The development of the private banking sector in India can be regarded as a sign of the country in terms of financial evolution and dynamism in 2025. The Private Bank List includes the institutions that transformed customer service, technological innovation, and financial inclusion throughout the country. These banks have become the major contributors to the economic development of India, providing advanced banking services to their millions of clients.

With the introduction of innovative online banking services to offering advanced corporate finance services, the private banks have transformed the banking industry. This extensive list of private banks is your one-stop shop in learning everything about the entire private banking industry in India, including their history, offerings, and role in the market.

Importance of Private Sector Banks in India’s Economy

The existence of the private sector banks is a key driving force behind the economic engine of India, a factor that helps in the growth of the GDP and financial stability of the country. These banks have introduced new banking products, increased technology platforms, and customer-focused services that have raised the standards of banking in the country. The diversity in serving different economic sectors is remarkable, with the Private Bank List indicating that they are adept in retail banking, corporate finance, entrepreneurship, and international trade.

Their competitive strategy has led to the rise of efficiency in the whole banking industry, compelling the public banks to increase their quality of services. By strategically lending their funds, these banks have aided in the development of infrastructure, manufacturing, and service industries, which is why they remain invaluable foundations of the Indian financial system and its economic growth.

What are Private Banks in India?

Definition of Private Sector Banks

Banks in the private sector are financial institutions in which the government does not own the majority of the shareholding. These banks are established and managed according to RBI regulations but their independent management structures and decision making processes are geared towards profitability and customer satisfaction.

Difference Between Private Banks vs Government Banks

There is a fundamental difference between a private bank and a government bank in the ownership structure, their efficiency in operations, and their service delivery. Whereas the public sector banks are owned by the government and have social banking requirements, the banks featured in the Private Bank List concentrate on shareholder value, technological development, and competitive service lines with wider flexibility of operations and an expedited decision-making process.

Growth of Private Banks in India After Liberalization (Post-1990s)

The liberalization period after 1991 also brought revolutionary change in the banking sector in India with the entry of the private players. This new direction in the banking policy resulted in the entry of Foreign Banks in India, which created international standards of banking, adopted new technology, and introduced customer-oriented strategies that greatly increased competitiveness and efficiency in the banking sector.

Types of Private Banks in India

- New Private Sector Banks: These are formed after 1993 banking reforms, and are represented by HDFC Bank, ICICI Bank, Axis Bank, and others and are based on the modern technology infrastructure and modern banking practices.

- Old Private Sector Banks: Banks that existed in the pre-independence era such as federal bank, south Indian bank, and Karnataka bank that have grown with the time and yet retained their age-old customer relationship.

- International Banks: International bank institutions in India which include Standard Chartered, Citibank, and HSBC, with the expertise of global banking and international connectivity.

- Small Finance Banks: These are specialised banks dealing with financial inclusion and catering to the underbanked customer, such as Equitas Small Finance Bank and AU Small Finance Bank, which facilitate the progress of grass root banking. Many of these institutions fall under the broader category of Small Finance Banks in India, playing a vital role in extending accessible financial services to underserved communities.

How Many Private Banks are There in India (2025)?

- Number of Private Banks now: There are 19 private sector banks operating in India at present which are classified as new and old private sector.

- New Private Sector Banks: 9 major banks namely HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, IndusInd Bank, YES Bank, IDFC FIRST Bank, Bandhan Bank and RBL Bank.

- Old Private Sector Banks: 10 traditional banks such as Federal Bank, South Indian Bank, Karnataka Bank, Karur Vysya Bank, City Union Bank, Dhanlaxmi Bank, Tamilnad Mercantile Bank, CSB Bank and Nainital Bank.

- Market Coverage: The total number of branches and ATMs operated by these banks exceeds 50, 000 and 80,000+ respectively operating in urban and rural India, and catering to diverse customer segments.

- Job Creation: There are over 8 lakh professionals employed by the Indian private bank industry and this is a great contribution to the Indian financial services employment sector and the economy.

