The reason why commercial truck insurance is such an important financial stabiliser in the transportation sector of business is that the United States transportation industry transports over 700 billion dollars worth of freight along the country roads every year.

Progressive is the leading commercial truck insurer in the US, making it the perfect choice for truck drivers. The trucking sector is a risk-exposed sector that requires specialised cover and exclusive insurance cover that makes choosing the right Top Trucking Insurance Companies In US a vital business decision.

Why Choosing the Right Trucking Insurance Matters for Trucking Companies in the US

- Legal Compliance Protection: Commercial trucks must maintain the minimum insurance coverage as required by federal and state regulations to help business avoid fines and business closure.

- Asset Protection Security: Umbrella coverage protects valuable assets, including trucks, trailers, and cargo, against theft, accidents, natural disasters, and vandalism.

- Liability Risk Management: With appropriate insurance, transportation firms are not exposed to potential catastrophic lawsuits and other third-party damages that may bankrupt businesses not covered by proper insurance.

- Financial Stability Assurance: Insurance creates predictability regarding costs and cash flow protection; this enables trucking companies to run their business without the worry of a big surprise expenditure.

- Business Continuity Support: High-quality insurance policies offer rental car policies, rapid physical repair, and business interruption coverages, among others to reduce working disruption.

Overview of Trucking Insurance

What is Commercial Truck Insurance?

Commercial Truck Insurance allows businesses to insure their commercial motor vehicle in a variety of different ways. In contrast to personal auto insurance, commercial truck insurance takes a look at the specific risks and regulatory demands of customers working in the truck industry, independent owner- operators, and other freight carriers. This broad protection has insured the businesses against loss of finances through accidents, damages to cargo, liability, as well as all other risks related to the transportation business.

Types of Trucking Insurance Policies

- Primary Liability Coverage: Keep off claims that can occur due to the accident under the commercial truck that can cause body injury; and sources of property damage. This compulsory coverage is mandatory in most of the operations throughout the state and is usually between the range of 750,000 $ to 1 million.

- Physical Damage Insurance: Covers repair or replacement of damaged trucks and trails damaged as a result of collision, theft, destruction, fire or natural calamity. This coverage is essential for protecting valuable fleet assets.

- Motor Truck Cargo Insurance: Covers the freight on transit in case it is lost in transit through theft, breakage, or contamination. Coverage amounts vary based on cargo value and type.

- General Liability Insurance: Closes the coverage gap concerning non-trucking factors of loss (slip-and-fall accidents at the loading dock, property damage en route to make the delivery, etc.).

- Bobtail and Deadhead Coverage: Completes coverage gaps not covered by regular liability when it comes to unloading or loading without a trailer, or empty trailers.

- Workers’ Compensation Insurance: Pays the costs of treatment and absenteeism in case of patients injured at work and required in majority of states of the trucking business with employees.

Why Trucking Insurance is Crucial for Top Trucking Insurance Companies In USA

In addition to their basic roles in complying with the laws, trucking insurance play many important roles. The Federal Motor Carrier Safety Administration (FMCSA) sets minimum levels of coverage insurance, which frequently are insufficient to cover the risks of exposure to the action. Nuclear verdicts are yet another liability risk that modern trucking operators are exposed to as awards made by juries in serious accidents may most likely cross the $10 million mark.

Moreover, the complexity of the regulations covering interstate commerce implies that the trucking companies have to remain in constant coverage that fulfills different state requirements. Just like Insurance Companies in India provide businesses with risk management and financial protection, insurance services in trucking serve a very important business continuity essential, such as claims management, legal defense and the loss prevention programs serving to keep businesses running balanced with a low risk exposure profile.

