The emergence of ‘Finfluencers’ has made a significant change in the way personal finance is handled. The change is mainly felt in India, a country with a large, young demographic who are very much interested in learning the art of money management. The creators of content in this field have not only explained the stock market, mutual funds, and budgeting easily, but have also made the topics so attractive that one can’t help but get involved. The growth in the Indian mutual fund industry’s assets under management is a clear indication of the success of this revolution, which has brought millions of new retail investors into the market.

By using attractive Reels, engaging short videos, and relatable storytelling in simple language, these financial guides build absolute trust and thereby have significant influence, putting them in a position to support a large number of people in taking the proper steps toward financial freedom. This article will help us figure out what a finance influencer does to be successful, get a glimpse into the world of some of the top financial influencers in India, and learn how they are changing the investment landscape in the country.

What Makes a Finance Influencer Successful?

Some of the main features that make a financial influencer successful are:

- Being Credible: The audience has to be sure that the advice shared is from a knowledgeable and sincere source, which is often supported by a professional qualification or a certain amount of experience.

- Simplification: The skill of using fewer technical words, without leaving out financial concepts like derivatives or macroeconomics, and making them more accessible to the general public is crucial.

- Regularity: The quality of the content chosen by the user and the relevance of the content to the latest developments in the financial world are key factors that also determine the regularity of the follower base, and this thus becomes a source of reliable and up-to-date information for them from which they can benefit.

- Being Relatable: By talking about one’s own financial stories, struggles, and successes, the content creator becomes like a friend or mentor for the viewer, which helps the viewer to establish a stronger bond.

- Interaction: Communicating with followers through Q&A sessions, comment responses, and solving common problems creates a strong, loyal community that revolves around the content.

We suggest you to check this blog also Influencer Marketing Agencies in India

Top 10 Financial Influencers in India You Should Follow

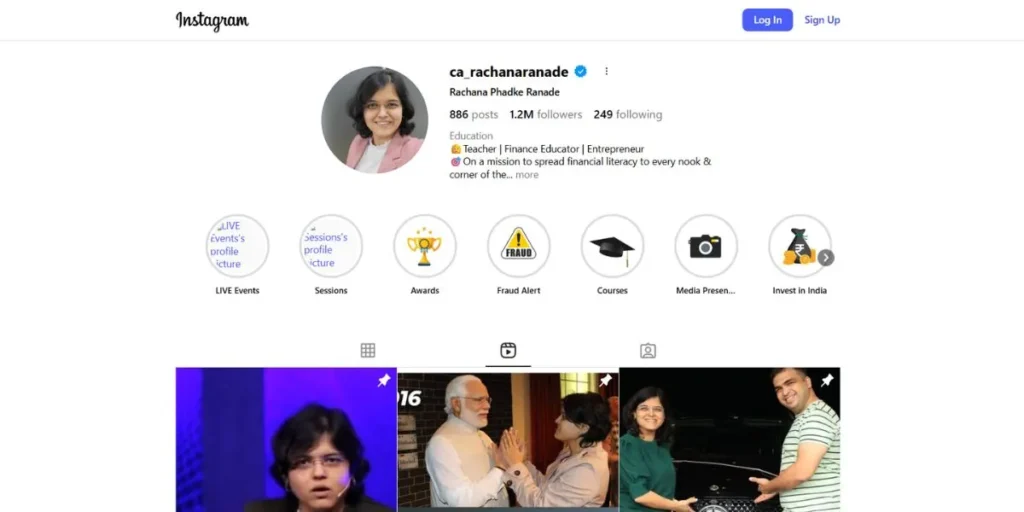

1. Rachana Phadke Ranade

- Platform: YouTube, Instagram (CA Rachana Ranade)

- Niche: Stock Market Education, Investing Basics, Mutual Funds

- Followers: 1.2 Million on Instagram

- Engagement: Approx. 0.26%

- Key Achievements: Chartered Accountant, makes complex financial topics easy to understand, Owns and manages her educational platform

- Why They Are Influential: Her CA qualification makes her the most trusted one, and she dissects the stock market in a simple, orderly classroom way, which makes it the most accessible starting point for beginners.

Through her highly effective and popular method, Rachana Phadke Ranade has converted complex and dry finance topics into interesting and fun lessons, which a large number of people can easily understand. She is the most popular for her clear, logical, and thorough explanations of the stock market and long-term investing. In addition to that, her content is very much centered around fundamental analysis, which not only educates the viewers but also equips them with the ability to do their own research in the future by giving them the tools instead of just tips.

