Choosing the right crypto trading broker or platform is crucial for a seamless trading experience. With the growing popularity of cryptocurrencies, traders need platforms that offer security, low fees, a user-friendly interface, and access to a wide range of assets. The best brokers provide advanced trading tools, high liquidity, and regulatory compliance to ensure safe and efficient transactions.

Some platforms cater to beginners with simple interfaces, while others offer advanced features for professional traders. Factors like trading fees, customer support, and asset variety play a key role in decision-making. A well-chosen platform enhances trading efficiency and overall market experience.

In this blog, we will take a look at 10 Best Crypto Trading Brokers and Platforms.

Key Features to Look for in Crypto Trading Brokers and Platforms

- Security Measures: Platform security requires deployment of two-factor authentication (2FA) along with cold storage and encryption protocols.

- Regulation & Compliance: Look for brokers who operate within regulatory frameworks to ensure safe trading and legal protection.

- Low Trading Fees: Investors should select trading platforms with competitive maker/taker fees to achieve maximum profit potential.

- User-Friendly Interface: A user-friendly interface works well for new traders and experienced users equally.

- Variety of Cryptocurrencies: Having multiple cryptocurrency options provides users with better asset diversity through their investments.

- Liquidity & Volume: Higher liquidity combined with increased trading volume allows execution of trades at quick speeds with small price differences.

- Deposit & Withdrawal Options: Clients benefit from easy access because the trading platform accepts various payment options which include fiat currencies as well as different cryptocurrencies.

- Leverage & Margin Trading: Proper control methods along with margin trading options create vital advantages for traders who want to increase their financial gains.

- Customer Support: A reliable 24/7 support system helps customers find quick solutions to their problems.

- Advanced Trading Tools: Trading efficiency increases through advanced tools including charting features and APIs alongside automation capabilities.

Types of Crypto Trading Platforms

- Centralised Exchanges (CEXs): Operated by a central authority, offering high liquidity, security, and ease of use (e.g., Binance, Kraken).

- Decentralised Exchanges (DEXs): Peer-to-peer platforms with no intermediaries, ensuring privacy and control (e.g., Uniswap, PancakeSwap).

- Derivatives Exchanges: Enable trading of futures, options, and leverage products for advanced traders.

- Brokerage Platforms: Offer simplified buying/selling at set prices, ideal for beginners (e.g., eToro, Forex.com).

- Peer-to-Peer (P2P) Exchanges: Direct user trading with flexible payment options (e.g., LocalBitcoins, Binance P2P).

- Automated Trading Platforms: Use AI and bots for trading strategies (e.g., Cryptohopper).

- Hybrid Exchanges: Combine CEX security with DEX transparency (e.g., DeversiFi).

Security Measures in Crypto Trading Platforms

- Two-Factor Authentication (2FA): Adds an extra layer of security beyond passwords.

- Cold Storage: Most funds are stored offline to prevent hacks.

- Encryption & Secure Socket Layer (SSL): Protects data from cyber threats.

- Multi-Signature Wallets: Requires multiple approvals for transactions.

- Withdrawal Whitelisting: Limits withdrawals to approved addresses.

- Regular Security Audits: Ensures platform integrity against vulnerabilities.

- Bug Bounty Programs: Rewards ethical hackers for finding security flaws.

- KYC & AML Compliance: Prevents fraud and ensures regulatory adherence.

- DDoS Protection: Safeguards against cyberattacks disrupting services.

- Insurance Funds: Covers losses from potential breaches (e.g., Binance SAFU).

