A white label payment gateway allows the business to offer its own payment system rather than having to design the entire system, not to mention the fact that the system may be tailored to meet specific requirements. This technology enables fintechs, payment service providers, and big thematic companies to initiate custom payment platforms in little time.

White label gateways provide complete authority over the brand, customer experience, and the money collected and also reduce the cost of development and time to penetrate the market. With the increase in digital payments across the globe, white label solutions are crucial in companies that would like to have a competitive advantage in payment markets.

What Is a White Label Payment Gateway?

White label payment gateway is an existing payment platform which can be whitened and made available by a business as its own. The white label solutions are customizable compared to the normal Payment Gateways in India, allowing businesses to customize the entire brand, interface, and features.

Data and full control of customers is retained by companies as they can enhance their existing systems with the new gateways. These payment gateways support numerous payment options, currencies, and regulations such that the business can enter payment markets quickly without extreme infrastructure-related finances or technical expertise

How a White Label Payment Gateway Works

- Payment Capture: The customer begins a transaction with your branded checkout page and is ultimately safe.

- Data-Encryption: The gateway automatically encrypts the payment information with high standards of security.

- Authorization Request: The encrypted data is sent to the acquiring bank where it is approved.

- Verification Response: The bank investigates the availability of money and returns yes or no.

- Settlement Process: Authorized money is automatically transferred out of the account of the customer to the account of the merchant.

Benefits of a White Label Payment Gateway

- Brand Control: The payment screen can get in full customization in order to maintain your brand.

- Revenue Generation: You earn the commission charges and are able to generate new revenue streams independently.

- Rapid Launch: Checks-in infrastructure reduces launch time as it said years to weeks.

- Scalability: You can add the payment options, currencies, and regions during the growth.

- Customer Ownership: You maintain direct relationships with sellers and are able to access the data of their transactions.

White label Payment Gateway Pricing Models

- Installation expenses: Integration, first configuration, and customization are one-time expenses.

- Monthly Subscription: Ongoing fees are – that include access, maintenance, updates and support in the platform.

- Transaction Fees: Every transaction incurs a low fee and this is often a percent of the fee and a predetermined amount.

- Customization Costs: There is an additional fee on special features and integrations or branding work.

- Volume basis Pricing: Pricing is offered in various levels of discount according to the number of transactions you carry on a monthly basis.

Top 10 White Label Payment Gateway Providers (2026)

1. DECTA

- Headquarters: Riga, Latvia

- Ideal For: Businesses prioritizing reliability

The White label DECTA is a quick White Label Payment Gateway which is quality oriented. It operates by way of trusted buyers rather than attempting to connect to a number of systems simultaneously and this assists it to obtain good acceptance rates. The service is one that has 99.99⁻ of uptime and can expand with your requirements.

It provides personalized services at affordable prices and as a result, traders in any supermarket can easily receive payment. DECTA is not rigid; it is distinguished by a helpful attitude and the ability to introduce the additional payment forms and meet the market demands.

Key Features:

- 99.99 % uptime guaranteed

- Fidel and performing acquirers.

- New payment forms, future-proof architecture.

- Merchant and eeasy onboarding management tools.

- Fraud prevention and intelligent routing.

Why Choose: Uncompromising dependability.

Pricing: Monthly maintenance and set up fee.

White label Use Case: Enterprise solutions.

Link: https://www.decta.com/

2. Spell

- Headquarters: Riga, Latvia

- Ideal For: Fintechs and PSPs seeking fast deployment

White label Spell (WeSpell) is a payment gateway SaaS service that enables firms to roll out their branded payment platforms within a short period. It also accepts more than 100 ways of payment in more than 200 currencies. It saves infrastructure risks through the use of the cloud. It provides intelligent routing, live tracking, and analytics.

Since payment processing runs all the way to the reconciliation of payments signed up by a merchant, Spell used to be 99.99% available and guarded against fraud. Its clients are startups, banks, and ISOs, who require complete solutions that are scalable and fully customized — much like modern White Label Cryptocurrency Exchange Solutions that empower businesses to launch their own secure and high-performance digital platforms.