Top 10 Private Banks in India Based On Market Cap – Table

| Rank | Bank Name | Market Capitalization (In Rs. Crore) |

| 1 | HDFC Bank | 13,84,615 |

| 2 | ICICI Bank | 8,45,232 |

| 3 | Kotak Mahindra Bank | 3,78,945 |

| 4 | Axis Bank | 3,21,567 |

| 5 | IndusInd Bank | 98,432 |

| 6 | Bandhan Bank | 67,890 |

| 7 | Federal Bank | 45,321 |

| 8 | YES Bank | 43,876 |

| 9 | RBL Bank | 25,643 |

| 10 | IDFC FIRST Bank | 23,987 |

Updated Private Bank List in India (2025)

A) New Private Sector Banks

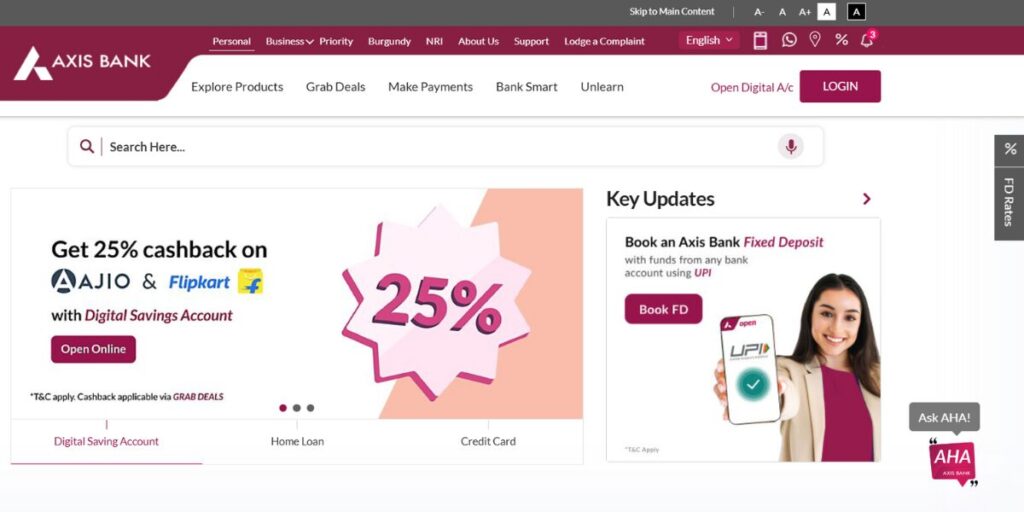

1. Axis Bank

- Year Founded: 1993

- Number of Branches: 5,706

- Chairperson: Rakesh Makhija

- Headquarters: Mumbai, Maharashtra

Axis Bank is the third-largest Indian bank in the private sector and is known to offer a wide range of financial services, as well as technological advancement. Featured in the Private Bank List, the bank has grown to be one of the best in the business in terms of retail banking, corporate finance, and digital banking solutions, and currently enjoys millions of customers in various segments with high-quality service and financial expertise.

Services:

- Personal finance and retail banking

- Treasury Operations and Corporate Banking

- Capital Markets and investment banking

- Insurance and Mutual Fund Distribution

- Online Banking and Apps

Key Highlights: The third-largest bank in India in the private sector with sizable digital banking operations.