List of 10 Best Crypto Trading Brokers and Platforms

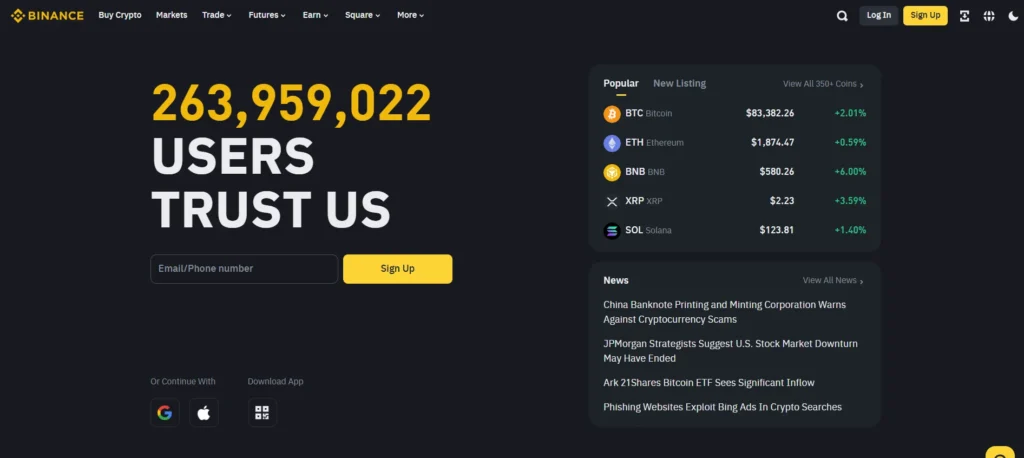

1. Binance

- Minimum deposit: $10

- Maker fees: 0.00% to 0.10%

- Taker fees: 0.02% to 0.10%

- Available cryptocurrencies: 365+

Binance stands as the globe’s largest cryptocurrency exchange with its trading volume while offering access to more than 365 diverse cryptocurrency options. Binance operates an extensive trading platform which includes spot deals along with futures trading and margin accounts as well as crypto stake options.

Users can trade at Binance with fees ranging up to 0.01% while benefiting from diverse tools that include sophisticated charting features alongside API connections and learning resources. The platform enables users to buy cryptocurrencies using fiat money and it also provides safe wallet storage functions.

The BNB native token of Binance gives users reduced trading fees when used on the platform. The platform stands out as it combines robust security measures with SAFU (Secure Asset Fund for Users) to protect funds from potential breaches and implements multi-factor authentication.

Pros:

- Low trading fees and additional discounts with BNB token

- Extensive selection of cryptocurrencies and trading pairs

- Offers futures, margin, staking, and P2P trading

Cons:

- Regulatory scrutiny in some regions, leading to restricted access

- Complex interface may not be ideal for beginners

- Limited fiat withdrawal options in certain countries

2. Bybit

- Minimum deposit: $10

- Maker fees: 0.00% to 0.10%

- Taker fees: 0.05% to 0.10%

- Available cryptocurrencies: 150+

Bybit operates as a premier cryptocurrency platform which focuses on trading futures contracts and perpetual contracts. Traders benefit from this platform’s sophisticated trading instruments combined with its easy-to-use interface alongside fees that start from zero. Experienced traders will find leverage trading with Bybit to be suitable because it allows them to increase their trading position up to 100x.

Traders benefit from liquid order books alongside fast execution speeds and secure transaction protocols. Users can access spot trading on the platform together with copy trading options while staking and earn programs are available.

Through its robust customer support system and educational resources this platform helps users build stronger trading strategies. The basic withdrawal process on Bybit functions without requiring KYC procedures which enables worldwide access.

Pros:

- No KYC required for basic withdrawals

- High leverage up to 100x for derivatives trading

- User-friendly interface with advanced trading tools

Cons:

- Limited fiat deposit and withdrawal options

- Not available for users in the U.S.

- High risk involved in leverage trading

3. HTX

- Minimum deposit: $10

- Maker fees: 0.02%

- Taker fees: 0.04%

- Available cryptocurrencies: 321+

HTX operates as a prominent cryptocurrency exchange enabling trading across 321 digital assets. The exchange delivers exceptional deep liquidity along with creative trading tools to its users in addition to providing top-grade security features.

Users access spot trading and futures along with margin trading through the platform while paying low fees of 0.02% for makers and 0.04% for takers. The platform supports earn programs as well as staking features alongside a launchpad for new crypto startup projects.

Security features on the platform earn high ratings because they include cold multi-signature wallets. Active traders find HTX’s native token, HT, appealing due to its ability to offer discounted trading fees and unique purchasing advantages.

Pros:

- Deep liquidity with a large selection of crypto assets

- Strong security features, including multi-signature wallets

- HT token holders get discounts on trading fees

Cons:

- Regulatory uncertainty in some jurisdictions

- Limited fiat deposit methods

- Higher withdrawal fees compared to some competitors

4. Bitfinex

- Minimum deposit: $10

- Maker fees: 0.10%

- Taker fees: 0.20%

- Available cryptocurrencies: 150+

Bitfinex is a professional-grade trading platform offering spot and margin trading with up to 10x leverage. It supports over 150 cryptocurrencies and provides advanced order types, API trading, and high liquidity.

Bitfinex is best suited for experienced traders due to its sophisticated tools, such as algorithmic trading and lending options. The platform’s maker and taker fees range from 0.1% to 0.2%. Bitfinex also features an earn program, staking services, and a peer-to-peer lending platform.

Security measures include cold wallet storage and advanced encryption. Despite past security issues, Bitfinex has strengthened its infrastructure to ensure user safety.

