When entrepreneurs enter the real estate business sector, substantial monetary prospects emerge to create lasting financial security. The urban development process creates business potential in real estate by addressing the increasing market demand for residential, commercial, and industrial properties. India’s real estate market was valued at approximately $477 billion in 2022 and is projected to reach $1 trillion by 2030, with exponential growth expected through 2047. This positions the sector as a key driver of economic expansion, fueled by increasing demand and investment opportunities.

Deep strategy planning needs to match industry knowledge for any real estate company to begin operations successfully. Establishing success in the real estate sector requires staged planning together with a sufficient understanding of business models, regardless of agent, investor, or developer roles. How to Start a Real Estate Business is essential knowledge for entrepreneurs, providing insights into real estate business models, start-up guidelines, and longevity techniques for success.

Understanding different types of real estate businesses

For establishing successful real estate businesses you need to grasp all available property investments thoroughly. Initiating a real estate business depends on selecting appropriate business models first. The multiple forms of real estate businesses establish both their investment hazards and their investment duties and expected profits. Selecting the right business model requires you to link your monetary resources with your market expertise. Real estate businesses come with specific financial earning opportunities that are attached to each business model.

1. Real Estate Brokerage & Agents

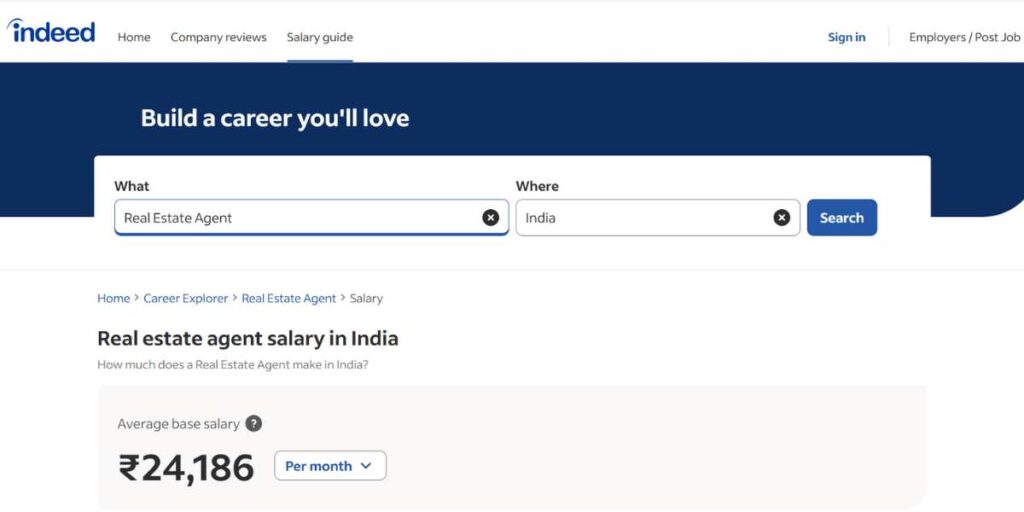

Real estate brokers direct the real estate transaction process by connecting potential buyers with sellers of property. The real estate business process moves smoothly through broker-agent services which include market analysis, settlement negotiation and complete transaction management support. Property brokers get paid through commission payments that represent 3% to 6% of the transportation deal value. Real estate brokers in 2023 earned $81,450 annually. And The real estate sector is expected to contribute 13% to India’s GDP in 2025.

Outstanding sales abilities together with networking and market examination expertise enable people to build rewarding business opportunities in brokerage. The path to business success in real estate requires holding a real estate license together with exceptional negotiation abilities along with thorough market trend knowledge in your local area.

You don’t need to be a real estate agent or brokerage to become a Realtor, but you must be an active real estate professional. Additional requirements include:

- A valid real estate license is required.

- No history of official sanctions for unprofessional conduct.

- No recent or active bankruptcy filings.

2. Real Estate Investment

The process of real estate investment includes buying properties with the purpose of earning rental payments or selling them at increased values to obtain capital gains. To attain maximum profits investors perform market trend analysis together with rental demand assessment and property appreciation rate evaluation.

The global real estate business investment market contains $10.5 trillion worth of properties that experts expect to expand at 4.8% annually throughout the upcoming ten years. The real estate market keeps expanding because key markets experience growing population counts and rising property prices while urban spaces continue expanding.

