The online payment market keeps changing at a high rate, as the choice of the most effective credit card processing software becomes as important to business of any size as never before. In 2025, companies are in search of the full-service payment systems that provide convenience in integrations, offer the highest levels of security, and maintain the price structure. The credit card processing tool used today has quite advanced beyond mere processing of transactions and has been able to perform elaborate analysis and fraud detection as well as payment channels.

Regardless of your size and nature (as a small startup or an established enterprise), the appropriate choice of the payment processing solution can largely contribute to the efficiency of your business operations and satisfaction of your clients. As a top-notch guide, we keep you informed of the Best credit card processing software of 2025 that suits your business needs, and works within a financial limit.

Key Features to Look for in Credit Card Processing Software

- Security: State of the art encryption applications, PCI DSS compliance levels to be adhered to and fraud monitoring mechanisms are adopted in securing theses sensitive customer information at all levels of the transaction procedures.

- Integration: Having an ease of being compatible with all the current business systems, accounting software, e- commerce platforms, and point-of- sale systems to facilitate the ease of operations and data synchronization.

- Multi-Channel: Acceptance of both in-person, online, and mobile payments through a multi-channel so that businesses can accept payments anywhere customers like to shop.

- Analytics: Fiscal and analytics reporting capabilities which offer information of pattern of transaction, customer behaviour, business performance metrics to make decisions with informed intentions.

- Scalability: Scalable solutions with the choice to add on to your solution as your business needs more transactions and other features as it scales to larger operations.

- Customer Support: Friendly technical support, technical documentation and training solutions to make the payment system implemented easily and run smoothly.

Comparison Table – Features, Fees, and Ratings

| Software | Monthly Fee | Transaction Fee | Rating | Key Features |

| Square | $0-$60 | 2.6%-2.9% | 4.5/5 | Free plan, POS integration, inventory management |

| Stripe | $0-$500 | 2.9%-3.4% | 4.6/5 | Developer-friendly, global payments, advanced APIs |

| PayPal | $0-$30 | 2.7%-3.5% | 4.2/5 | Brand recognition, buyer protection, easy setup |

| Helcim | $0 | 2.2%-2.6% | 4.4/5 | Transparent pricing, no monthly fees, volume discounts |

| Clover | $14.95-$69.95 | 2.3%-2.6% | 4.3/5 | Hardware included, app marketplace, restaurant focus |

| Stax | $99-$199 | 0.05%-0.15% | 4.5/5 | Membership model, lowest processing fees, enterprise features |

| Worldpay | $9.95-$39.95 | 2.2%-2.9% | 4.1/5 | Global reach, omnichannel solutions, risk management |

| Authorize.Net | $25 | 2.9%-3.5% | 4.0/5 | Gateway focus, extensive integrations, reliable uptime |

| Payment Depot | $59-$99 | 0.05%-0.15% | 4.3/5 | Interchange-plus pricing, membership model, cost savings |

| Shopify Payments | $29-$299 | 2.4%-2.9% | 4.2/5 | E-commerce integration, automated taxes, dispute management |

Top 10 Best Credit Card Processing Software in 2025

1. Square

With its all-inclusive business-type business tools, Square is still a market leader in payment processing. The platform has a free starter kit that provides a basic payment processing activity, which make it an appealing business among new commercials and entrepreneurs. The ecosystem Square has to offer comprises not only payment processing ecosystem but point-of-sale systems, inventory management, employee scheduling, and customer relationship management tools. This is one of the Best credit card processing software.

Features:

- Free starter plan

- All-in-one business tools

- Easy setup interface

- Strong hardware ecosystem

- Comprehensive customer support

Pros:

- Free starter plan with no monthly fees

- Comprehensive business management tools

- Easy setup and user-friendly interface

- Strong hardware ecosystem with various POS options

- Excellent customer support and extensive documentation

Cons:

- Higher transaction fees compared to some competitors

- Limited customization options for larger enterprises

- Some advanced features require paid plans

- Processing holds can occur for new accounts

- Limited international payment options

Pricing: Free plan available, paid plans start at $60/month with transaction fees ranging from 2.6% to 2.9% plus $0.10 per transaction.

2. Stripe

Stripe has become the Best credit card processing software in the market among developers and technology-smart businesses that demand maximum customization and integrations. The platform provides high quality APIs, comprehensive documentation and options in more complicated payment situations such as subscriptions, marketplaces and cross border payments. Stripes is globally based and workers to distinct global standards, which is why it is a perfect choice among businesses, which have international aspirations.