List of Top Trucking Insurance Companies In USA

| Name | Year Founded | Headquarter City | Average Pay Scale | Employees | Best For | Average Pricing | Ratings |

| Progressive | 1937 | Cleveland | $50,000-$75,000 | 50,000+ | Fleet Coverage | $8,000-$15,000 | A+ (AM Best) |

| State Farm | 1922 | Bloomington | $45,000-$70,000 | 65,000+ | Owner-Operators | $9,000-$16,000 | A++ (AM Best) |

| Nationwide | 1926 | Columbus | $48,000-$72,000 | 25,000+ | Small Fleets | $8,500-$15,500 | A+ (AM Best) |

| Berkshire Hathaway | 1955 | Omaha | $55,000-$85,000 | 15,000+ | Large Carriers | $10,000-$18,000 | A++ (AM Best) |

| Chubb | 1882 | New York | $60,000-$90,000 | 31,000+ | High-Value Cargo | $12,000-$20,000 | AA (AM Best) |

| The Hartford | 1810 | Hartford | $52,000-$78,000 | 18,000+ | Mid-Size Fleets | $9,500-$17,000 | A+ (AM Best) |

| Allstate | 1931 | Chicago | $48,000-$74,000 | 45,000+ | Regional Carriers | $8,800-$16,200 | A+ (AM Best) |

| Liberty Mutual | 1912 | Boston | $50,000-$76,000 | 45,000+ | Specialized Transport | $9,200-$17,500 | A (AM Best) |

| Farmers Insurance | 1928 | Los Angeles | $47,000-$71,000 | 21,000+ | Local Haulers | $8,600-$15,800 | A (AM Best) |

| Sentry Insurance | 1904 | Stevens Point | $49,000-$73,000 | 4,500+ | Construction Trucks | $9,000-$16,500 | A+ (AM Best) |

Top 10 Top Trucking Insurance Companies In USA

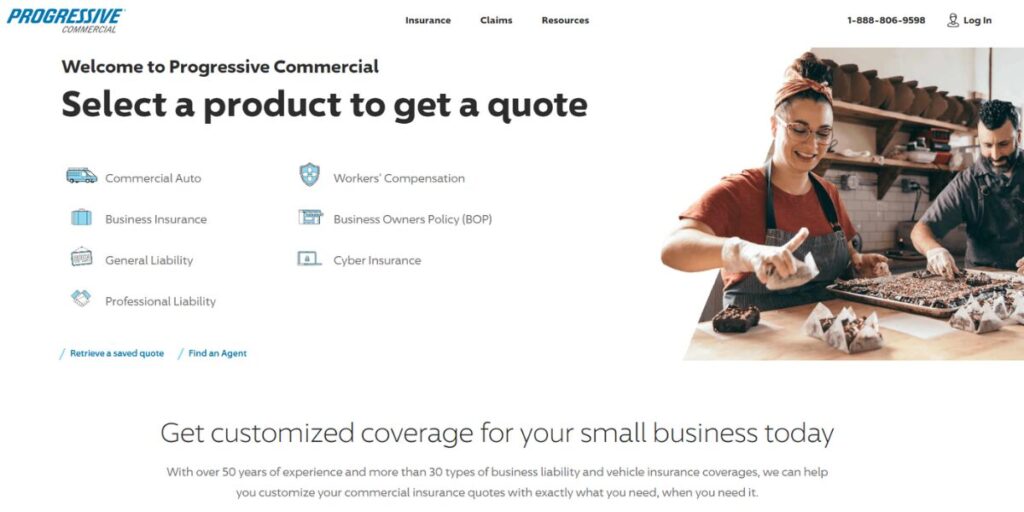

1. Progressive Commercial

Year Founded: 1937

Headquarter City: Cleveland

Average Pay Scale: $62,500

Employees: 50,000+

Best For: Fleet Coverage

Progressive is the largest commercial truck company in the US hence it is a straightforward decision to the truck drivers. This insurance provider is licensed in all 50 States and performs free state and federal insurance filings.