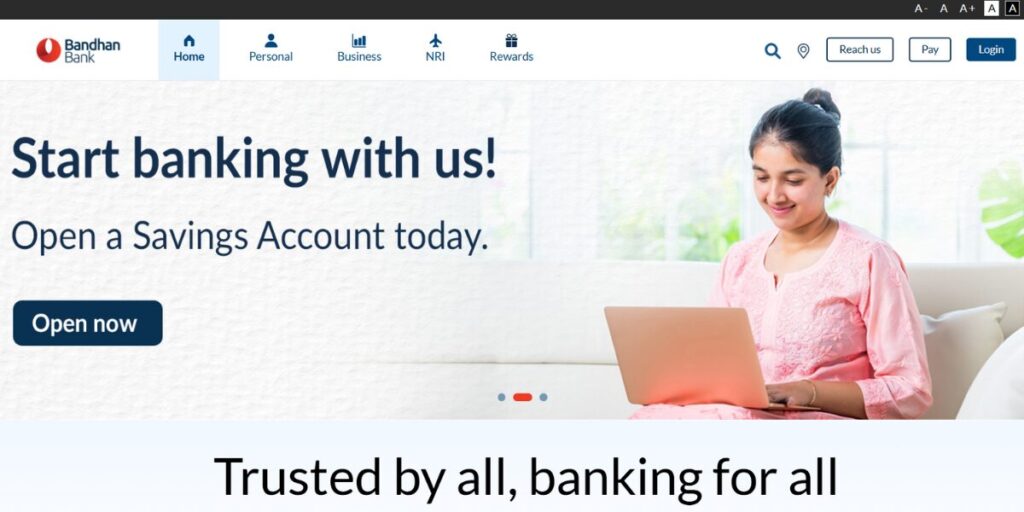

2. Bandhan Bank

- Year Founded: 2015

- Number of Branches: 6,187

- Chairperson: Harun Rasid Khan

- Headquarters: Kolkata, West Bengal

Bandhan Bank is a commercial bank that started as the largest microfinance institution in India that has evolved into a full-service bank with a focus on the unbanked and rural population. The bank focuses on providing financial services to unbanked and underbanked people, especially in the eastern and northeastern parts of India, and is now entering urban centers with innovative financial products and client-centric solutions.

Services:

- Micro finance and rural banking

- Retail Banking Services

- SME Lending Solutions

- Agricultural Finance

- Digital Payments Solutions

Key Highlights: It is the largest microfinance institution which transformed into a universal bank with strong rural orientation.

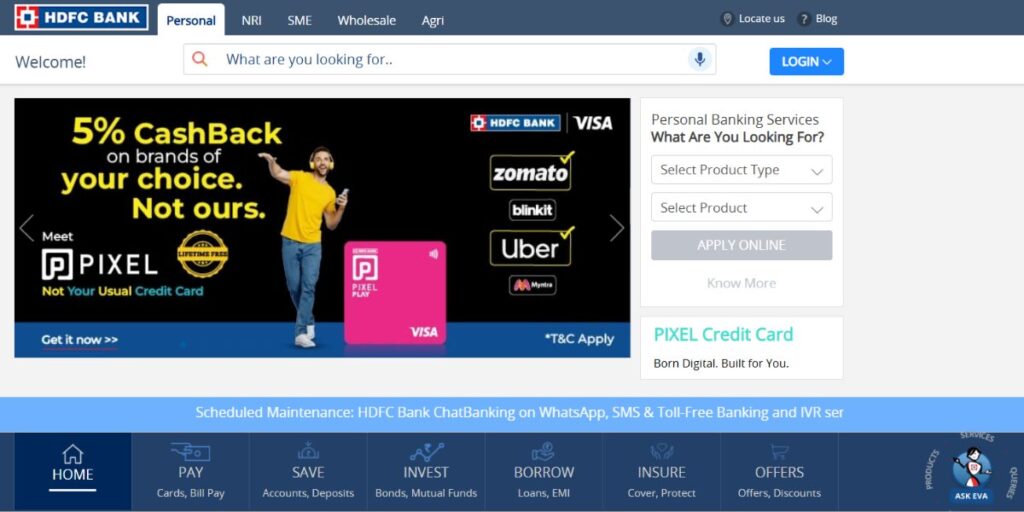

3. HDFC Bank

- Year Founded: 1994

- Number of Branches: 9,092

- Chairperson: Atanu Chakraborty

- Headquarters: Mumbai, Maharashtra

HDFC Bank is the market leader in the Indian private banking industry with the largest market capitalization and wide network of branches. Included in the Private Bank List, the bank has continuously provided good financial results with the best corporate governance and customer service. Its full product and service range offers banking solutions that are comprehensive in their coverage and focus on all customer segments with innovative solutions and technological excellence.

Services:

- Retail Banking & Wealth Management

- Trade Finance and Corporate Banking

- In the Treasury and Capital Markets

- Consumer Credit & Finance

- Online Banking and Internet Services

Key Highlights: India largest private sector bank in terms of market capitalization and branch network.