Features:

- Developer-friendly APIs

- Global payment support

- Advanced fraud detection

- Flexible subscription billing

- Strong integration ecosystem

Pros:

- Developer-friendly with extensive APIs and documentation

- Global payment support with local payment methods

- Advanced fraud detection and machine learning capabilities

- Flexible subscription and recurring billing options

- Strong integration ecosystem with third-party applications

Cons:

- Requires technical expertise for full implementation

- Higher fees for some transaction types

- Limited phone support options

- Can be complex for non-technical users

- Some features require additional setup and configuration

Pricing: No monthly fees, transaction fees start at 2.9% plus $0.30 per transaction, with volume discounts available.

3. PayPal

PayPal has become a household name in the field of Best credit card processing software, achieving a kind of consumer loyalty due to its reputation of secure and provide platform. Customers are confident when they use the services of the company to make their transactions since it has earned them a reputation. To fit a variety of customer needs and preferences, PayPal suggests various methods of transferring money: transferring traditional PayPal accounts, credit and debit card transactions, and the latest distribution of easy-pay options called buy-now-pay-later, which allows customers to offer more flexibility in paying.

The extensive buyer protection program of PayPal is another major selling point of PayPal as it protects customers in case of fraudulent purchase and purchase disputes.

Features:

- Strong brand recognition

- Multiple payment options

- Buyer protection program

- Easy e-commerce integration

- Mobile-friendly payments

Pros:

- Strong brand recognition and customer trust

- Multiple payment options including PayPal accounts

- Buyer protection and dispute resolution services

- Easy integration with e-commerce platforms

- Mobile-friendly payment options

Cons:

- Higher transaction fees for some payment methods

- Account holds and reserves can impact cash flow

- Limited customization options for checkout experience

- Potential for account limitations or freezes

- Less suitable for high-volume businesses

Pricing: No monthly fees for basic plans, transaction fees range from 2.7% to 3.5% depending on payment method and volume.

4. Helcim

Helcim has been a leader in the Best credit card processing software in the aspect of pricing strategies whose approach is to charge businesses transparent fee and offer affordable payment processing services to business enterprises of all levels. The interchange-plus price model ensures that the platform does not require the payment of any monthly fees, and this aspect renders it an extremely appealing choice attracting the combined consideration of businesses to reduce the number of their processing expenses as well as overhead costs.

The distinguishing factor about Helcim is its price structure which in turn is based on volumes, whereby the rates decrease automatically with an increased volume of business transactions. This flexible model provides that expanding businesses will enjoy progressively reduced processing rates which creates an intrinsic economic incentive to expand whilst minimizing costs of operation.

Features:

- Transparent interchange pricing

- No monthly fees

- Volume discount rates

- Strong customer support

- PCI compliance included

Pros:

- Transparent interchange-plus pricing with no hidden fees

- No monthly fees or setup costs

- Volume discounts for growing businesses

- Strong customer support and educational resources

- PCI compliance and security features included

Cons:

- Limited advanced features compared to some competitors

- Smaller partner ecosystem for integrations

- Less suitable for complex payment scenarios

- Limited international payment options

- Newer platform with less market presence

Pricing: No monthly fees, interchange-plus pricing starting at 2.2% plus interchange fees.

5. Clover

Clover is a complete point-of-sale system with built-in processing that works as an optimal issue of retail and restaurant businesses. The platform offers different pieces of hardware and leaves a wide range of apps marketplace, where businesses can personalize their POS based on what they want. On top of simply processing transactions, Clover offers powerful inventory management features, advanced analytics and reporting functionalities, and support of accounting packages. The system offers many varieties of payment methods which include contactless payments, EMV chip cards, and mobile wallets, so that the businesses can support the different customer preferences.

Features:

- Complete POS system

- Extensive app marketplace

- Various hardware options

- Strong inventory management

- Retail/restaurant focused

Pros:

- Comprehensive POS system with integrated payments

- Extensive app marketplace for customization

- Various hardware options for different business types

- Strong inventory management and reporting features

- Excellent for retail and restaurant businesses

Cons:

- Higher monthly fees compared to some alternatives

- Limited e-commerce capabilities

- Some apps require additional fees

- Hardware costs can be significant

- Less suitable for service-based businesses

Pricing: Monthly fees range from $14.95 to $69.95, with transaction fees between 2.3% and 2.6% plus $0.10.