In the J.D. Power Insurance Digital Experience Study 2024, Progressive scored 737 out of 1,000, and was in the first place among the largest number of insurers, and 20 points more than the other insurers. The company is the expert in providing insurance to truckers and fleet operators by giving them comprehensive insurance covering all the aspects of trucking business.

Standout Features

- Smart Haul smart program telematic

- 24/7 devoted claims support

- DOT filing services free of charge

- Comprehensive access to MPN repair network

- Customer experience that first-digital

Pros

- The greatest market share in the country

- Specialty trucking specializes in specialty exclusively

- State of the art technology integration is present

Cons

- The rates of premiums differ considerably

- Not many bundling choices are on tabulated

- Waiting times in all customers service desks

Website Link: https://www.progressive.com/

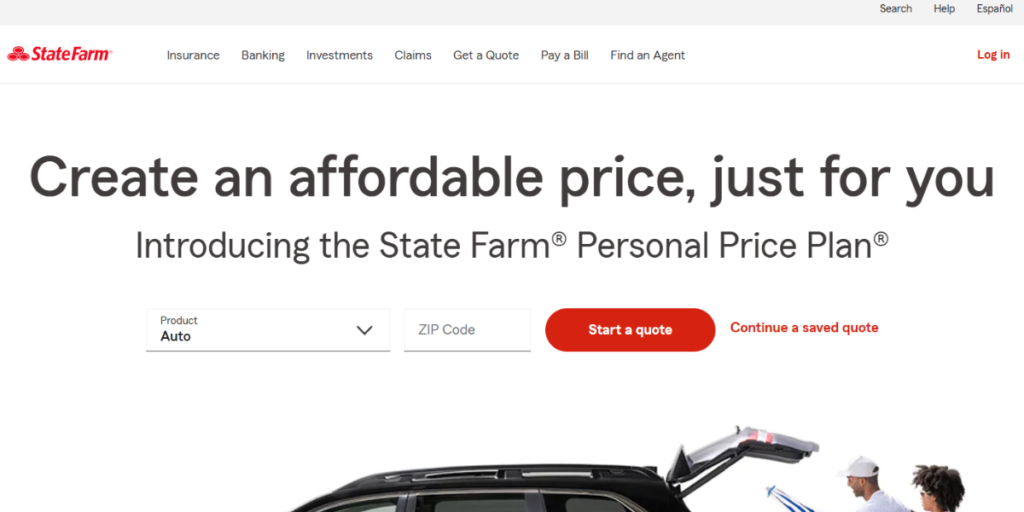

2. State Farm

Year Founded: 1922

Headquarter City: Bloomington

Average Pay Scale: $57,500

Employees: 65,000+

Best For: Owner-Operators

State Farm holds the reputation as one of the most trusted brands of Top Trucking Insurance Companies In US and has close to a century of experience to offer in the field of commercial trucking insurance. The company does very well on personalized service with the wide number of local agents around the country.

The commercial trucking business segment of state farm is devoting their attention to the maintenance of long-term relationships with the owner-operators and small fleet-owning business, providing the personalized coverage packages, which integrate the commercial truck insurance with other commercial protection solutions.

Standout Features

- Large local agent network

- Multi-policy discount schemes on offer

- Options of accident forgiveness programs

- 24 hour claim reporting services

- Business general liability

Pros

- Good customer service record

- High ratings on financial stability

- Individual approach to relations with an agent

Cons

- Increased premium rates tend to.