4. ICICI Bank

- Year Founded: 1994

- Number of Branches: 7,066

- Chairperson: Girish Chandra Chaturvedi

- Headquarters: Mumbai, Maharashtra

ICI Bank is the second largest bank in the private banks in India and has a very good presence in international markets in 11 countries. The bank has not only been an innovator in new banking solutions, digital transformation and the provision of all-inclusive financial services. Its well-regulated risk management and tech-intensive model has made it a beacon institution in the Indian banking sector.

Services:

- Universal Banking Services

- International Banking Activities

- Investment banking and securities

- Insurance & Asset Management

- Digital Solutions & Technology

Key Highlights: Second-largest privately-owned Bank with high internationalization and digital innovation.

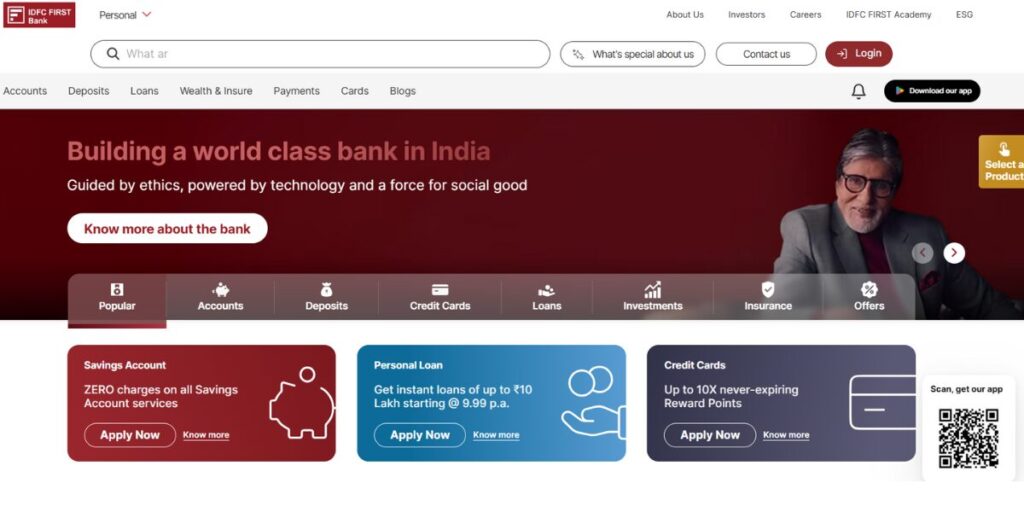

5. IDFC FIRST Bank

- Year Founded: 2018

- Number of Branches: 760

- Chairperson: Rajiv Lall

- Headquarters: Mumbai Maharashtra

IDFC FIRST Bank is the result of a merger between IDFC Bank and Capital First, which makes the bank a unique organization due to its focus on the retail, rural, and MSME segments. Featured in the Private Bank List, the bank focuses on customer-friendly policies, transparent rates, and innovative banking services aimed at serving the needs of the growing middle-class and small business community in India through personalized financial services.

Services:

- Retail Banking and Consumer Lending.

- SME Banking Solutions

- Rural and Agricultural Finance

- Electronic Banking Services

- Wealth Management Solutions

Key Highlights: Consolidated company that specializes in retail and MSME banking that offers friendly policies to customers.

6. IndusInd Bank

- Year Founded: 1994

- Number of Branches: 2,987

- Chairperson: Anil Rao Parab

- Headquarters: Mumbai Maharashtra

IndusInd Bank has established itself in the niche of premium banking services, vehicle finance and consumer lending. The bank has a reputation as an innovator in product offerings, a provider of a high-quality customer experience and good relations with automotive manufacturers. Its business strategy of technological adaptation and service quality has given it a strong customer base in urban markets.

Services:

- Premium Banking Services

- Vehicle and Consumer Finance

- Corporate Banking Solutions

- International Banking Services

- Online Payments Systems

Key Highlights: It is a strong premium banking franchisee and a leading vehicle finance provider.