6. Stax

Stax is an interchange-plus pricing which it grants access to through membership; hence in case companies incur large volumes of transaction; it can be referred to as one of the Best credit card processing software. This site targets the existing businesses which have made an initial investment in a business and therefore can be able to pay the membership fee since they are saving a whole lot in terms of the processing fees.

The subscription program can eliminate the old high charge out markup fees normally used by the other processors and it will only charge the actual interchange rates charged by the card networks with a small fixed fee. The membership plan will be appropriate to the advantage of the firms that carry out a lot of transactions in a particular month since the more transactions made, the more will be saved on the feeslex.

Features:

- Membership-based pricing

- Lowest processing fees

- Advanced reporting tools

- Strong security features

- High-volume business focus

Pros:

- Lowest processing fees in the industry

- Membership model provides significant cost savings

- Advanced reporting and analytics tools

- Strong security features and PCI compliance

- Excellent for high-volume businesses

Cons:

- Monthly membership fees required

- Not suitable for low-volume businesses

- Limited hardware options

- Less comprehensive than all-in-one solutions

- Requires commitment to membership model

Pricing: Monthly fees range from $99 to $199, with processing fees as low as 0.05% to 0.15% plus interchange.

7. Worldpay

Worldpay provides end to end payment processing services that include strong multi currency and multi local payment services in global marketplaces. The main platform offers advanced omnichannel products that allow users to process payments easily across multiple channels such as online, mobiles, in-stores, and even over the phone, and at the same time have a coherent reporting system and system of control. To maximize conversion, the service incorporates robust fraud security, real-time analytics and checkout customization.

The system of Worldpay allows processing a large number of transactions using high enterprise-level security standards and adhering to international laws. Their single command gives merchants a comprehensive idea of payment performance, customer behavior and basket trends across an array of channels.

Features:

- Global payment processing

- Multi-currency support

- Omnichannel payment solutions

- Strong fraud prevention

- International business focus

Pros:

- Global payment processing with multi-currency support

- Omnichannel payment solutions

- Strong risk management and fraud prevention

- Extensive integration options

- Suitable for international businesses

Cons:

- Complex pricing structure

- Higher fees for some international transactions

- Can be overwhelming for small businesses

- Limited customization options

- Requires technical expertise for full implementation

Pricing: Monthly fees range from $9.95 to $39.95, with transaction fees between 2.2% and 2.9%.

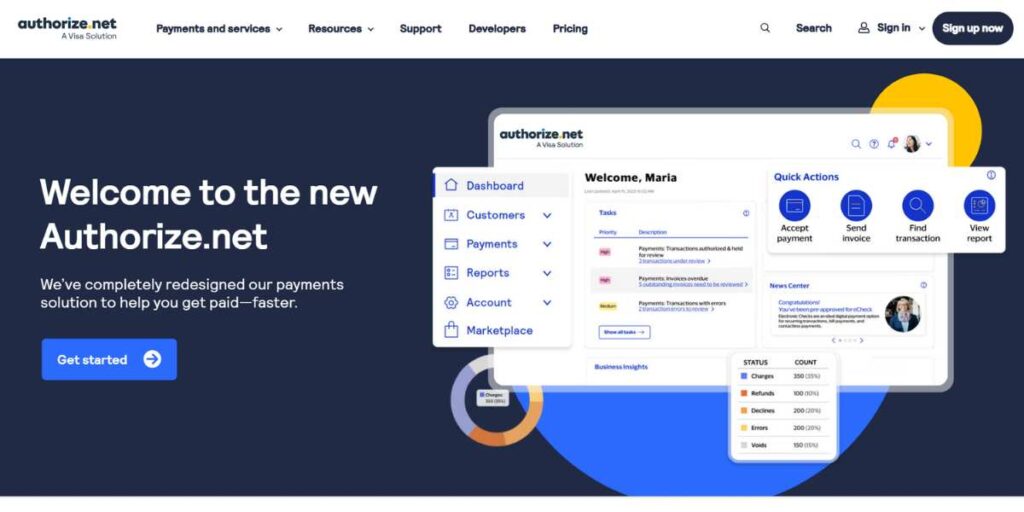

8. Authorize.Net

Authorize.Net is specialized in the field of providing payment gateway services, reliable transaction processing, and a wide variety of integration choices and merchant services. It is especially friendly to the business that requires a solid payment gateway to bridge the gap between the current systems and merchant accounts and operate through PCI-compliant services.