- Few online self-service models

- Higher underwriting standards often

Website Link: https://www.statefarm.com/

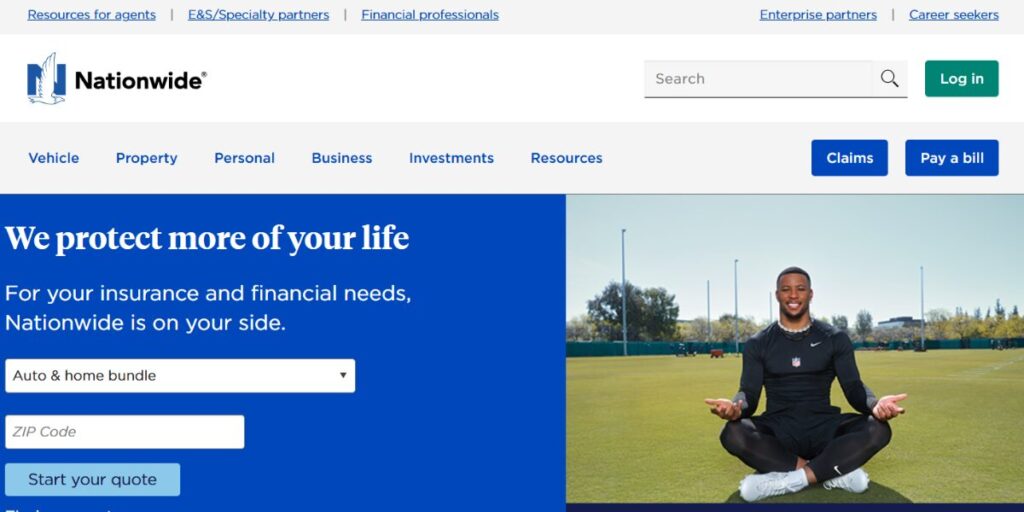

3. Nationwide Insurance

Year Founded: 1926

Headquarter City: Columbus

Average Pay Scale: $60,000

Employees: 25,000+

Best For: Small Fleets

Nationwide Insurance is a Fortune 500 company whose experience in the world of insurance spans almost a century providing insurance products of all kinds and specializes in business insurance especially active in the commercial trucking field.

The company offers the solution to the comprehensive coverage of the small to medium trucking operations offering competitive rates and offering wide span of the coverage. Nationwide has a strong value of its balanced actions regarding risk evaluation and customer care, which offers the online convenience and one-on-one agent support.