7. Kotak Mahindra Bank

- Year Founded: 2003

- Number of Branches: 1,780

- Chairperson: Uday Kotak

- Headquarters: Mumbai Maharashtra

Kotak Mahindra Bank is one of the three largest private banks in India with a reputation for innovating financial solutions and having high capital adequacy ratios. Included in the Private Bank List, the bank has effectively diversified in retail banking, corporate finance, and capital markets without compromising its risk management practices and has recorded steady growth in profitability.

Services:

- Retail Banking and Corporate Banking

- Investment Banking Services

- Capital Markets & Securities

- Management Solutions

- Insurance and Mutual Funds

Key Highlights: Third biggest in private banking, good capital ratios and financial services diversification.

8. RBL Bank (Ratnakar Bank)

- Year Founded: 1943 (as Ratnakar Bank)

- Number of Branches: 569

- Chairperson: R. Subramaniakumar

- Headquarters: Mumbai, Maharashtra

RBL Bank was previously known as Ratnakar Bank Limited, a regional cooperative bank which has been transformed into a moderate, privately owned bank focusing on corporate banking, agri-business and development banking. The bank is specialized in providing financial services to specific customer groups with customized financial products and good relations with corporate customers and financial institutions.

Services:

- Wholesale Banking

- Agri-Business Banking Solutions

- Development Banking Services

- Retail Banking Products

- Treasury and Capital Market Operations

Key Highlights: Innovated regional bank focused in the corporate and agri-business banking.

9. YES Bank

- Year Founded: 2004

- Number of Branches: 1,135

- Chairperson: Sunil Mehta

- Headquarters: Mumbai, Maharashtra

YES Bank specialises in corporate banking, retail banking, and digital financial services, with a particular emphasis on knowledge-based banking and customer relationship management. Featured in the Private Bank List, although the bank has been struggling, it has also undertaken a thorough restructuring program to support its operations, boost its asset quality, and restore customer confidence by offering innovative banking solutions.

Services:

- Trade Finance and Corporate Banking

- Consumer Banking Services

- Digital Banking Solutions

- Treasury and Investment Services

- Support of SME Banking

Key Highlights: Corporate banking driven, knowledge-based banking model and digitalization.

B) Old Private Sector Banks

1. City Union Bank

- Year Founded: 1904

- Number of Branches: 689

- Chairperson: N. Kamakodi

- Headquarters: Kumbakonam, Tamil Nadu

Drawing upon a 100-plus-year history of banking experience, City Union Bank concentrates on MSME lending, gold loans, and retail banking. The bank has sustained itself from generation to generation by nurturing a strong relationship with local communities and by taking a broad view of India while keeping central pillars of single-customer attention and deep community engagement.

Services:

- SME and SME Banking

- Gold Loans Services

- Products of Retail Banking

- Agricultural Finance Solutions

- Online Banking Services

Key Highlights: One-hundred year old bank whose focus is on MSME financing and gold loans with regional strength.

2. CSB Bank (Catholic Syrian Bank)

- Year Founded: 1920

- Number of Branches: 430

- Chairperson: Anand Krishna Iyer

- Headquarters: Thrissur, Kerala

CSB Bank is one of the oldest private banks that has survived and continues to exist in India, giving it more than a hundred years of legacy in Kerala. Included in the Private Bank List, the bank concentrates on retail banking, agricultural financing, and MSME lending, fostering community ties with a commitment to time-honored banking practices, while adopting cutting-edge banking technology and service delivery.

Services:

- Retail Banking Products

- Agricultural and Rural Finance

- SME Lending Solutions

- NRI Banking Services

- Plataformas De Bancos Digitais

Key Highlights: It is one of the oldest and leading privately-owned banks in India that has a significant presence in Kerala and also focused on community banking.

3. Dhanlaxmi Bank

- Year Founded: 1927

- Number of Branches: 278

- Chairperson: Sunil Gurbaxani

- Headquarters: Thrissur, Kerala

Its customer base is spread across Kerala, Karnataka, Tamil Nadu, and Maharashtra; however, retail bank customers remain the predominant clientele, along with agricultural finance and MSME customers. Traditional banking skills combined with modern technologies give the bank the ability to undertake a highly personalized approach to financial services for individuals, small enterprises, and agricultural communities.

