Are you in need of urgent cash and want instant approval? Don’t worry; with the increase of a 7-day loan app list in India, you can get funds instantly.

Digital lending platforms are changing the loan market, and several apps offer short-term loans from ₹5000 to ₹5,00,000 with minimal documentation, a quick approval process, flexible repayment options, and quick disbursal.

Below, we will learn about top 10 7 Days Loan App List in India that provide instant cash to manage financial emergencies, especially for salaried and self-employed people.

What is a 7-day loan App?

A 7 Days Loan App is a digital lending platform designed to provide short-term personal loans that are repaid within a period of seven days. These apps are built for speed, simplicity, and accessibility, making them ideal for individuals facing immediate financial needs.

Key Highlights:

- Short-Term, Instant Loans

- No Collateral Required

- Fast Disbursal and Minimal Documentation

- Digital and User-Friendly

- Fixed 7-Day Repayment Window

Why are short-term loans gaining popularity in India?

The emergence of digital lending platforms has transformed traditional borrowing methods, offering unprecedented convenience and accessibility. These apps leverage cutting-edge technology to provide instant credit solutions, eliminating lengthy paperwork and branch visits. With 24/7 availability and quick disbursals, they effectively address urgent financial needs while maintaining transparency.

- Instant Access to Funds: These apps provide immediate access to emergency funds, with most loans being disbursed within 24 hours of approval, helping users handle urgent financial needs effectively.

- Minimal Documentation: Digital loan apps for student require minimal paperwork, usually just KYC documents and bank statements, making the application process quick and hassle-free for borrowers.

- Flexible Repayment Options: Users can choose from various repayment tenures and methods to manage their loan repayments according to their financial situation.

- 24/7 Availability: Unlike traditional banks, these apps operate around the clock, enabling users to apply for loans anytime, making them ideal for emergencies.

- No Collateral required: The 7-day loan app provides unsecured loans, which means people do not need to keep gold or property for security. It is perfect for salaried employees, self-employed or even students who need instant loans for quick financial emergencies. The loan approval is faster to get a loan.

10 Best 7 Days Loan App List in India for 2025

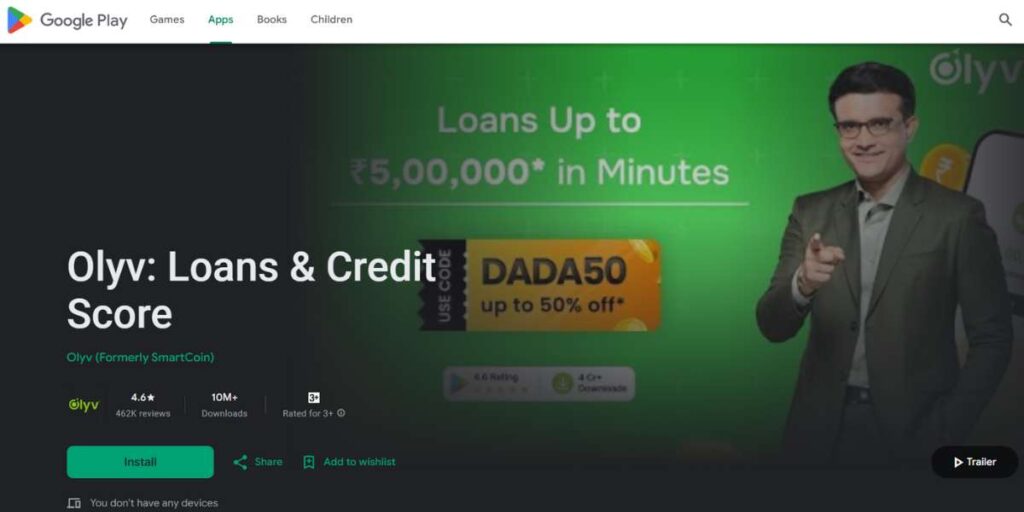

1. SmartCoin

- Loan Amount: ₹1,000 – ₹1,50,000

- Interest rate: 1.5% – 2.75% per month

- Repayment Tenure: 2 to 24 months

- Best suited for: Salaried or self-employed individuals (especially new-to-credit users)

SmartCoin is one such financial technology product that is developed to become a low-cost, reliable, and efficient financial solution to individuals who remain underserved and new-to-credit in India. The app uses unorthodox data sources such as mobile usage patterns and transaction history, and has access to thousands of such kinds of data to determine the creditworthiness of users using sophisticated artificial intelligence and machine learning algorithms.