Besides that, her organized method has earned her a position among the top financial influencers in India with the most trusted voices; thus, she has motivated thousands of people to make their first venture into the world of investment with confidence.

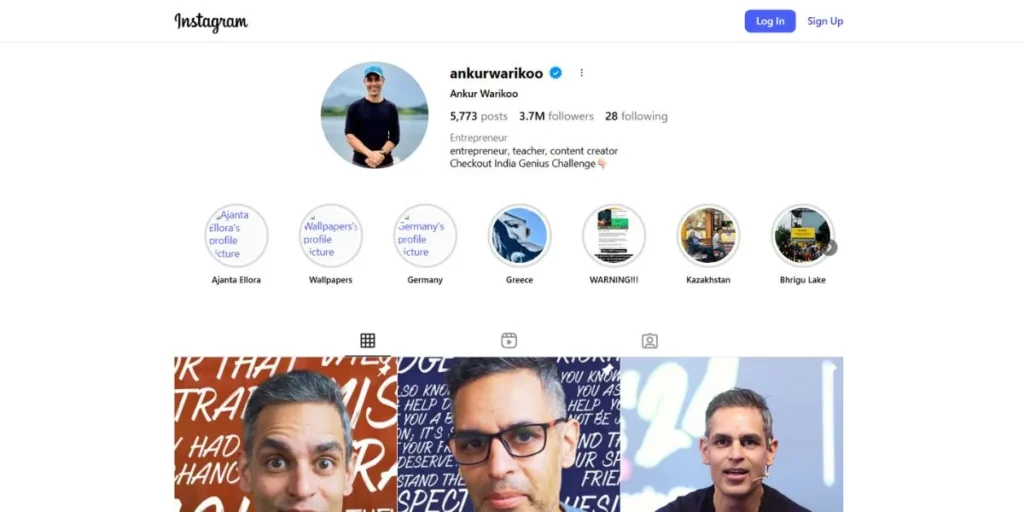

2. Ankur Warikoo

- Platform: YouTube, Instagram, LinkedIn

- Niche: Personal Finance, Productivity, Career Growth, Mindset

- Followers: 4 Million on Instagram

- Engagement: Approx. 0.24%

- Key Achievements: Co-founder of Nearbuy, Bestselling Author (Do Epic Shit), Behavioral finance focus

- Why They Are Influential: He combines money management with life advice, concentrating on financial discipline, decision-making, and career growth, which is, therefore, a deep resonance with young professionals.

Ankur Warikoo’s influence goes beyond investment strategies, as he emphasizes the need for a certain mindset for wealth creation and financial independence. His storytelling way and use of real-life scenarios make his budget, debt, and savings advice very easy for the audience to understand and follow. Besides that, he keeps on delivering top-notch content on YouTube and Instagram, which deals with the psychological side of money management. Moreover, by being an author and a mentor, he is strengthening his position among the leading financial influencers in India who are a source of both personal and economic success for the masses.

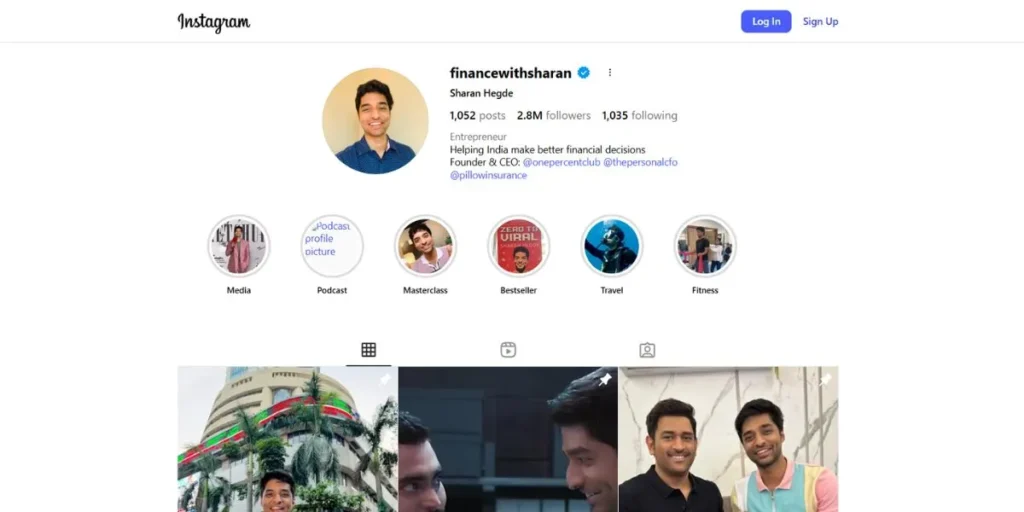

3. Sharan Hegde

- Platform: Instagram, YouTube (Finance With Sharan)