Real estate investments consist of various types which include Residential properties: Single-family homes, apartments, and vacation rentals. Commercial properties like office buildings, retail spaces, and industrial facilities. REITs (Real Estate Investment Trusts), through REITs investors receive passive income from income-generating properties managed by companies that do not need active property management. The process of real estate investment demands market research together with adequate capital and risk analysis abilities. Correct planning enables real estate investments to produce substantial money from rental payments as well as property value gains.

3. Property Development

Real estate development under its broader name of property development starts with buying land followed by building structures that developers sell through sale or leasing agreements to make profits. All business activities related to property development need significant funds and a thorough understanding of zoning regulations and construction methods as well as market requirements. Property development depends heavily on the construction trade which currently generates $12.9 trillion in value but analysts expect this number to grow to $15.5 trillion by 2028. The city experiences expansion through the work of builders who construct houses as well as commercial facilities and infrastructure elements.

Property development involves creating fresh residential dwellings and workplace areas together with combined architectural complexes. Property developers renovate unimproved real estate business properties before selling these upgraded assets at greater value. Proficient developers frequently unite with architects, engineers and contractors for completing successful construction projects.

4. Real Estate Management

The real estate management of residential alongside commercial and industrial real estate properties serves as a duty fulfilled by representatives of owners. The role encompasses managing tenants and handling repairs together with collecting rent payments and upholding housing legislation. The U.S. property management market achieved a value of $101.3 billion in 2024 because rental property numbers rose while owners sought expert management assistance.

People interested in this business need to possess excellent organizational abilities and property law awareness together with tenant relationship expertise. The fees that property managers charge clients consist of 8% to 12% of their monthly rental earnings resulting in reliable earnings for managers.

5. Real Estate Consultancy

Real estate consultancy delivers specialized expertise about market intelligence and property valuation services together with investment planning advice to financial stakeholders and builders. Consultants gather market data through research while performing financial assessments and feasibility research which enables clients to obtain better decision-making abilities. The real estate advisory market produces earnings which surpass $30 billion each year worldwide based on PwC data.

Consulting firms deliver services of risk assessment and portfolio management to corporate clients while delivering tax planning to developers alongside institutional investors. For success in this field, one must have strong analytical skills along with industry knowledge and a developed investor and developer network. Real estate business consultants usually arrive from financial, law or urban planning backgrounds.

Choosing the Right Real Estate Business

The various real estate business patterns provide specific strengths along with specific business complexities. Real estate brokerage together with property management generates consistent revenue yet demands financial capital to achieve increased financial gains through investments and development activities. Real estate consultants who understand finance tend to reach financial success in their field.

The evaluation of personal talents combined with money supply and market conditions needs to occur before initiating new ventures. The achievement of a successful real estate business becomes more likely when you research well and gain exposure to the industry. How to Start a Real Estate Business is essential knowledge for entrepreneurs, providing insights into real estate business models, start-up guidelines, and longevity techniques for success.

Step-by-Step Guide to Starting a Real Estate Business in India

1. Market Research and Niche Selection

- Analyze Market Trends: Review the present-day trends in real estate alongside property prices together with local supply and demand patterns in distinct market locations.

- Identify Your Niche: The analysis of research data should guide your selection of an appropriate sector that matches your skills and interests while offering market potential between residential sales, commercial leasing, property management and real estate consultancy.

2. Develop a Comprehensive Business Plan

To build a successful real estate business, start by defining clear, time-bound, and long-term professional objectives. Establishing precise goals will provide direction and measurable benchmarks for growth. Financial planning is crucial, requiring a thorough assessment of startup expenses, projected operational costs, and estimated revenue. Exploring funding options, such as personal savings, bank loans, and investor backing, can help secure the necessary capital. If you’re wondering how to start a real estate business, a well-crafted marketing strategy is essential, incorporating strong branding techniques, promotional campaigns, and client acquisition methods to ensure sustained business growth and market presence. Creating Google Ads for apartments is also necessary to attract potential buyers or renters effectively.

Create a financial plan that outlines:

- Startup Costs – Estimate the initial expenses required to launch your business.

- Funding Sources – If you don’t have the capital, explore options such as partners, private investors, or loans.

- Ongoing Expenses – Include costs for advertising, marketing, travel, and accounting once operations begin.

- Revenue Generation – Define how your business will generate income.