Standout Features

- F500 monetary might F500 monetary force

- The extended cargo coverage plans

- Ability to do online filing of claims

- Expertise in industry specialized expertise

- Enhanced payment payment plans

Pros

- Good history of financial stability

- Wide coverage customization is allowed

- Composite favorable rates on fleets

Cons

- Quote process phone-only demanded

- Expensive premiums as compared to others

- Digital self-service deficient

Website Link: https://www.nationwide.com/

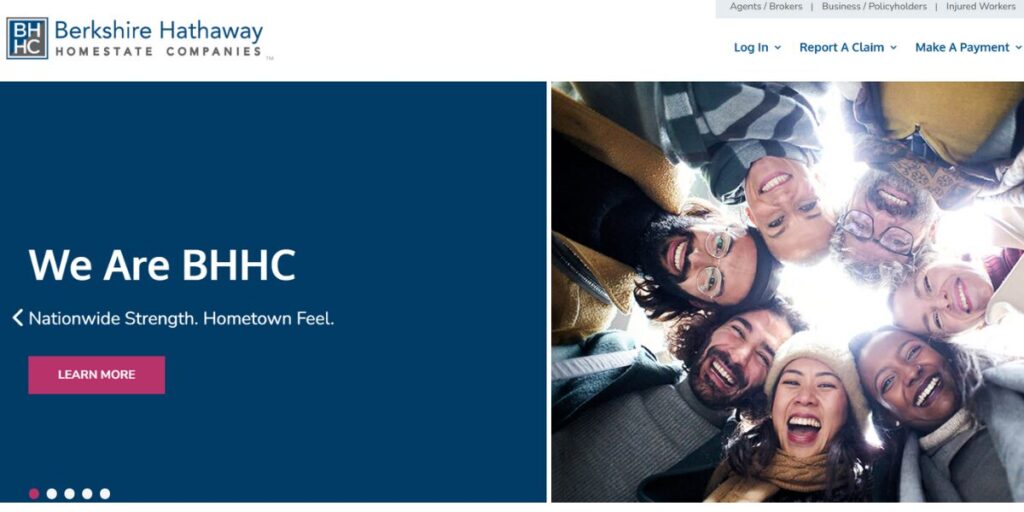

4. Berkshire Hathaway

Year Founded: 1955

Headquarter City: Omaha

Average Pay Scale: $70,000

Employees: 15,000+

Best For: Large Carriers

Berkshire Hathaway has various insurance subsidiaries including GEICO Commercial and General Re, which developed insurance products to cover commercial trucking risks that are also underwritten by the Warren Buffett financial conglomerate. The firm aims at serving larger companies in transportation and fleet operations with advanced insurance requirements representing higher limit coverage and multifaceted-risk control solutions.

Their method of operation underlines a stable financial situation and long-term relationship and, therefore, they are highly popular among the long-standing trucking companies interested to receive high-limit insurance and exceptional claims management.

Standout Features

- Warren Buffett support power

- Large coverage limit capacities

- Various subsidiary choice ideas are there

- Sophisticated risk management services

- Outstanding record in AO-Profil reputation

Pros

- Exceptionally high financial strength ratings

- High-limitation coverage access specialty

- There are various choices of brands

Cons

- Increased premium charges normally

- Narrow small operator attention

- Complicated application procedures mostly

Website Link: https://berkshirehathaway.com/

5. Chubb Limited

Year Founded: 1882

Headquarter City: New York

Average Pay Scale: $75,000

Employees: 31,000+

Best For: High-Value Cargo

Chubb is the world leader in commercial insurance with a history of 140 years in the market to serve the commercial trucking sector. This company focuses on offering top insurance products to trucking firms moving high value good and companies that have complex logistic operations. Chubb is an industry leader in sophisticated risk analysis and tailor-made coverage designs to handle the various issues of specialized transportation businesses.

Their broad based solution consists of property casualty, financial lines protection and management liability coverages and it makes them the choice of trucking firms that need a sophisticated insurance program with a high level of customer service attributes and global financial strength.

Standout Features

- International reputation as an insurance leader

- High-value cargo specialization Offered

- Custom policy designing services

- The requirements of excellent claims handling

- Global reach capacities provided

Pros

- High standards of service quality

- Diverse options in coverage plans

- Global presence and potentials

Cons

- The high cost of premiums is a common case.

- There are minimum revenue requirements

- Scarcity of small operators

Website Link: https://www.chubb.com/us-en/

6. The Hartford

Year Founded: 1810

Headquarter City: Hartford

Average Pay Scale: $65,000

Employees: 18,000+

Best For: Mid-Size Fleets

With more than two centuries of insurance industry expertise, The Hartford is a long-term, reliable partner to fleet operators of mid-sized Top Trucking Insurance Companies In US. The average strength of the company is its in-depth knowledge of business insurance requirements and the capacity to offer structured coverage to cover several areas of trucking operation.

Hartford delivers affordable commercial trucking insurance by having traditional insurance knowledge coupled with the latest technology platforms, allowing it to provide efficient quotes quickly and process claims in a way that is efficient.

Standout Features

- More than 200 years of insurance history

- Worldwide business reporting services

- Online quotation capabilities

- Mid-market specialization focus is provided

- Fleet management software

Pros

- Substantial industry experience fame

- Easy- activated quote offer

- Considerable mid-market exposure strategy

Cons

- Restricted small operator possibilities

- Pricing above competition

- Complicated coverage aspect occasionally

Website Link: https://www.thehartford.com/

7. Allstate Corporation

Year Founded: 1931

Headquarter City: Chicago

Average Pay Scale: $61,000

Employees: 45,000+

Best For: Regional Carriers

Allstate offers decades worth of auto insurance experience to the commercial trucking industry and is able to utilize its vast experience in vehicle insurance to cover regionally based trucking companies. The commercial trucking division within the company is aimed at offering a cost-effective coverage to the region carriers and local delivery services that operate on geographic specific areas. Its USP is within its large agent network and customer support infrastructure offering the customers with highly specialized support with the assistance of superior technology platforms.