The service also provides sophisticated fraud prevention tools, recurring payment functionalities and extensions to printing extensive reports that enable merchants to run their payment business in an orderly manner. Authorize.Net supports various payment options such as credit cards, debit cards, and digital wallets and can process different customer preferences.

Features:

- Reliable payment gateway

- Extensive integration options

- Strong fraud detection

- Recurring billing support

- Gateway service focus

Pros:

- Reliable payment gateway with high uptime

- Extensive integration options with e-commerce platforms

- Strong fraud detection and security features

- Recurring billing and subscription management

- Good for businesses needing gateway services

Cons:

- Requires separate merchant account

- Limited POS and hardware options

- Higher fees compared to some competitors

- Less comprehensive than all-in-one solutions

- Additional setup complexity

Pricing: Monthly fees start at $25, with transaction fees ranging from 2.9% to 3.5% plus $0.30.

9. Payment Depot

Payment Depot is a membership-based model, just like Stax, and gives access to wholesale payments processing. The platform is meant to be used by those businesses which are interested in low processing costs with the transparent interchange-plus pricing. This membership method succeeds in getting rid of the standard markups designs and merchants pay merely the authentic interchange rates along with slender once-a-month membership charge. Business that perform high volumes and have large transaction amounts saved are a major beneficiary of this model because they will have increased savings through time. Pay Depot pricing model is transparent: businesses can fully realize what they pay on each component of the transactions, interchange fees, assessment fees, processing margins, etc.

Features:

- Membership-based model

- Transparent interchange pricing

- No long-term contracts

- Strong customer support

- Cost-conscious business focus

Pros:

- Transparent interchange-plus pricing model

- Membership model provides cost savings

- No long-term contracts required

- Strong customer support and education

- Good for cost-conscious businesses

Cons:

- Monthly membership fees required

- Not suitable for very low-volume businesses

- Limited advanced features

- Smaller partner ecosystem

- Less comprehensive than full-service providers

Pricing: Monthly fees range from $59 to $99, with processing fees as low as 0.05% to 0.15% plus interchange.

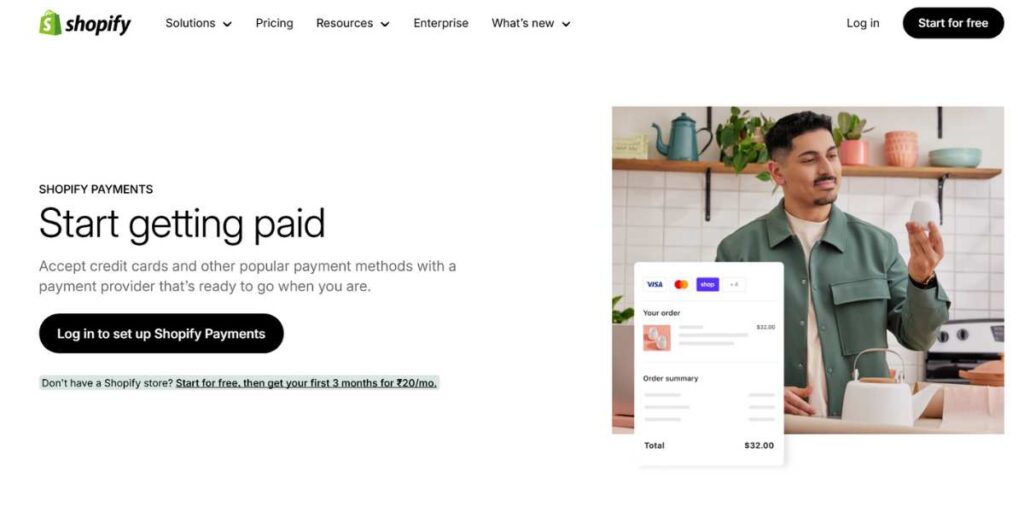

10. Shopify Payments

In the sphere of e-commerce companies working in the Shopify setting, we find Shopify Payments, which is oriented to the needs of the specified domain and offers the company with the optimized payment processing. The platform also lowers the risk of using the third party payment services so switching to online payment channels becomes easier which eliminates the possibility of using third party systems and the rates are competitive, with its services and much more. It is a complete package that allows merchants to carry out their entire payment process via the Shopify dashboard and it also makes the process convenient and conscientious.