Key Features:

- Cloud based model avoids risks of infrastructure investments.

- Intelligence routing and cascading payment logic.

- Spring boot and higher performance rates.

- Quick delivery and reduced time to market.

- 100+ payment options globally.

Why Choose: Fastest deployment

Pricing: Setup costs plus subscription (monthly/annual)

White label Use Case: Fintech startups

Link: https://wespell.com/

3. Ikajo

- Headquarters: Amsterdam, Netherlands

- Ideal For: Businesses handling crypto and fiat payments

The white label Ikajo is special in that it combines both the cryptocurrency payments and fiat payments within the same White Label Payment Gateway. It is based in Amsterdam making it operate globally. Smart routing, advanced fraud prevention, chargeback protection and dynamic currency conversion in more than 150 currencies in well over 170 countries are provided by Ikajo.

Its admin panel has real-time reports, subscriptions and analytics. Ikajo serves merchant services, fintech payment solutions, and embedded finance, which makes it flexible across a wide range of business designs and high-risk industries.

Key Features:

- Accepts both Bitcoin and monetary payments.

- State-of-the-art anti-fraud and chargeback insurance.

- Smart routing, smart cascading.

- International currencies conversion on a dynamic basis.

- API-based custom payment pages.

Why Choose: Crypto flexibility

Pricing: Quote-based (transaction, setup, monthly, customization fees)

White label Use Case: Crypto platforms

Link: https://ikajo.com/

4. Akurateco

- Headquarters: Amsterdam, Netherlands

- Ideal For: PSPs requiring extensive payment connectors

White label Akurateco is what provides a payment gateway and an orchestration platform supported by 15 years of experience. It serves over 500 payment connectors globally contributing to fintechs and PSPs to handle complicated flows.

It is certified as Google Pay since February 2024. Smart routing, cascading logic, fee calculators, fraud protection, analytics, and recurring billing are just some of these features that will provide a complete payment management experience.

Key Features:

- 500+ international payment connectors.

- Intelligence routing and coordination.

- Google Pay certified

- Pricing calculator that is flexible.

- Fraud prevention and analytics.

Why Choose: Maximum connectors

Pricing: Contact for custom quote

White label Use Case: Payment orchestration

Link: https://akurateco.com/

5. Tranzzo

- Headquarters: London, England

- Ideal For: Businesses of all sizes seeking global reach

White label Tranzzo is a full-stack and flexible White Label Payment Gateway solution that can be used globally. It does business with a great number of acquiring banks and payment methodology, provides several types of currencies, and simplifies the operations everywhere.

It has a base in Europe and is a company based in Kyiv which centers on flexible models to scale fast. It is PCI DSS Level 1 certified and has a wide range of routing, real-time fraud detection, recurring payment, mass payout and a conveniently designed merchant portal.

Key Features:

- Level 1 certification of security by PCI DSS.

- Fraud prevention advanced routing.

- Multiple currencies and languages.

- Repeat billing and mass disbursements.

- A merchant portal that is easy to use.

Why Choose: Full-stack flexibility

Pricing: Contact for pricing details

White label Use Case: Enterprise platforms

Link: https://tranzzo.com/

6. Stripe

- Headquarters: London, United Kingdom

- Ideal For: Large-scale merchants requiring payment orchestration

White label Stripe is an international payment gateway that has over 650 payment provider integrations. It is based in London and has offices in Ukraine, Netherlands, Israel, and Manila and is successful at organizing large-scale payments.

It operates in 200+ currencies, has local multi-language interfaces, smart routing, real-time transaction optimization, PCI-DSS compliance, batch payouts, and transparent dashboards. Stripe is the best option when it comes to the enterprises that require full-access and worldwide coverage.

Key Features:

- 650 and more payment provider integrations.

- Intelligent routing engine and real time optimization.

- PCI‑DSS compliant security

- Geolocation and multi -language.

- Dashboard that has batch payout preference.