Standout Features

- Network of agents all over the country

- Specialization by region carrier focus

- All round customer care services

- Claims processing that is enhanced with technology

- Multi car insurance pays programmes

Pros

- A well-recognized brand nationally

- Amazing customer support name

- Regional carrier competitive rates

Cons

- Very low nationwide coverage options

- Increased expenses on premiums

- Less trucker- collected qualities

Website Link: https://www.allstate.com/

8. Liberty Mutual

Year Founded: 1912

Headquarter City: Boston

Average Pay Scale: $63,000

Employees: 45,000+

Best For: Specialized Transport

Liberty Mutual is one of the largest property and casualty insurers in America and specializes in providing coverage solutions to the specialized transport operation particularly to the commercial trucking industry. Liberty Mutual is one of the largest insurance carriers in the world, having operations in more than 30 countries and which is headquartered in Boston and founded in 1912.

The company is also good in insurance cover of trucking companies that engage in transportation of specialized commodities including what is considered hazardous materials, oversized freights, and freight involving high-value commodities that require specialized insurance cover considerations.

Standout Features

- Expertise in general cargo coverage

- Hazardous materials transportation emphasis

- Advanced risk assessment tools

- International insurance coverage possible

- High-Fidelity safety program offerings

Pros

- Evidence of expert transport available

- Insurance company rating

- Global coverage abilities provided

Cons

- Increased premium rates usually

- Involved application procedures needed

- Small operator specialisation

Website Link: https://www.libertymutual.com/

9. Farmers Insurance

Year Founded: 1928

Headquarter City: Los Angeles

Average Pay Scale: $59,000

Employees: 21,000+

Best For: Local Haulers

Farmers Insurance can offer almost 100 years of insurance experience to local and regional trucking markets that specialize in delivering comprehensive coverage solutions to local hauling companies and short-distance transportation facilities.

Their advantage is an agent-based distribution system and their commitment to working with customers on an individual basis, which makes them especially appealing to smaller trucking operators who want to establish more of a relationship with the insurer.

Standout Features

- Focus on Local Market Specialization

- Service model based on agents

- Analysis and knowledge in the region

- Flexibility of coverage customization options

- Competitive local fleets rates

Pros

- Good community market base

- Relationship model approach based on agents

- Locals friendly prices

Cons

- Small national reach level

- Only purchase via agent is required

- More expensive than competitors

Website Link: https://www.farmers.com/

10. Sentry Insurance

Year Founded: 1904

Headquarters City: Stevens Point

Average Pay Scale: $61,000

Employees: 4,500+

Best For: Construction Trucks

Sentry Insurance, Top Trucking Insurance Companies In US that ranks among the largest in the country, was included by both Forbes Advisor and U.S. News and World Report in the list of the best commercial truck insurers of 2024. The company is focused on offering insurance to the construction-related trucking activities such as dump trucks, concrete mixers and heavy equipment haulers.

The mutual insurance basis of Sentry enables them to put more emphasis on their long-term relations with customers that are not pressured by quarterly profitability but are committed to providing superior customer service and stable prices.

Standout Features

- Specialization in the area of focus in the construction industry

- Mutual insurance company structure

- Recognition by Forbes Advisor

- Specialized heavy equipment insurance

- Risk management services in construction

Pros

- Expertise in construction trucking

- Mutual company stable pricing

- Industry awareness and rewards

Cons

- Narrow emphasize asset trucking

- Smaller of the enterprise risks

- There are regional restrictions on bundle availability

Website Link: https://sentry.com/

Factors to Consider When Choosing Top Trucking Insurance Companies In US

- Coverage Adequacy Assessment: Determine whether the liability limit and the kind of insurance in the cover address a sufficient portion of the operational risks and compensation to facilitate the worth of the cargo.