Allowing making purchases between different locations with ease, Shopify Payments enables dealing with the international market with fraud protection therein, cross-currency support, and tax calculations made automatically. The solution also consists of complete analytics and reporting since it allows entrepreneurs to track payments and performance rates as well as provides respective opportunities to simplify checkout by offering trends.

Features:

- Seamless Shopify integration

- Competitive transaction fees

- Automated tax calculations

- Dispute management included

- E-commerce business focus

Pros:

- Seamless integration with Shopify platform

- Competitive transaction fees for Shopify users

- Automated tax calculations and reporting

- Dispute management and chargeback protection

- Excellent for e-commerce businesses

Cons:

- Limited to Shopify platform users

- Less suitable for omnichannel businesses

- Limited customization options

- Requires Shopify subscription

- Not available in all countries

Pricing: Included with Shopify plans ($29-$299/month), transaction fees range from 2.4% to 2.9% plus $0.30.

Best for Small Businesses

- Affordability: People who are financially strained with restricted budgets and cash flow will find cost-effective solutions with an understandable pricing system, a low cost per month, and a competitive rate of transactions.

- Ease-of-Use: Easy installation procedures, user-friendly, and minimal technical skills that would help the company owners to concentrate on their businesses other than on the hassles of a complicated payment process.

- Scalability: Scalable solutions that allow the business to expand in transaction volumes and new features and abilities, as the business itself grows and its need of specialized features increases with time.

- Support: Extensive customer support, training materials, and guide support to aid small business owners in successfully passing through the payment processing system.

- Integration: Completely interoperable with popular small business tools, accounting software and even e-commerce based system to provide a positive ecosystem of business management processes.

- Quick-Setup: High speed onboarding allowing companies to begin processing payments swiftly with no drawn out acceptance procedures and no intricate technical integration.

Best for High-Volume Businesses

- Interchange-Plus: Direct access to wholesale pricing models that give considerable savings to businesses that do volumes on a routine basis in terms of transactions.

- Enterprise-Features: Intelligent reporting, analytics and management solutions that can present detailed information on payment trends, customer analytics and business performance measure.

- Customization: Adaptable APIs and integrations which enable companies to personalise payment processing to their unique workflows, branding and business needs.

- Dedicated-Support: High-level support services like account managers, priority support, and special support in challenging implementation and support.

- Global-Reach: Multi-currency: Support international payment processing services and support local payment gateways, international regulations and standards.

- Risk-Management: Proprietary tools of fraud detection, chargeback prevention, and risk assessment so that businesses avoid payment-driven losses and preserve the trust of customers.

How Credit Card Processing Software Works

- Authorization: The payment processor checks the card details and credit balances of the customer against the issues bank to check whether the processing of payment can be carried out successfully.

- Authentication: To facilitate unauthorized transactions, the cardholders are authenticated via security measures such as verification of PIN, matching signature, or even using biometrics.

- Capture: This is to hold the transaction amount in the available credits or debits in the customer and ready sending the amount to the merchant account.

- Settlement: The payment processor carries the transfer between the customer bank address to the merchant account, which is normally taken between one to three days of business calendar.

- Reporting: Reporting dashboards are used to capture and avail transaction data to the merchants that help them to gain insight into sales trends, customer activity and business performance.

- Compliance: Throughout the process, the system will maintain the industry standards and regulations such as the PCI DSS compliance, data security requirement, and anti-fraud standards.

Benefits of Using Credit Card Processing Software

- Increased-Sales: Accepting credit cards, you would expose yourself to more customers since it enables a broad range of individuals to consume the cards depending on the preferred mode of payment plus creates the instant buying, which would otherwise not transpire when cash-only is adopted.

- Better-Security: The new generation processing systems have extremely strong encryption, anti-fraud verification systems and PCI security systems that guarantee security of business and its authenticators to its customers and their transactions.

- Streamlined-Operations: Application of automated processing also reduces the level of manual inputs, reduces errors and can be incorporated with accounting and inventory soft wares to produce sweeter business processes and operations.

- Enhanced-Customer-Experience: The faster, safer, and convenient payment process is increasing customer satisfaction, reduces instances of abandoned transactions due to customer loyalty and subsequent repetitive purchase.