This is a new and efficient method that gives access to all those people who have little or no formal credit history to reach loans easily and with comfort. Due to its innovative approach and accessibility, SmartCoin is frequently mentioned in the 7 Days Loan App List in India for offering fast and inclusive lending solutions.

Key features:

- AI-driven credit assessment

- Quick digital loan disbursal

- Multi-language support

Pros:

- AI-based approval system

- Low minimum loan amount

- Available in multiple languages

Cons:

- The lower maximum loan limit

- Limited to Android users

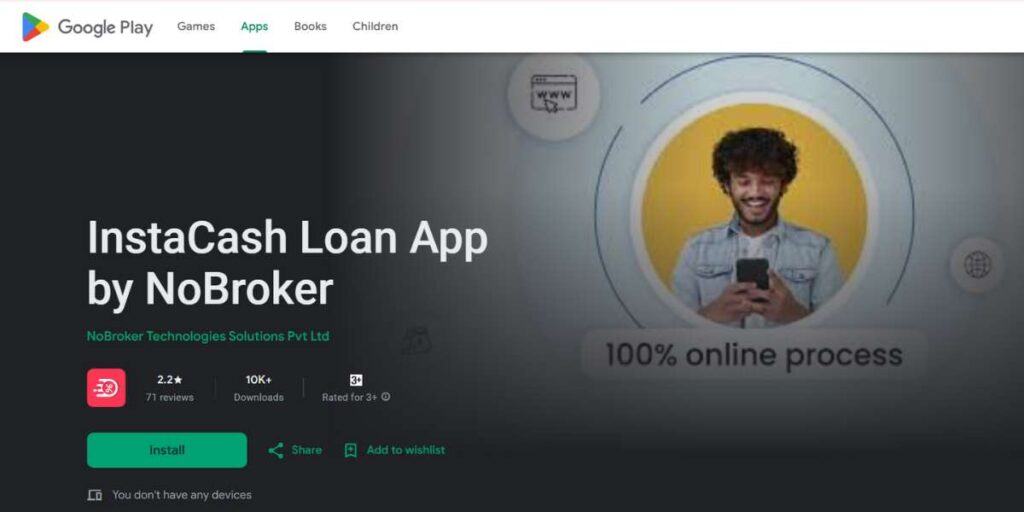

2. NoBroker Instacash

- Loan Amount: Up to Rs 10 Lakh

- Interest rate: 12.99%

- Repayment Tenure: Flexible (depends on loan amount and user profile)

- Best suited for: Salaried individuals and professionals needing quick, instant loans

NoBroker Instacash is a personal loan entity by NoBroker, an already established entity in India in terms of real estate tech space. The app also offers convenience to the already available users by giving instant approvals when it comes to taking a loan, especially to those taking a loan when they are salaried and using the NoBroker platform to take rentals or avail home services.

It pays good attention to accessibility, speed of disbursal, as well as transparency, and this makes it so appealing to individuals who need money urgently but do not have to undergo the tedious process of filling paperwork and waiting a long time to get it approved. Because of these benefits, NoBroker Instacash is often included in the 7 Days Loan App List in India, catering to quick and hassle-free personal financing needs.

Key features:

- Instant loan approval and disbursal

- Minimal documentation

- Competitive interest rates

Pros:

- Quick and easy loan application

- Transparent fees

- Suitable for larger loan amounts

Cons:

- Interest rate may be higher than traditional bank loans

- Eligibility criteria can be strict

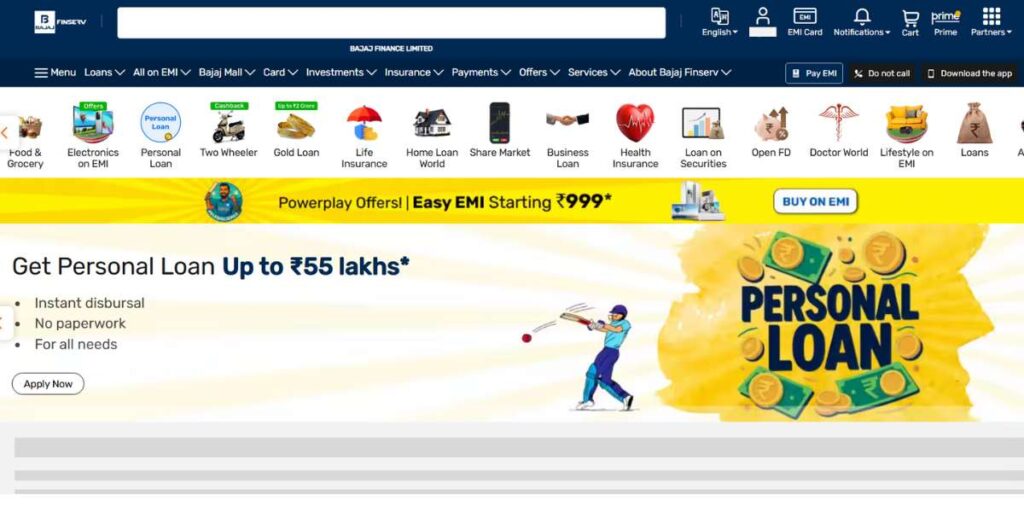

3. Bajaj Finserv App

- Loan Amount: Up to 80 lakhs

- Interest rate: Up to 31% p.a

- Repayment Tenure: Flexible (depending on loan type and amount)

- Best suited for: Salaried and self-employed individuals seeking large personal or business loans

Mobile avatar of one of the NBFCs (Non-Banking Financial Companies) with the highest trust in India, Bajaj Finserv App facilitates a wide range of financial products. Whether it is a personal loan of high ticket value or credit cards, fixed deposit and insurance, it all falls under one digital rooftop using this application. It serves salaried and self-employed people and is particularly helpful when one requires a large sum of loan at a flexible rate.

The app limits paperwork and introduces quick ways of approval of loans to their users to have the ease of managing, tracking and repaying loans, all in one dashboard. Due to its speed, reliability, and comprehensive features, Bajaj Finserv is often mentioned in the 7 Days Loan App List in India for those seeking fast and trusted loan disbursement.

Key features:

- 100% digital application and approval process

- Flexible EMI and repayment options

- Wide range of loan amounts

Pros:

- Quick approval, 100% online process

- Easy repayment options

- Easy EMI options

Cons:

- Strict eligibility criteria

- High interest rate

4. MoneyView App

- Loan Amount: ₹5,000 – ₹5,00,000

- Interest rate: 1.33% – 2.5% per month

- Repayment Tenure: 3 to 60 months

- Best suited for: Salaried and self-employed individuals with a stable income and moderate-to-good credit score

Moneyview is a leading digital lender in the industry because of its progress towards emphasising lending to borrowers in the middle income who do not necessarily have good credit grades. The app employs its credit scoring system, and it does not rely only on CIBIL scores, as there is more to the picture when it comes to risk assessment. Moneyview, being user experience-driven and customizable, lets the applicants select their loan amount, tenure, and the EMI plan.

It is a convenient solution that can be used by people with an urgent need to get money for personal purposes, to cover medical expenses, or to combine their debts, and in the long run, the system can assist a user in developing or repairing their credit record. Due to these features, Moneyview is often listed among the top options in the 7 Days Loan App List in India for fast, flexible, and inclusive lending.

Key features:

- Fast approval using AI-based credit models

- Custom loan offers based on profile

- Long and flexible repayment options

Pros:

- Quick approval process

- Minimal documentation

- Flexible repayment options

Cons:

- Higher interest rates for first-time borrowers

- Requires a good credit score

5. Navi Loan App

- Loan Amount: ₹5,000 – ₹5,00,000

- Interest rate: 9.9% – 36% per annum

- Repayment Tenure: 3 to 72 months

- Best suited for: Salaried individuals and self-employed professionals looking for quick, paperless personal loans

Navi is a digital lending yet full-stack platform built by Sachin Bansal (Flipkart co-founder), envisaging to make credit simpler and accessible to all. It provides instant personal loans through an easy and hassle-free system that eliminates the need to physically visit the company offices and the long waiting time to get verifications. Navi is best distinguished by aggressive interest rate pricing on well-credit users and immediate loan disbursement in a matter of a few minutes upon applying during the same day.

Navi comes with full pricing transparency, an intuitive mobile experience, and flexible payment terms, which are navigable by tech-savvy customers who care about speed and transparency. Its fast processing and convenience have earned Navi a place in the 7 Days Loan App List in India for users looking for quick and dependable personal financing.