- Financial Strength Ratings: Consumers should check on insurance companies rates on AM best rating and financial stability so that the company can be in a position to reimburse the claim within the shortest time and survive any economic crisis.

- Industry Specialization Experience: Select Insurers that possess knowledge about the trucking industry risks and regulations since they know your specific challenges and corrective requirements in this sector.

- Claims Handling Reputation: Check past claims payment performance, claims response time, and the claims satisfaction score of the company so as to ensure that the claims are handled promptly when you are in accidents.

- Premium Cost and Payment Options: Compare the total amount premiums without the fees, deductibles and payment plans options so you find the coverage that fits in your budget and covers you adequately.

Tips to Save on Top Trucking Insurance Companies In US

- Implement Comprehensive Safety Programs: In order to demonstrate reduced risk and access safety discounts to establish powerful driver training programs, safety plans and fleet maintenance plans.

- Utilize Telematics and GPS Tracking: Put on fleet tracking systems and electronic logging devices because the driver behaviour, the state of safety, and the programs of usage-based insurance along with the information that you can win some savings on premiums can work.

- Increase Deductibles Strategically: Another alternative suggestion you can do is to close or increase the deductibles on the physical damage coverage to cut down the levels of premiums involved. Nonetheless, you must make sure that the additional out-of-pocket expenses can be covered by you financially should any claims be registered.

- Bundle Multiple Coverage Types: Increase your savings bundle your truck insurance with other business insurance coverages such as general liability and workers compensation and save money on multi-policy rates.

- Maintain Clean Driving Records: The emphasis on the need to hire drivers with no record of traffic offense and add a permanent surveillance, which will guarantee the business positive safety ratings that will lead to the payment of low insurance costs.

Conclusion

Choosing the appropriate Top Trucking Insurance Companies In US involves taking a closer look at coverage needs, financial capacity, expertise and cost factors. The most noteworthy car insurance companies are Mercury, Progressive, Travellers and Liberty Mutual among the top 10 companies by the size of market share. The rest in the top 10 are Old Republic Group, Zurich, Berkshire Hathaway, Auto-Owners, State Farm, W.R.Berkey, and The Hartford. As part of this in-depth study, the following companies are selected as the most successful representatives and leaders in the industry to provide various traits and specialisations to different parts of the trucking industry.

The commercial truck insurance industry is constantly changing as new regulations and risks are discovered, along with new technologies. The secret to the successful selection process in the right insurance partner is matching your specific operational requirements with insurance companies with proven expertise in your specific industry sector, whether you own a small and desolated independent owner-operator, a regional carrier, or a large-scale fleet operation. Many businesses also look toward trusted Finance Companies in India that collaborate with insurers to provide tailored financial and coverage solutions for the transport industry.

FAQs

How much insurance do commercial trucks in the US need?

FMCSA mandates the bare minimum of liability insurance of $750,000 on most commercial trucks, but more may be necessary in the transportation of hazardous materials, up to $5 million dollars based on the nature of the material carried.

What is the average cost of Top Trucking Insurance Companies In US?

Insurance on commercial trucks may start at around 8,000 dollars a year to up to 20,000, depending on the type of truck, the cargo, driving record, type and limits of insurance, and the area-insurance coverage.

How is bobtail insurance different to non-trucking liability?

A: Bobtail insurance is a form of insurance that covers trucks when used without the trailer on a personal basis, but non-trucking liability provides coverage when the truck is not in the act of business but in the course of dispatch.

Do owner-operators need to have a CDL to fall under commercial truck insurance?

A: No, commercial trucks require an active Commercial Driver License (CDL) suitable to the vehicle used and the type of cargo that is being loaded.

What is the procedure for calculating rates of insurance on commercial trucks by insurance companies?

A: Insurance charges are determined by the experience of the driver, safety record, truck value, commodity to be transported, operating radius, the size of the annual miles, coverage limit, and claims.