Why Choose: Orchestration leader

Pricing: Subscription plus transaction fees

White label Use Case: Global platforms

Link: https://stripe.com/in

7. PayXpert

- Headquarters: London, United Kingdom

- Ideal For: Regulated environments requiring compliance

white label PayXpert is a secure, fully expandable White Label Payment Gateway of fintech companies, acquirers, banks and PSPs requiring global service. It takes in excess of 170 payment methods and excess of 150 currencies that are always open (24 hours) and it has top fraud tools, and channel support.

The platform has tokenization, a customizable checkout, and subscription management, which is significant to embedded finance. It partners with large companies like Clarins, Eurostar, and Hoff and is considered to be one of the best white-label payment solutions in Europe to regulated companies.

Key Features:

- 24 hrs also available with all channels supported.

- Safe recurring payments tokenization.

- Checkout that can be branded

- Automatic billing of subscriptions.

- Sophisticated fraud and compliance packages.

Why Choose: Compliance strength

Pricing: Contact for pricing information

White label Use Case: Regulated industries

Link: https://www.payxpert.com/

8. IXOPAY

- Headquarters: Vienna, Austria

- Ideal For: Enterprise clients needing orchestration

White label IXOPAY specializes in white-label orchestration and gateway solutions of large businesses. IXOPAY was established in 2014 and currently has approximately 100 staff members in both Austria and the U.S. IXOPAY bridges merchants with hundreds of payment processing firms on a single platform.

It provides intelligent routing policy, risk-handling policies, subscribing policies, real-time reporting, transaction reconciling tools, and complete branding policies. It has customers like Grover, Siemens, and Etoro so it is suitable as a service provider requiring good orchestration and adherence.

Key Features:

- A single platform that relates to numerous providers.

- Intelligent pathing and risk policies.

- Real time reporting and reconciliation.

- Controlling subscription automatically.

- complete branding and modification.

Why Choose: Enterprise orchestration

Pricing: Contact for enterprise pricing

White label Use Case: Large enterprises

Link: https://www.ixopay.com/

9. EcomCharge

- Headquarters: Vilnius, Lithuania

- Ideal For: PSPs and acquiring banks

White label EcomCharge builds beGateway, a fully branded payment platform with one of its most trusted PSPs and acquiring banks since 2011. It maintains PCI DSS Level 1 status and accepts more than 170 payment options and additional than 150 currencies.

It has collaborations with more than 40 e-commerce sites, mobile wallet applications (Apple Pay, Google Pay, Samsung Pay), and local payment options to both the local and international markets. It has smart routing, multi-currency processing, tokenization, analytics, payment orchestration, and easy merchant onboarding features.

Key Features:

- Level 1 certified security using PCI DSS.

- Connection with 40+ e-commerce services.

- Mobile wallet, support (Apple, Google, Samsung).

- Routing Smart with payment orchestration.

- Details and analytics tokenization.