Services:

- Retail Banking Solutions

- Agricultural Banking Services

- SME Finance Products

- NRI Banking Services

- Electronic Payments Solutions

Key Highlights: Regional bank with multi-state location that specializes in retail and farm banking.

4. Federal Bank

- Year Founded: 1931

- Number of Branches: 1,339

- Chairperson: Grace Elizabeth Koshie

- Headquarters: Aluva, Kerala

Federal Bank is among India’s leading private sector banks and one of the oldest and most established institutions with a wide range of footprints operating pan-India and internationally. The bank holds a dependable reputation in NRI banking, agriculture finance, and technically inclined digital banking solution services rendering, making it eligible to serve socially diverse customers on retail, corporate, and international fronts.

Services:

- Universal Banking Services

- NRI Banking Solutions

- Agricultural Finance Programs

- Corporate Banking Services

- International Banking Operations

Key Highlights: Major old private sector bank with a good NRI banking franchise and pan-India presence.

5. Karnataka Bank

- Year Founded: 1924

- Number of Branches: 863

- Chairperson: Mahabaleshwara M.S.

- Headquarters: Mangaluru, Karnataka

Karnataka Bank is a regional powerhouse with a presence in the western and southern sectors of India. It develops its activities toward retail banking, agricultural finance, and support to small and medium enterprises (SMEs). A good customer base and long-standing relations in the localities have supported its steady growth over almost 100 years.

Services:

- Retail Banking Products

- Agricultural and Rural Banking

- SME Financing Solutions

- Corporate Banking Services

- DT Virtual Bank Platforms

Key Highlights: Strong southern India presence, well rounded banking services of a regional bank.

6. Karur Vysya Bank

- Year Founded: 1916

- Number of Branches: 858

- Chairperson: Meeta Makhan

- Headquarters: Karur, Tamil Nadu

With more than a 100-year history of retail banking, Karur Vysya Bank promotes small and medium enterprises, microenterprises, and agricultural lending in Southern India and other states. Featured in the Private Bank List, the bank integrates traditional banking principles with modern technology to offer products in customized ways for customers residing in urban and rural areas.

Services:

- Retail Banking Services

- Agricultural Finance Solutions

- SME Banking Products

- Corporate Banking Services

- Banking Technologies

Key Highlights: Century old bank with massive presence in Tamil Nadu and retail and agricultural banking as its focus.

7. Nainital Bank

- Year Founded: 1922

- Number of Branches: 135

- Chairperson: Atul Kumar Goel

- Headquarters: Nainital, Uttarakhand

Nainital Bank operates like a devoted hill partner, serving the people of Uttarakhand while also climbing over the ridges into neighbouring Uttar Pradesh. Included in the Private Bank List, it helps agrarian communities through purpose-driven lending, so that the hill economy, handmade shawls, apple orchards, and remote villages can quietly but surely weave into the rhythm of growth. Its microservices, whether credit or savings, affirm that mountains are more than reservoirs of natural beauty; they are reservoirs of opportunity.

Services:

- Banking Services in the Rural Areas

- Farming Finance Programs

- Government Banking Solutions

- Retail Banking Products

- Online Banking Services

Key Highlights: Regional bank that focuses on the state of Uttarakhand with specialization in rural and government banking.

8. South Indian Bank

- Year Founded: 1929

- Number of Branches: 950

- Chairperson: Salim Gangadharan

- Headquarters: Thrissur, Kerala

South Indian Bank, a private-sector institution founded long ago, maintains extensive reach across the southern states and is steadily broadening its footprint across the rest of the nation. By delivering an extensive spectrum of products and services to retail, corporate and NRI clients, the bank continues to be linked with customer-centric banking, innovative solutions, and comprehensive financial services.

Services:

- Retail Banking Solutions

- Corporate Banking Services

- NRI Banking Products

- Farming Finance Programs

- Banking Platforms

Key Highlights: Major historical old private sector bank having a good presence in southern India and a full range of services.