Key features:

- Fully paperless application and approval

- Instant eligibility check with minimal KYC

- Flexible loan amounts and long tenures

Pros:

- Quick disbursal and approval process

- Transparent interest rate structure

- User-friendly mobile app experience

Cons:

- Higher interest for low credit profiles

- Customer support may be slow in some cases

6. PayMe India App

- Loan Amount: ₹3,000 – ₹2,00,000

- Interest rate: 1.5% – 2.5% per month

- Repayment Tenure: 7 days to 12 months

- Best suited for: Salaried employees looking for salary advances or short-term personal loans

PayMe India will aim at targeting working professionals and salaried people who end up having a cash crunch towards the middle of the month. The app focuses on offering short-term loans and salary advances through the utilisation of employment verification and underwriting based on salary. The difference is that it will also allow people to be able to take loans as low as 3000 rupees payable in as little as a 7-day period, which will be useful in times of need of meeting small yet urgent expenditures. It is the combination of financial speed and customisation with which the risk of using a credit card (with high interest) or borrowing money informally from friends and family can be avoided by the employees.

Key features:

- Quick salary advance for salaried employees

- Custom loan amounts based on salary and profile

- Fast verification and disbursal

Pros:

- Instant salary advances

- Low minimum income requirement

- Quick verification process

Cons:

- Limited to salaried employees

- Small initial loan amounts for new users

7. CASHe

- Loan Amount: ₹10,000 – ₹3,00,000

- Interest rate: 2.0% – 2.75% per month

- Repayment Tenure: 7 to 180 days

- Best suited for: Young salaried professionals with limited credit history

CASHe is a lending platform with an innovative technology that lures young, regular working professionals, particularly those who do not fall into the traditional credit score model. It uses an exclusive algorithm, the Social Loan Quotient (SLQ), using your online presence and social media usage and work history to determine creditworthiness. The app is designed to give immediate access to a short-term loan, and the procedure should be as dynamic as possible and as modern as its customers.

The USP of CASHe is that it is ready to accept information that is not based on conventional measures but instead relies on data based on technology; this makes CASHe a choice for people who are new to the field of lending. Due to its innovative credit assessment model and quick disbursal, CASHe is often featured in the 7 Days Loan App List in India as a reliable solution for short-term financial needs.

Key features:

- AI-based credit scoring using social and professional data

- No collateral or credit history required

- Quick processing and same-day disbursal

Pros:

- AI-based credit assessment

- No collateral required

- Quick disbursal

Cons:

- Limited to salaried individuals

- Higher interest rates

8. EarlySalary (Fibe)

- Loan Amount: ₹8,000 – ₹5,00,000

- Interest rate: 1.2% – 2.5% per month

- Repayment Tenure: 7 days to 12 months

- Best suited for: Salaried professionals with a minimum monthly income

Fibe (formerly known as EarlySalary) was the first-ever enterprise to offer microloan services in India, aligned to the salary. It has merged AI with financial services to provide personal loans and salary advances in the short term at a favourable interest rate. Millennial professionals are a group of people who are especially fond of the app and frequently require an urgent loan to travel, get an education, or find themselves in an emergency.

EarlySalary is not only different from the old way in that it uses new data types, but it also saves money on interest by assessing on a daily reducing balance, so that an honest payer can save a lot. Due to its innovative model and popularity among young professionals, Fibe is often featured in the 7 Days Loan App List in India as a preferred choice for quick and flexible borrowing.

Key features:

- Instant salary advances and personal loans

- No prepayment charges

- Interest on daily reducing balance

Pros:

- Social scoring model

- No prepayment charges

- Interest charged on daily reducing balance

Cons:

- Higher-income eligibility requirement

- Limited availability in tier-3 cities

9. FlexSalary

- Loan Amount: ₹4,000 to ₹2,00,000

- Interest rate: Varies (usually around 2% – 3% per month based on usage)

- Repayment Tenure: Starts from 7 days, with flexible repayment options

- Best suited for: Salaried professionals looking for a line of credit-style loan

FlexSalary is not a loan application; it is a personal credit line that behaves more like a digital version of a credit card, but no plastic is involved. It is designed to serve the salaried people, and the user can withdraw any amount within the agreed credit limit, as and when required and the interest is charged only on the amount used. This is an idea, especially for those whose earnings are not regular or those who tend to have periodic minor costs. FlexSalary is flexible and efficient, does not need to reapply and reapply for further withdrawals. FlexSalary has one-off approval only.