- Niche: Personal Finance, Financial Myths, Short-Form Comedy

- Followers: 3 Million on Instagram

- Engagement: Approx. 0.28% (Instagram), 3.61% (Reported High)

- Key Achievements: Listed in Forbes India ’30 Under 30′, co-founded the ‘1% Club’, and employs humor and skits to explain finance.

- Why They Are Influential: His humorous short-form videos use comedy and relatable situations to clarify commonly held financial myths, thus making him very popular among Gen Z.

Sharan Hegde is well known for changing the generally boring topic of personal finance into interesting, fast-paced videos, mainly on Instagram Reels. His videos are praised for their quality and funny skits in which characters show the audience complex situations like credit card usage or mutual fund selection. Besides that, his experience as a consultant in the past gives him a strong base for his financial insights. Also, by focusing on simplifying the basic saving and investing principles, Sharan becomes a highly effective and popular creator among top financial influencers in India for the youth.

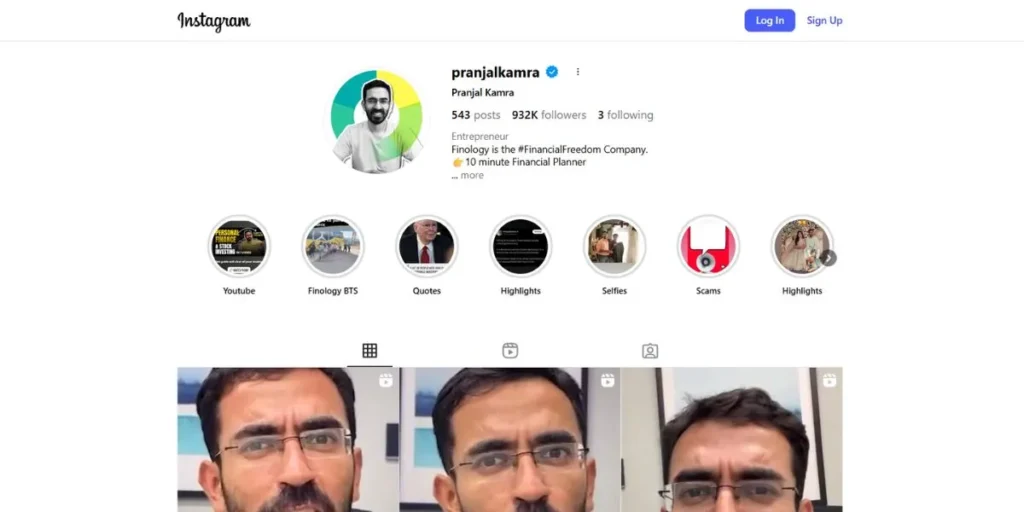

4. Pranjal Kamra

- Platform: YouTube, Instagram

- Niche: Value Investing, Stock Market Strategies, Long-Term Wealth Creation

- Followers: Approx. 900K on Instagram

- Engagement: Approx. 0.25% (Instagram)

- Key Achievements: Founder of Finology Ventures, Author of Investonomy, Focuses on in-depth fundamental analysis.

- Why They Are Influential: He is the go-to person for deep-dive, fundamental analysis, steering his audience towards serious, long-term wealth creation and value investing principles.

Pranjal Kamra offers a perspective that is highly analytical and driven by thorough research, with a strong focus on the core value investing principles, taking inspiration from characters like Warren Buffett. His YouTube videos are of great length and are complete, and they are designed for people who wish to get a theoretical understanding of how to pick stocks and manage portfolios. At the same time, he is not showing the way to quick riches but is instead emphasizing waiting and doing proper research.

Besides that, by running an educational brand, Finology, he showcases the effort he is putting into making premium investment education accessible to a large number of people, which is why he remains one of the most influential and best financial influencers in India.