Why Choose: PSP focused

Pricing: Contact for pricing details

White label Use Case: Banking solutions

Link: https://ecomcharge.com/

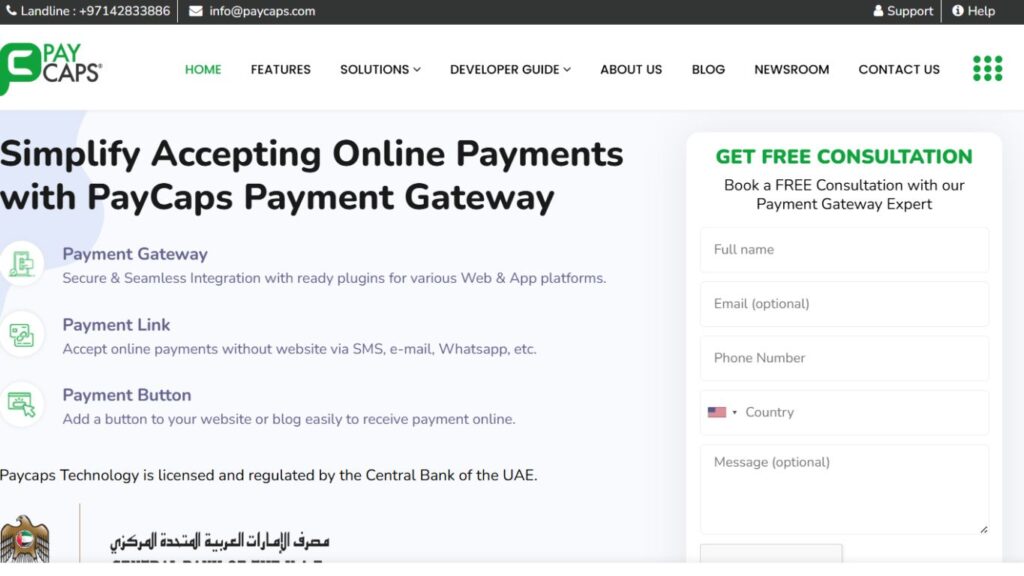

10. PayCaps

- Headquarters: Dubai, United Arab Emirates

- Ideal For: Middle East and North Africa markets

The White label PayCaps provides a localized payment system, which has been widely used in the Middle East and North Africa. It has a modular design permitting it to be tied to domestic and international payment options, multiple languages, invoicing options, refund management, and intelligent routing none without maintaining your brand.

It will also focus on PCI-DSS compliance, prevention of fraud, and performance dashboards which ensure banks, e-commerces, and fintechs deliver tailor-made solutions within shorter periods of time. PayCaps is viewed as one of the most appropriate white-label payment systems that can meet the requirements of the Middle Eastern market.

Key Features:

- Focus on Middle East markets

- Multilingual system of serving local customers.

- The invoice links and refunding.

- Performance dashboards on smart routing.

- PCI-DSS approval and fraud prevention.

Why Choose: Regional expertise

Pricing: Contact for regional pricing

White label Use Case: MENA markets

Link: https://www.paycaps.com/

White Label Payment Gateway in India

- Growing Market: Digital payment system in India is expanding rapidly since more fintech applications are employed.

- Regulatory Compliance: White label gateway has to obey RBI rules and payment laws.

- Local Integration: UPI, RuPay, net banking, as well as wallets, should be supported.

- Cost Efficiency: White label solutions reduced the costs of the development of payment systems among Indian providers.

- Customization Needs: There are the Indian businesses that require support of a variety of languages and of the local payment methods.

How to Choose the Best White Label Payment Gateway

- Integration Capability: See what number of payment methods, currencies and technical means the gateway provides.

- Security Standards: Confirm the certification of the gateway by PCI-DSS certification, fraud tools and data protection.

- Pricing Structure: Consider the establishment fee, subscription fee, per transaction fees and high-volume discounts.

- Scalability Features: The platform ought to perform better with the introduction of more transactions and new locations.

- Support Quality: Test whether technical support, documentation and installation support is okay.

Conclusion

The right white-label debt hinge is up to choosing the appropriate gateway to use to process your payments without losing your brand name. The given White Label Payment Gateway Providers offer numerous features, costs, and a variety of specialties in place of various demands.

You can find an uptime pay local help crypto fit, whether you are most interested in it. Through digital payment transformations, the white-label gateways provide flexibility, growth, and advantage. Examine your needs, rules and plans to select the most favorable gateway to succeed in the long-term.

FAQs

What is white label payment gateway?

It is a payment platform that is renamed and presented to the customers as an own-brand.

How much does a white-label payment gateway cost?

Costs are different. Setup fees can be thousands. Monthly fees vary. There are also per-transactions fees which will vary according to business level.

What are the benefits of using a white-label payment gateway?

You retain ownership of your brand, can make more finances, penetrate the market at a quicker rate, expand with ease, possess your own customers and do not have to construct infrastructure at a high investment cost.

Which payment methods do white-label gateways support?

In the majority of locations and on almost every support card, digital wallets, bank transfer, crypto, and local payment.

Is a white-label payment gateway secure?

Yes. VCIOs with the right certification (PCI-DSS), encryption, provides fraud tools, and adheres to security regulations are good providers.