Pros:

- Advanced trading tools and API support for professional traders

- High liquidity and deep order books

- Offers lending, staking, and margin trading

Cons:

- Past security breaches raise concerns for some users

- Not beginner-friendly due to complex interface

- Requires full verification for fiat deposits and withdrawals

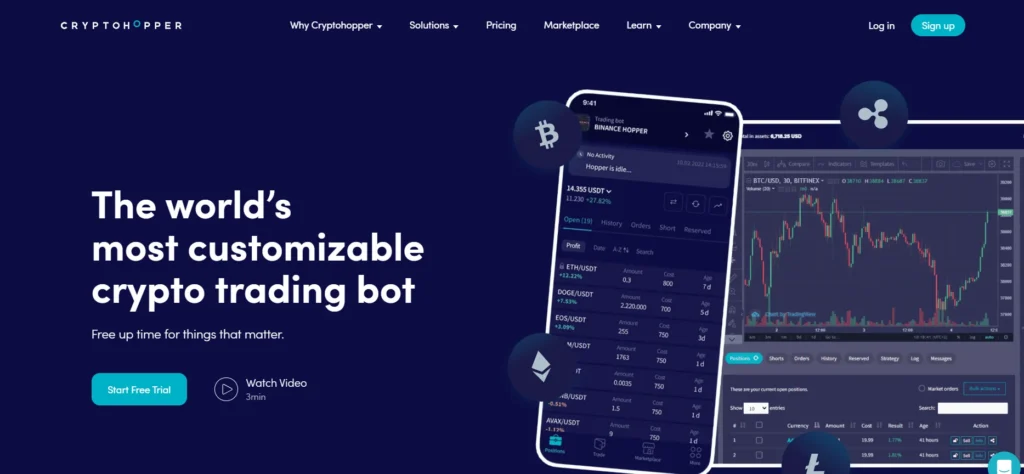

5. Cryptohopper

- Minimum deposit: $10

- Maker fees: 0.00% to 0.20%

- Taker fees: 0.10% to 0.25%

- Available cryptocurrencies: 100+

The automated crypto trading platform, Cryptohopper, enables users to combine multiple exchange accounts through its AI-powered trading bots feature. This system operates with different trading methods that consist of arbitrage and trailing stop-loss as well as copy trading.

The platform’s customisable bot functions support trading operations from basic to professional levels. Cryptohopper combines with various well-known crypto exchanges. The platform gives traders access to purchase ready-made trading strategies which also include signals.

Users benefit from instant analytics which combine with portfolio management features and cloud-based automation. Users obtain great value from this service because its subscription-based cost enables round-the-clock optimization of trades.

Pros:

- Automated trading bots for 24/7 trading

- Supports multiple exchanges and custom strategies

- Offers a marketplace for pre-built trading strategies

Cons:

- Requires a subscription fee to access premium features

- Can be complex for beginners to configure bots

- Market conditions can impact bot performance

6. WazirX

- Minimum deposit: $10

- Maker fees: 0.20%

- Taker fees: 0.20%

- Available cryptocurrencies: 150+

WazirX maintains its position as India’s top white label cryptocurrency exchange solutions with its sleek platform that provides access to more than 150 different cryptocurrencies. Users can take advantage of the trading platform because it charges a simple flat fee of 0.2% which benefits new traders.

Users can trade crypto on WazirX for spot and futures markets while staking their digital assets and utilising point-to-point networks to convert fiat money into cryptocurrency. WazirX provides integrations with Binance because users can transfer their assets easily. Trading fees and exclusive rewards are available to users who hold WRX tokens on the platform.

Security measures at this platform consist of two-factor authentication(2FA) and multi-signature wallets. The Indian laws regulate WazirX and its robust customer service makes it a top selection for Indian traders.

Pros:

- Integrated with Binance for enhanced liquidity

- Easy P2P transactions for fiat-to-crypto conversion

- Strong security and compliance with Indian regulations

Cons:

- Higher fees compared to global competitors

- Limited support for advanced trading features

- Some withdrawal issues reported during high volatility

7. Kraken

- Minimum deposit: $10

- Maker fees: 0.00% to 0.25%

- Taker fees: 0.10% to 0.40%

- Available cryptocurrencies: 300+

Kraken stands out as a leading cryptocurrency exchange because it provides reliable security alongside adhering to regulations as well as delivering educational resources. The exchange supports more than 110 cryptocurrencies through its spot trading operation alongside futures and margin trading which lets users access up to 5x leverage.

Kraken charges users based on their trading type where makers pay 0.16% in fees and takers pay 0.26% in fees. Users can obtain passive income through stake service offerings on this platform. The security mechanisms at Kraken encompass cold storage facilities alongside encrypted backups alongside a dedicated bug bounty program.

The exchange fulfills regulatory standards in various international jurisdictions among very few trading venues. Users of all experience levels can benefit from Kraken’s user-friendly platform design and dependable customer service assistance.