9. Tamilnad Mercantile Bank

- Year Founded: 1921

- Number of Branches: 609

- Chairperson: K.V. Rama Moorthy

- Headquarters: Thoothukudi, Tamil Nadu

Tamilnad Mercantile Bank concentrates on delivering financial services to retail customers, small, medium, and small-scale enterprises, and the agriculture sector throughout Tamil Nadu and the surrounding states. Though the bank maintains its regional character, digitalization and the launch of new financial products enable it to broaden its service opportunities to satisfy the requirements of the local market.

Services:

- Retail Banking Services

- SME Financing Solutions

- Agricultural Banking Products

- Online Banking Services

- Corporate Banking Solutions

Key Highlights: Regional bank with deep focus on Tamil Nadu and well diversified portfolio of banking services.

First Private Bank in India

- Historical significance: Allahabad Bank was one of the earliest privately owned banks in British India, founding modern banking in the subcontinent in the year 1865.

- Modern Era Foundation: In the modern day era of private banking, HDFC Bank (1994) and ICICI Bank (1994) were the first modern generation of private banks after the economic liberalization in the year 1991.

- Pioneering Role: The first generation of these privately owned banks pioneered international banking standards, use of advanced technology systems, and customer centric approach to services and transformed the Indian banking system.

- Industry History: The pioneering nature of these institutions set the stage and established the effectiveness of the current list of comprehensive private banks in India and the significance of the contribution of the private sector to the Indian economy.

- The transformation catalyst: These initial private banks were the transformation catalysts of the entire banking sector since they made the public sector banks improve their services and the efficiency of their operations.

Largest Private Banks in India

- Market Leader: HDFC Bank is considered the largest bank in the Indian private banking industry with a market capitalization of over 13 lakh crores as of 2025 making it the market leader by far.

- Branch Network: HDFC Bank has more than 9000 branches and 20,000+ ATMs spread all across India that provide the widest coverage of distribution amongst the other private banks and enable wide accessibility of customers.

- Customer Base: The bank has a customer base of more than 6.8 crore customers that cut across the different market segments including individual retail banking to large corporate accounts, thus showing its wide outreach and service capabilities.

- Financial Performance: HDFC Bank has been the highest in revenues, profits, and asset base among the private sector banks and has continued to maintain the industry leading financial ratios and operational efficiency parameters.

- Innovation Leadership: HDFC Bank is the largest privately held bank and it continues to be a leader in technological innovation, digital banking and customer service excellence and this is the benchmark set by the bank to the whole industry.

Conclusion

The detail of the complete list of private banks in india 2025 presents the dramatic growth and transformation of the Indian private bank industry, decades of innovations, expansion and service to the customers. Throughout this list of private banks in India, there is a bank-specific market leadership, such as HDFC Bank, and regional specialty oriented banks like Nainital Bank that each play an important role in India as a financial ecosystem. These banks have changed banking operations comparatively to brick and mortar operations to high-tech digital platforms with more than 100 million customers in the country.

With India making strides to become a 5 trillion economy, the list of private banks will only grow and change according to the change in technology, regulatory assistance, and customer needs. India has a bright future ahead of it in terms of greater innovation, financial inclusion, and service excellence by the dynamic banking institutions that are the basis of the country as a modern financial system.

FAQs

What is the number of private banks in India in 2025?

India has 19 private sector banks of which 9 are new sector banks and 10, old sector banks.

What is the biggest privately owned bank in India?

HDFC Bank is the biggest privately owned bank in India based on the market capitalization, branches, and the number of customers.

What is the distinction between the new and old banks of the private sector?

The old banks in the private sector were set up prior to independence and the new banks in the private sector were set up after the 1991 liberalization.

How many branches are there of the biggest private banks in India?

HDFC bank has the largest number of branches among the non-public banks with branches totaling more than 9,000 branches across the nation.

Do you believe that private banks are more secure than government banks?

Both government and private banks are under the control of RBI and come under deposit insurance and are equally safe to customers.