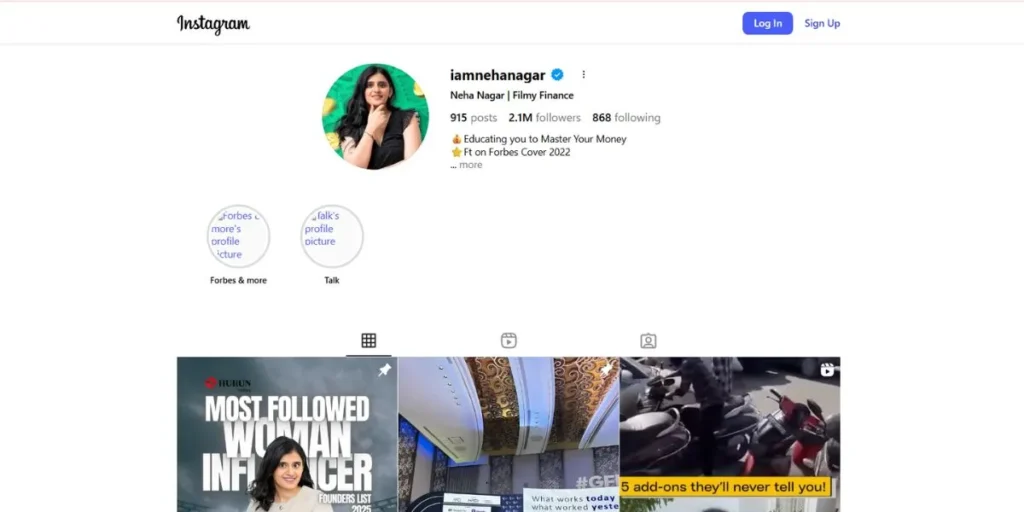

5. Neha Nagar

- Platform: Instagram, YouTube (Filmy Finance)

- Niche: Personal Finance, Tax Planning, Investment Tips

- Followers: 2.1 Million on Instagram

- Engagement: Approx. 2.24% (Instagram)

- Key Achievements: Awarded ‘Finance Influencer of the Year 2023’ by NDTV, Integrates pop culture and humor in her work

- Why They Are Influential: With the help of relatable humor, pop-culture references, and easy language, she turns a topic like taxation and GST into something easy and fun to learn.

Neha Nagar is a very engaging content creator who succeeds in making even the driest and most boring topics, like tax filing and insurance, seem approachable and engaging. As the creator of Filmy Finance, she makes good use of short-form video to provide low-input, high-impact, and actionable financial advice.

Additionally, her high engagement rate is a reflection of an authentic connection with her followers, who are lovers of her straightforward, no-jargon approach. Besides that, by simplifying complicated government schemes and regulations into easy tips, she makes her content very handy and thus ranks among the top financial influencers in India.

6. Pushkar Raj Thakur

- Platform: YouTube, Instagram

- Niche: Stock Market Education, Business Coaching, Motivation

- Followers: 2.4 Million on Instagram

- Engagement: Approx. 0.1% (YouTube), 0.72% (Instagram)

- Key Achievements: Certified Mutual Fund Distributor, NISM Research Analyst, Popular for huge educational live sessions

- Why They Are Influential: With his very energetic and motivational manner, he brings the stock market and business topics down to the level of the simple and thus wins the attention of a large number of people who seek wealth creation strategies.

Pushkar Raj Thakur is an inspiring and educational keynote speaker whose overall concentration is to empower individuals through market awareness and self-growth. His work is full of life and energy, which makes the audience very receptive, even if it takes a long time to deliver the content.

Moreover, his status as a NISM-certified professional gives him the right to be listened to as he navigates the market. Besides that, his stress on having multiple sources of income and reaching financial freedom is the reason why he is one of the most visible financial influencers in India, with a significant number of followers who are very loyal.

7. Akshat Shrivastava

- Platform: YouTube, Wisdom Hatch

- Niche: Macroeconomics, Business Analysis, Investing

- Followers: 299k on Instagram

- Engagement: Approx. 2.33% (YouTube)

- Key Achievements: Experience with McKinsey and BCG, MBA from INSEAD, Established Wisdom Hatch for courses

- Why They Are Influential: By analyzing real-world investing scenarios and using academic theory, he creates deep-thinking videos on macroeconomics and business that make the topics accessible to everyone.

Akshat Shrivastava is a financial content creator who’s very thorough in his intellectual approach and goes deep into topics such as the influence of global politics and AI on the Indian economy. His content is especially attractive to young professionals who are looking for a more complex and detailed explanation of how business and economic trends impact their investments. Besides that, his background in management consulting equips him with a distinct perspective to dissect financial news and corporate strategies.