3. Legal Formalities and Business Registration

- Choose a Business Structure: The operation should begin by evaluating which legal business structure works best for the operation out of the options between sole proprietorship or partnership Limited Liability Partnership (LLP) or Private Limited Company. The selection of business structure leads to specific legal arrangements along with financial associated factors.

- Register with RERA: The Real Estate (Regulation and Development) Act, 2016 requires every real estate project along with its connected agents to enrol with state RERA authorities to achieve transparency and protect residential buyers. en.wikipedia.org

- Obtain Necessary Licenses: Your business model requires additional licenses such as GST registration professional tax registration and local municipal permits depending on your business model.

4. Establish a Professional Network

- Build Relationships: Develop business connections between developers and financial institutions and real estate agents and legal advisors apart from potential clients.

- Join Associations: The Confederation of Real Estate Developers’ Associations of India (CREDAI) stands as an organization that gives members exceptional industry insights while promoting networking opportunities through its program.

5 .Set up your own office and Online Presence

- Physical Office: Choose a convenient location to serve your clients while being accessible to your main market clientele.

- Digital Presence: Your website must display your services together with your listings and showcase validator testimonials from satisfied clients. You need to choose well-known social media sites to contact numerous audiences so prospects can connect with you.

6. Marketing and Lead Generation

- Digital Marketing: A combination of SEO and PPC advertising techniques and content marketing solutions will help you achieve digital platform visitors.

- Traditional Marketing: Rising client connections depend on property exhibitions along with printed material distribution through various channels for realtor businesses.

- Referral Programs: Your clients will earn rewards for referring friends who join your business through such derived-income generation programs.

7. Financial Management

- Accounting Systems: Thorough accounting software serves the company by tracking its financial inflows expenses and net profits simultaneously. The company must understand GST regulations together with income tax requirements to detect tax payments promptly while avoiding penalties.

8. Stay Informed and Adapt

- Continuous Learning: Regular attendance of workshops and seminars enables staff to stay current regarding industry progress, market changes and legal industry modifications.

- Adapt to Market Changes: Your business approaches require changes based on market information and client demand adjustments.

An individual seeking to start a real estate business in India should prepare meticulously while having extensive market expertise and maintaining total adherence to ethical conduct. When you follow this strategic method you will succeed in finding your way through real estate industry dynamics to create both a profitable and respectable business.

Discover More Business Opportunities:

Conclusion

Business start-ups in real estate require investors to make strategic plans and develop industry expertise while dedicating themselves fully to the process. Proper tactics enable business founders to develop successful ventures despite market competition. Building success in the real estate market requires businesses to study different property types while obeying legal mandates together with creating a strategic business plan to handle difficult situations efficiently.

A business expansion can be hastened through technology utilization with industry networking and effective marketing approaches that build brand credibility. How to Start a Real Estate Business is an essential guide for those looking to navigate this competitive landscape.

The pathway to real estate business success requires prolonged effort coupled with flexible business approaches which eventually produce lasting profit potential. Real estate entrepreneurs must understand market trends and regularly review their customer service standards to build a respected organization through investment and continuous development. The path to sustainable business growth in real estate exists through proper planning along with proactive decision-making which enables new professionals to succeed during market changes and economic shifts.

FAQs

What level of startup investment is necessary to begin operating as a real estate business?

Startup expenses fluctuate based on the nature of the business operations. A real estate agency typically needs investment between ₹2-5 lakh for registration costs and marketing expenses but property development demands capital at a crore level.

Do I need a license to start a real estate business?

A real estate business startup requires a license or permit for operation. A real estate broker requires specific licenses to operate such as RERA registration for India along with NAR (U.S.) registration. Property developers must obtain authorization from both local government authorities as well as from district authorities.

What approaches should I use to obtain prospective client contacts for my real estate company?

The generation of leads for real estate business opportunities occurs through digital advertising combined with property database listings and social media advertisements and investor-homebuyer networking activities.

Which difficulties do people encounter when managing a real estate enterprise?

The real estate business faces four main obstacles such as market volatility combined with strict regulatory needs and intense marketplace competition and limited project capital.

What is the time required for becoming successful in the real estate industry?

Success determination depends on multiple factors including business approaches and market performance together with professional expertise. Real estate agents start to earn consistent profits between six and twelve months after starting their business yet developers typically need longer to receive returns on their investments.