Pros:

- Low fees for beginner and advanced cryptocurrency traders

- A good selection of educational resources and research amenities

- Access to web, desktop, mobile, and Kraken Pro platform

Cons:

- Kraken is not available in all 50 U.S. states

- Does not offer FDIC or SIPC insurance or other criminal insurance

- Does not allow options trading for cryptocurrency

8. OKX

- Minimum deposit: $10

- Maker fees: 0.10%

- Taker fees: 0.15%

- Available cryptocurrencies: 100+

As one of the world’s leading cryptocurrency exchanges, OKX delivers competitive trading fees alongside extensive trading possibilities. Through its platform users can trade over 100 cryptocurrencies alongside futures trading, options trading and margin trading along with staking capabilities.

The OKX platform combines intuitive mobile applications with professional grade trading software for expert users. The exchange charges makers at 0.1% and takers at 0.15%. OKX protects user assets using cold-storage wallets combined with security features like multi-factor authorisation and anti-phishing protection.

Apart from other features, OKX lets users access a DeFi wallet which enables them to work with decentralized finance applications. The platform’s dedication to new ideas has established it as a favored trading platform amongst global users.

Pros:

- Strong derivatives and futures trading platform

- Supports DeFi wallet and staking options

- Advanced security features with cold storage

Cons:

- Not available in the U.S. due to regulations

- Requires KYC for full access to trading features

- Some fiat deposit methods have high fees

9. eToro

- Minimum deposit: $10

- Maker fees: 0.00% to 0.20%

- Taker fees: 0.10% to 0.30%

- Available cryptocurrencies: 90+

eToro is a social trading platform that combines traditional financial assets with cryptocurrencies. It supports a variety of digital assets and allows users to trade stocks, commodities, and forex alongside crypto. eToro is best known for its copy trading feature, enabling beginners to follow and replicate the strategies of experienced traders.

The platform provides a user-friendly interface, a demo account for practice, and extensive educational resources. eToro charges spread-based fees rather than direct trading commissions.

Security measures include two-factor authentication and encrypted transactions. Regulated in multiple jurisdictions, eToro is a trusted choice for long-term crypto investment.

Pros:

- Social trading features allow beginners to copy top traders

- Regulated in multiple jurisdictions, ensuring safety

- Supports trading of stocks, commodities, and crypto

Cons:

- Spread-based fees can be higher than traditional exchanges

- Limited selection of crypto assets compared to competitors

- Requires verification for deposits and withdrawals

10. Forex.com

- Minimum deposit: $10

- Maker fees: 0.10%

- Taker fees: 0.20%

- Available cryptocurrencies: 50+

Forex.com is a well-established trading platform specialising in forex and cryptocurrency trading. It offers access to popular cryptocurrencies like Bitcoin, Ethereum, and Litecoin through CFDs.

The platform is ideal for traders looking to diversify their portfolios with traditional financial markets. Forex.com provides advanced trading tools, including algorithmic trading, market analytics, and in-depth charting options. Security features include segregated client funds and negative balance protection.

The platform is regulated in multiple countries, ensuring compliance and trustworthiness. Forex.com is best suited for traders who prefer leveraging professional trading strategies across multiple asset classes, including cryptocurrencies.

Pros:

- Well-established and regulated trading platform

- Supports forex, commodities, and crypto trading

- Advanced charting and analysis tools for traders

Cons:

- Only offers crypto CFDs, no direct ownership of assets

- Not ideal for long-term cryptocurrency investors

- Requires higher minimum balances for premium accounts

Ending Thoughts

Choosing the right crypto trading platform is essential for security, profitability, and ease of use. Crypto Trading Brokers and Platforms with low fees, strong security, high liquidity, and diverse cryptocurrency offerings play a crucial role in a trader’s success. Also, learn about how Bitcoin can act as a hedge against inflation. Whether using centralised exchanges for convenience, decentralised platforms for privacy, or derivatives trading for advanced strategies, selecting a platform that aligns with your trading goals is vital.

Security measures such as two-factor authentication, cold storage, and regulatory compliance ensure fund protection. Additionally, platforms with advanced trading tools and responsive customer support provide a seamless trading experience. As the crypto market evolves, staying informed and choosing a reputable, secure, and feature-rich platform can significantly impact your long-term trading success.

FAQs

What is a crypto trading broker?

A crypto trading broker acts as an intermediary that allows users to buy, sell, and trade cryptocurrencies, often offering additional tools and leverage options.

How do crypto trading platforms differ from brokers?

Platforms like Binance and Coinbase provide direct trading, while brokers like eToro or Forex brokers offer crypto trading through CFDs and derivatives.

Are crypto trading brokers regulated?

Some brokers are regulated under financial authorities, while many global platforms operate in unregulated environments, requiring traders to assess security risks.