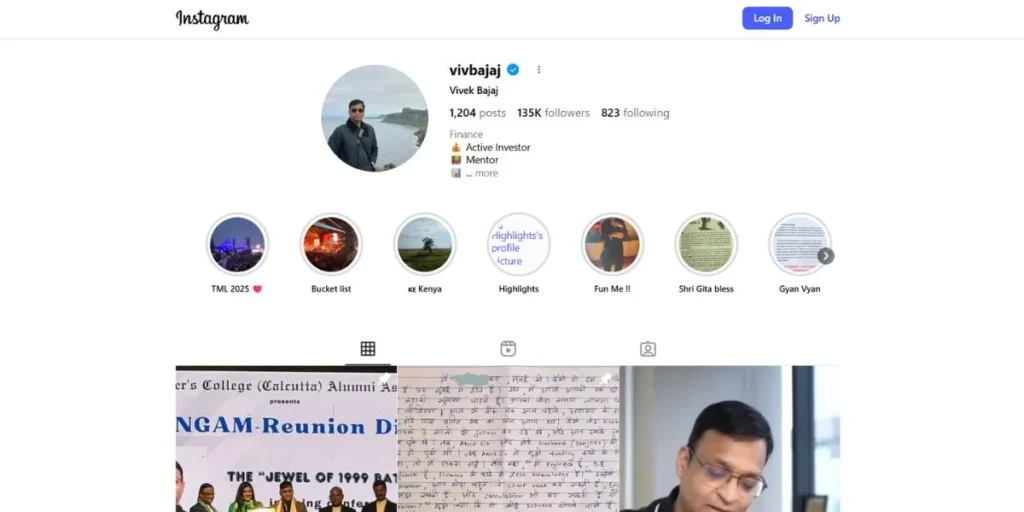

8. Vivek Bajaj

- Platform: YouTube, Elearnmarkets, StockEdge

- Niche: Stock Market Analysis, Trading, Market Data Tools

- Followers: 135k on Instagram

- Engagement: Consistent, focused engagement on niche topics

- Key Achievements: Over 20 years of trading experience, Co-founded Elearnmarkets and StockEdge, and is a Chartered Accountant

- Why They Are Influential: As a seasoned market veteran, he brings deep industry-level insights and offers several valuable tools for technical and fundamental analysis, thus facilitating the democratization of market data.

Vivek Bajaj is a well-known person whose achievements are primarily based on market experiences and are very practical. By initiating Elearnmarkets (for education) and StockEdge (for data analytics), he manifests his dedication to giving real resources to investors. In his videos, he frequently invites other industry experts to chat, thus giving viewers a comprehensive insight into trading and investing. Moreover, his education is mainly aimed at bridging the gap between theory and practical application. In addition, his focus on quality, consistent content rather than on short-lived popularity makes him a trustworthy resource among the top financial influencers of India for serious market participants.

9. Harsh Goela

- Platform: Instagram, YouTube (Goela School of Finance)

- Niche: Stock Trading, Behavioral Economics, Fundamental Analysis

- Followers: 13.9k on Instagram

- Engagement: About 3.84% (Goela School of Finance Instagram)

- Key Achievements: Co-founder of Goela School of Finance, TEDx Speaker, Concentrates on ethical investing

- Why They Are Influential: He concentrates on the use of a well-structured system in trading and behavioral finance, thus teaching people the correct way of handling their emotions when investing.

Harsh Goela, via the Goela School of Finance, promotes a responsible and morally right approach to the stock market. His material is essential for those market participants who have to deal with trading psychology; the most common mistakes are the fearful side of the trading cycle and greed, which often lead to wrong investment decisions. Besides that, he offers just the right amount of technical vs. fundamental analysis to serve both traders and long-term investors. Furthermore, his high engagement rate is a strong signal to the community that they highly value his down-to-earth and practical advice; thus, he is positioned among the top financial influencers in India for ethical market learning.

10. Abhishek Kar

- Platform: Instagram, YouTube

- Niche: Investing, Stock Trading, Startup Ideas, Finance Humor

- Followers: 3 Million on Instagram

- Engagement: About 1.39% (Older Data), About 7.37% (Newer Data)

- Key Achievements: TEDx Speaker, The short-content format of his work is highly engaging and has an extensive viewership

- Why They Are Influential: Using an edutainment method, he intriguingly and most of the time humorously blends sharp financial tips to win over the audience’s attention rapidly.