Key features:

- Credit line facility with reusable limit

- Interest is charged only on the utilised amount

- Instant disbursal after approval

Pros:

- Flexible borrowing as per need

- Fast approval and disbursal

- No repeated documentation for each withdrawal

Cons:

- Limited to salaried individuals

- Higher interest rates on smaller withdrawals

10. Pocketly

- Loan Amount: ₹500 to ₹10,000

- Interest rate: 12.99%

- Repayment Tenure: 7 to 30 days

- Best suited for: College students and early job seekers

Pocketly is a micro-lending app specifically developed for students and early-career professionals. It provides small loans starting from just ₹500 to help users deal with immediate, everyday expenses like rent, tuition, or travel. The app emphasises financial literacy and aims to help young Indians establish their first credit profile.

Pocketly’s simplified KYC process, quick disbursal, and intuitive interface make it a go-to platform for those who are just beginning their financial journey and need trustworthy short-term credit. Owing to its speed and accessibility, Pocketly is frequently featured in the 7 Days Loan App List in India, especially for users looking for small-ticket, fast loans without a complex process.

Key features:

- Microloans for students and first-time earners

- Fast KYC and instant disbursal

- Simple repayment structure

Pros:

- Great for building early credit history

- Quick and easy application process

- Low entry barrier (loan starts at just ₹500)

Cons:

- Very low loan limit

- Short repayment tenure may be difficult for some

Features to Look for in a 7-DayLoan App

Making an informed decision when selecting a loan app requires careful evaluation of multiple factors. Understanding these crucial elements, from security measures to interest rates, helps protect your financial interests. This comprehensive assessment ensures you choose a reliable platform that aligns with your borrowing needs while complying with regulatory guidelines.

- Interest Rates and Charges: The annual percentage rates (APR) and associated fees across different apps to find the most cost-effective option for your needs.

- Credibility and Reviews: Research the app’s reputation, user reviews, and RBI registration status to ensure you deal with a legitimate lender.

- Privacy and Security: Verify the app’s data protection measures and privacy policies to protect your personal and financial information.

- Terms and Conditions: Carefully read the loan agreement, including repayment terms, late payment charges, and prepayment penalties.

Eligibility Criteria for Getting a 7-Day Loan

Before applying for a loan through any 7-day loan app, it’s important to understand the basic eligibility requirements. Although specific criteria can vary slightly from one app to another, most digital lenders follow similar guidelines.

Age Requirement

Applicants must typically be between 21 and 55 years of age. Some platforms may have stricter limits depending on their risk policies.

Residency

You must be a resident of India with a valid government-issued identification. Permanent or semi-permanent address proof is usually required.

Income Criteria

Most apps require a stable monthly income, especially for salaried individuals. Some platforms also accept applications from self-employed professionals or freelancers, provided they have proof of consistent income.

- Minimum monthly income: Generally ₹12,000 to ₹20,000

- For students: Some apps offer small loans without strict income proof, often requiring a valid college ID and minimal bank activity

Employment Type

You may be:

- A salaried employee (private or government sector)

- Self-employed or running a small business

- A freelancer with regular bank credits

KYC Documentation

To comply with RBI norms, digital lenders require basic Know Your Customer (KYC) documents:

- PAN Card

- Aadhaar Card

- Recent passport-size photo

- Address proof (utility bill, voter ID, etc.)

Bank Account

You must have an active bank account in your name with internet banking enabled. This is required for both loan disbursement and automatic repayment.

Mobile Number and Email ID

A valid mobile number and email address are necessary for account verification, loan communication, and customer support.

Credit Score (optional)

While many 7-day loan apps do not require a high credit score, some apps assess your CIBIL or Experian score as part of their risk evaluation. A good score can increase your chances of higher loan amounts and lower interest rates.

How to Apply for a 7-Day Loan via These Apps

Navigating the loan application process requires understanding each step thoroughly to ensure quick approval. Modern loan apps have streamlined their application procedures, making them user-friendly and efficient. Following these systematic steps helps expedite your loan request while ensuring all necessary documentation and verification requirements are met properly.

- Download and Registration: Install the app from official stores and complete the registration process by providing basic personal information.

- KYC Verification: Use the app to submit the required KYC documents, including your PAN card, Aadhaar card, and proof of income.

- Bank Account Linking: Connect your bank account for loan disbursal and repayment by providing the necessary banking details.

