT emphasizes security and privacy, requiring minimal personal information for account creation. Its user-friendly interface and diverse asset offerings make it a popular choice among both beginner and professional traders.

Features

- Margin Trading

- Copy Trading

- Multi-Asset Trading

- Low Fees & Competitive Spreads

- Security & Privacy

- Educational Resources

- Mobile Trading

10. FXTM

FXTM (ForexTime) is a global online forex and CFD broker known for its user-friendly trading platforms and a strong focus on education. Established in 2011, FXTM offers a wide range of financial instruments, including forex, commodities, stocks, and cryptocurrencies.

The broker provides competitive spreads, fast execution speeds, and multiple account types catering to both beginners and professional traders. With strong regulatory oversight from bodies like the FCA (UK) and CySEC (Cyprus), FXTM ensures a secure trading environment. Additionally, it offers various educational resources, including webinars and market analysis, making it a popular choice for traders worldwide.

Features

- Forex Trading

- CFD Trading

- Stock Trading

- Copy Trading (FXTM Invest)

- Trading Platforms

- Educational Resources

- Customer Support

- Deposit & Withdrawal Options

How to Choose the Right Forex Trading Platform

- Selecting the right forex trading platform requires careful evaluation based on your trading goals and preferences. Consider the following factors:

- Regulatory Compliance: Ensure the platform is registered and regulated by SEBI or other financial authorities to ensure safety and transparency.

- Ease of Use: Choose a platform with an intuitive user interface and accessible trading tools for a smooth experience.

- Trading Costs: Compare transaction fees, spreads, commissions, and any hidden charges to find a cost-effective option.

- Asset and Currency Pair Availability: Ensure the platform offers a variety of currency pairs, including major, minor, and exotic pairs.

- Execution Speed: Fast order execution reduces slippage and ensures you trade at the best possible prices.

- Trading Features: Look for essential features like leverage, stop-loss orders, automated trading, and charting tools.

- Customer Support: A responsive and knowledgeable support team can assist with technical or trading-related issues.

- Mobile and Web Trading: A platform with a mobile app allows for trading on the go, ensuring flexibility.

- Security Measures: Ensure the platform has encryption, two-factor authentication (2FA), and strong data protection policies.

- User Reviews and Reputation: Check trader reviews and industry ratings to assess the platform’s reliability.

Conclusion

Selecting the best Forex Trading Platforms in India is crucial for a seamless and profitable trading experience. With strict regulations by SEBI and RBI, traders must ensure they use authorized brokers that comply with Indian laws. Platforms like IG, FOREX.com, Zerodha Forex, Angel Broking, ICICI Direct, HDFC Securities, and Upstox offer various features, including advanced charting tools, competitive spreads, secure transactions, and seamless banking integration.

Before choosing a platform, traders should consider factors such as regulatory compliance, trading fees, available currency pairs, execution speed, and customer support. Whether you are a beginner or an experienced trader, selecting the right platform can help you maximize profits while managing risks effectively. Always trade responsibly and stay updated with market trends to enhance your forex trading journey in India.

FAQs

1. Is forex trading legal in India?

Yes, forex trading is legal in India but is strictly regulated by the Reserve Bank of India (RBI) and the Securities and Exchange Board of India (SEBI). Traders can only trade in INR-based currency pairs (USD/INR, EUR/INR, GBP/INR, JPY/INR) through SEBI-authorized brokers. Trading in foreign currency pairs (like EUR/USD) with offshore brokers is illegal for Indian residents.

2. Which is the best forex trading platform in India?

Some of the best SEBI-regulated forex trading platforms in India include:

- Zerodha Forex – Low brokerage fees and a user-friendly interface.

- ICICI Direct Forex – Secure trading with seamless banking integration.

- HDFC Securities Forex – Backed by a trusted bank with strong research insights.

- Angel Broking Forex – AI-powered trading insights and multiple currency pairs.

- Upstox Forex – Ultra-fast trade execution with advanced charting tools.

3. What are the key factors to consider when choosing a forex trading platform?

When selecting a forex trading platform, consider:

- Regulation & Security – Ensure the platform is SEBI-registered.

- Trading Fees & Spreads – Lower fees mean higher profitability.

- Currency Pairs Available – Check if it supports INR-based pairs.

- Leverage & Margin – Look for leverage options that match your risk appetite.

- Platform Usability – A user-friendly interface with advanced charting tools.

4. Can I trade forex on international platforms like MetaTrader (MT4/MT5)?

Yes, but only through SEBI-regulated brokers. Many Indian forex brokers like Zerodha, ICICI Direct, and Angel Broking offer integration with MetaTrader 4 (MT4) and MetaTrader 5 (MT5) for advanced trading.