Abhishek Kar has been acknowledged for quick, fun, and highly informative content covering a wide range of money-related topics. One of his major successes revolves around his ability to create viral-ready short videos from complex financial truths. His ability to present his ideas clearly and convincingly is also well-demonstrated by his several TEDx talks. Moreover, the fact that he has a high engagement rate indicates that his audience is very enthusiastic about his unique style. Besides, his emphasis on taking financial steps makes him one of the most vibrant and leading financial influencers in India today.

How These Influencers Earn & Monetize

The business model of a top financial influencer in India is a clever blend of content creation and strategic partnerships. They do not draw their incomes from only one source; instead, they layer multiple streams of income to create a sustainable and successful digital business. Their methods often include:

- Brand Sponsorships: They, for instance, collaborate with financial brands like brokerages, credit card companies, and investment apps to create sponsored content and posts.

- Affiliate Marketing: They put up unique links or codes for financial products through which they receive a commission when a follower registers for a demat account or buys a product using that link.

- Digital Products: Creating a direct revenue stream by selling educational courses, workshops, and e-books on niche topics such as options trading or retirement planning.

- YouTube AdSense: They get a good part of their money from the advertisements shown in their long-form YouTube videos, in which the finance topic is the highest-paying niche.

- Exclusive Memberships: Some may grant access to performing a paid, exclusive community or subscription tier on platforms like YouTube and Patreon, allowing customers who pay for the service to attend live Q&As or get access to deeper analysis.

Trends in Indian Finance Influencing

The top financial influencers in India never fall behind the trend as they constantly modify their content to report the latest changes in regulations and innovations in the digital world, and some main trends at present are:

- AI and Machine Learning Integration: Finfluencers are now discussing how Artificial Intelligence is changing trading, risk assessment, and personalized financial planning, thus making it easier for consumers to grasp.

- Focus on ESG Investing: A rising trend among creators is to focus on Environmental, Social, and Governance factors, thus educating their followers about ethical and sustainable investment choices in the Indian market.

- Rise of Regional Content: A lot of influencers are now converting their content into local languages (such as Hindi, Tamil, Telugu, and so on) to tap the next wave of retail investors beyond English-speaking metros, thus, financial literacy gets spread faster.

- Embedded Finance Awareness: Creators are more and more explaining concepts like ‘Buy Now, Pay Later’ (BNPL) and how financial services are being integrated into non-financial apps, thus giving their followers the wisdom to make good use of new products.

- Short-Form Video Dominance: The main tools to share quick tips, market news, and busting myths about finance are still Instagram Reels and YouTube Shorts; the primary medium for sharing short clips with a maximum duration of 60 seconds.

Conclusion

The emergence of the top financial influencers in India is an excellent indication of how a generation is changing its approach towards money. By focusing on content that is easy, fun, and trustworthy, these creators have solved the puzzle of finance, thereby providing the impetus for millions to become the masters of their economic future. Besides teaching the public how to invest, they have also raised a debate all over the country about the people’s personal wealth and financial well-being.

At the end of the day, these online tutors are creating the conditions for a financially savvy India that will be able to make well-informed decisions that lead to sustainable prosperity. The influence of these top financial influencers of India is going to get even bigger as more and more people look for trustworthy guidance in an ever-changing economy.

FAQs

Are finance influencers replacing traditional financial advisors?

No, finance influencers are not replacing traditional financial advisors, rather they are a necessary first step to financial education. Influencers, in general, provide a great deal of simple and understandable information whereas a professional advisor is the one who offers personalized and detailed assistance that is specifically designed for the client’s individual financial situation.

Do I need a financial degree to follow these top financial influencers in India?

Not at all. The main point of the top financial influencers in India is to make complicated topics understandable, so that everyone, irrespective of their background, can begin learning money management and investing.

Is the advice given by finfluencers reliable?

Several top financial influencers in India may be professionals, but it is important to view their content as general educational information rather than personalized investment advice. You should always double-check the facts and get help from a registered advisor if you intend to make a significant financial decision.

What is the leading platform used by the top financial influencers in India?

Major influencers usually do not limit themselves to one platform but instead use a mix of platforms. YouTube is primarily the place for long, detailed educational videos, while Instagram/Reels are mostly for short, fun, and up-to-date daily tips and market news.

How can I identify a genuine finance influencer from a fake one?

A real finance influencer will be upfront about brand partnerships, focus mainly on educating rather than just giving stocks to buy, and disclose their qualifications or experience. Most dependable influencers will always tell their viewers that only a registered professional can provide personalized advice.