- Loan Application: Choose your desired loan amount and tenure, then apply for processing.

Things to Know Before Using a 7-Day Loan App

While 7 Days Loan App List in India offer quick access to cash during emergencies, they also come with certain risks and responsibilities. Before applying for a short-term loan, it’s essential to understand the fine print and make an informed decision.

High Interest Rates and Fees

Short-term loans typically carry higher interest rates than traditional personal loans. Although the loan tenure is only 7 days, the annualised percentage rate (APR) can be significant if you calculate it over a year. Additionally, some apps charge processing fees, convenience fees, or GST, which increases the overall cost.

Strict Repayment Timeline

The 7-day repayment period is non-negotiable on most platforms. Missing the due date can lead to:

- Late payment penalties

- Daily interest accrual

- Negative impact on your credit score

Impact on Credit Score

Even though the loan is short-term, most RBI-registered lenders report your repayment behaviour to credit bureaus like CIBIL or Experian. Timely repayment can improve your credit score, while defaults can significantly damage it.

Loan Extension or Rollover Charges

Some apps offer the option to extend the loan period for a fee. However, these rollover charges can be expensive and may lead to a cycle of debt if not managed responsibly.

Data Privacy and Permissions

Always download apps from verified sources (Google Play Store or Apple App Store) and review app permissions carefully. Avoid apps that ask for unnecessary access to your contacts, photos, or messages. Stick to lenders that clearly state how your data will be used and protected.

Eligibility Doesn’t Guarantee Approval

Meeting the eligibility criteria doesn’t automatically ensure loan approval. Apps use proprietary risk assessment tools, and factors like inconsistent income or a low credit score can still result in rejection.

Borrow Only When Necessary

Because of the short tenure and high cost, these loans should be used strictly for emergencies, not routine expenses. Avoid relying on them frequently, as repeated use can lead to financial strain.

Is It Safe to Use a 7 Days Loan Apps?

Yes, it can be safe to use a 7-day loan app, but only if you choose a regulated and trustworthy platform. While many apps offer secure and legitimate services, there are also unregulated operators in the market. The key to safety lies in selecting the right app and understanding what to look for.

Check the RBI Registration

Always choose loan apps that are partnered with RBI-registered NBFCs or licensed financial institutions. This ensures the lender operates under government regulations and follows fair lending practices.

Read the Terms and Conditions

A safe loan app will clearly outline interest rates, fees, repayment timelines, and penalties. Avoid apps that hide important loan terms or have vague policies.

Review App Permissions

Pay attention to the permissions the app requests during installation. Legitimate apps will not ask for access to your contacts, SMS, call logs, or media unless required for verification and always with user consent.

Look for Secure Data Handling

Reputable apps use encryption and secure servers to protect your personal and financial information. Check if the app has a privacy policy and clear guidelines on how your data is stored and used.

Research User Reviews and Complaints

Before applying, check user feedback on the Play Store or App Store. Low ratings, frequent complaints about harassment, or issues with repayments are red flags that should not be ignored.

Conclusion

Short-term financial needs don’t have to be stressful. With the right 7-day loan app, you can get fast, easy access to cash and manage unexpected expenses without hassles. The apps listed above are among the best in India for 2025, offering reliable service, minimal paperwork, and rapid disbursal.

However, it’s important to borrow responsibly. Evaluate your repayment capacity, read the terms carefully, and use short-term loans only when truly needed.

Looking for quick cash relief? Choose a trusted app from our 7 Days Loan App List in India and apply today!

FAQS

Are 7-day loan apps safe to use?

Yes, when choosing RBI-registered apps with good user reviews and transparent terms. Always verify the app’s legitimacy and read all terms carefully before applying.

What documents are required for loan approval?

Ans: Typically, you need a PAN card, an Aadhaar card, the latest salary slips, bank statements for the last 3 months, and a valid photo ID proof.

Can I get a loan with a low credit score?

Ans: Some apps offer loans to users with low credit scores but may initially charge higher interest rates and offer lower loan amounts.

How long does it take to get loan approval?

Ans: Most apps provide instant approval decisions within minutes, with loan disbursal typically happening within 24 hours of document verification.

What happens if I miss a loan payment?

Ans: Missing payments can result in late charges, negatively impacting your credit score and reducing chances of future loan approvals. Always communicate with the lender if you are facing repayment issues.