- Better-Cash-Flow: Checks and electronic payments are usually settled earlier than checks and they therefore provide a more certain cash flow and cause chances of possible slumping of checks or delays in payments.

- Detailed-Analytics: Comprehensive reporting and analytics contribute to the acquisition of useful customer behavior, sales trends, and data about the business health that can lead to decisions of making data-driven growth.

Tips to Lower Your Credit Card Processing Fees

- Compare-Pricing: Compare the costs of various processors and cost structures such as flat rate, interchange-plus based cost structure and tiered price structure to come up with the most cost effective solution to your business based on your own level of transaction quantity and tendencies.

- Negotiate-Rates: Do not take the deal that is offered; bargain with processors to have a better deal according to the size of business, the number of transactions made, and the history of processing to have a better deal offered.

- Optimize-Transactions: Promote the use of cheaper customer payment by the customer, off-peak registration of payments and correct categorization of transactions to reduce the amount of processing fee being charged.

- Minimize-Chargebacks: Whether these are implemented in the form of strong customer service, clear refunding and return policies or prevention of fraud, the costically duration in form of insidious chargebacks and related charges can easily run into the thousands, affecting profitability to a serious extent.

- Review-Statements: Check your processing statement on a regular basis to find out any extraneous charges, mistakes in billing, or to find areas where you can save money by minimizing its processing.

- Consider-Surcharging: When legally allowed, they should use surcharging schemes where the cost of the processing will be transferred to the customers paying by the card and they allow holding the level of profit.

Security & Compliance Requirements

- PCI-DSS: The compliance with Payment Card Industry Data Security Standard is provided to every company working with the information on credit card, indicating its necessary security assurance and evaluation.

- Data-Encryption: The sensitive payment information has to be encrypted both in transit and stored in a place which cannot be accessed by any outsider to secure it against any form of security breach.

- Tokenization: Substitute sensitive credit card information with dynamic tokens that can carry no value and are not compatible to be used by attackers, lowering the threat of data theft and making compliances easy on the merchants.

- Fraud-Detection: Use real-time fraud detection systems where transactions are studied to suspect any illegal behaviors to avoid approving unauthorized transactions and risk the money of the merchants as well as the customers.

- Regular-Updates: Use of all payment processing software, hardware and security systems is to be kept up to date with latest patches and security enhancements to provide protection against the shifting threats.

- Employee-Training: Instruct all employees involved in terms of processing payment in security practices, requirements and guidelines of best practice on customer data protection.

Conclusion

Choosing the Best credit card processing software to use on your business in 2025 depends on your business needs, the number of transactions to flow through your business as well as your budget. The payment processing market presents a wide spectrum of different choices, with affordable, basic payment option solutions that can solve the problems of small-scale businesses to the more complex, enterprise feature-rich challenging global solutions. The modern payment processors have now advanced to offer much more besides transaction processing to include inventory management, customer analytics, and integrated business solutions.

The main consideration is still the security and compliance where all the processors with reputations have a high level of security to sensitive customer data, and they comply with the industry standards. A benchmark reaction time is the Best credit card processing software plan to be reviewed carefully analyzing business needs, comparing pricing and choosing the processor that has the greatest capacity to accommodate your growing business and offers quality customer care and service. Using the knowledge and the ideas offered in the present guide, you will be able to make a decision that will favor your business, custom growth, and optimize the payment experience of your customers in 2025 and further.

FAQs

What is the median price of credit card processing in 2025?

There are mostly the businesses with 1.5 and 3.5 percentage rates per transaction, and there are charges per month between 0 to 99 dollars, depending on the used processor and chosen plan.

What will be the time taken to open credit card processing account?

Setup time is anywhere between the same day which is within simple solutions like square, to a couple of weeks in case of more complex implementations at enterprise level that demand further verification.

Am I allowed to change credit card processors should I be dissatisfied?

Yes, with most processors, you can do a switch, but be careful, some may be subject to early termination or may be under some sort of contract that there may be a change you would have to consider before changing.

What is the difference between the payment gateway and payment processor?

A payment processor is used to process the transaction between the banks, and a payment gateway is the technology that grasps the payment details and gives it out accordingly securely.

Do I require an independent credit card merchant account?

Square and Stripe are all in one, others (Authorize.Net) make you open a merchant account with a bank.